FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

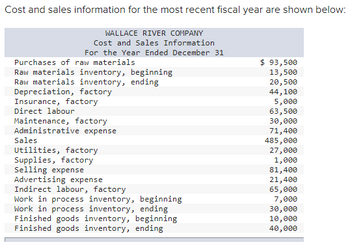

Transcribed Image Text:Cost and sales information for the most recent fiscal year are shown below:

WALLACE RIVER COMPANY

Cost and Sales Information

For the Year Ended December 31

Purchases of raw materials

Raw materials inventory, beginning

Raw materials inventory, ending

Depreciation, factory

Insurance, factory

Direct labour

Maintenance, factory

Administrative expense

Sales

Utilities, factory

Supplies, factory

Selling expense

Advertising expense

Indirect labour, factory

Work in process inventory, beginning

Work in process inventory, ending

Finished goods inventory, beginning

Finished goods inventory, ending

$ 93,500

13,500

20,500

44,100

5,000

63,500

30,000

71,400

485,000

27,000

1,000

81,400

21,400

65,000

7,000

30,000

10,000

40,000

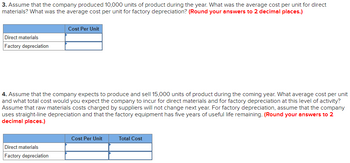

Transcribed Image Text:3. Assume that the company produced 10,000 units of product during the year. What was the average cost per unit for direct

materials? What was the average cost per unit for factory depreciation? (Round your answers to 2 decimal places.)

Cost Per Unit

Direct materials

Factory depreciation

4. Assume that the company expects to produce and sell 15,000 units of product during the coming year. What average cost per unit

and what total cost would you expect the company to incur for direct materials and for factory depreciation at this level of activity?

Assume that raw materials costs charged by suppliers will not change next year. For factory depreciation, assume that the company

uses straight-line depreciation and that the factory equipment has five years of useful life remaining. (Round your answers to 2

decimal places.)

Direct materials

Factory depreciation

Cost Per Unit

Total Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available for ABC Company for the year ended December 31: Beginning raw materials inventory Raw materials purchases Ending raw materials inventory Direct labor expense What is the amount of direct materials used in production for the year? Multiple Choice $5,200. $7,500. $4,700. $8,900. $ 3,700 5,200 4,200 2,200arrow_forwardRequired information [The following information applies to the questions displayed below] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,000 14,500 7,250 27,000 19,000 17,650 22,000 5,300 9,000 21,000 9,450 Req 1 Garcon Req 1 Pepper Req 2 Garcon Req 2 Pepper 4,780 33,000 50,000 Prepare the income statement for Garcon Company. GARCON COMPANY Income Statement For Year Ended Naramhar 11 195,030 20,000 13,200 Pepper Company $ 16,450 19,950 9,000 22,750 35,000 13,300 16,000 7,200 12,000 43,000 10,860…arrow_forward[The following Information applies to the questions displayed below. The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 13,300 15,700 11,700 27,750 21,800 21,950 25,600 7,100 13,800 27,500 15,700 6,380 40,000 53,600 284,550 26,000 14,400 Pepper Company $ 18,550 19,500 12,000 25,750 38,600 13,600 19, 200 8,600 14,750 43,500 13,920 3,300 55,500 57,400 379,108 17,700 21,950 Exercise 18-8 (Algo) Preparing financial statements for a manufacturer LO P1 1. Prepare Income statements for both Garcon Company and…arrow_forward

- . Iron Sheets Company had the following information for the month of June 2021. Sales Purchases Sales and administrative expenses V Factory overhead V Direct labor Shs. 257,000 92.000 79,000 37,000 25.000 Work in process, June 1 22,000 Work in process, June 30 Raw Material inventory, June 1 Raw Material inventory, June 30 Finished goods inventory, June 1 Finished goods inventory, June 30 18.500 6.000 8,000 21,000 25,000 Prepare the following: A manufacturing account An income statement for the month ended June 30, 2021 The inventory section of the statement of financial statement.arrow_forwardThe following information has been taken from the perpetual inventory system of Elite Manufacturing Company for the month ended August 31: Purchases of direct materials Direct materials used Direct labor costs assigned to production Manufacturing overhead costs incurred (and applied) Balances in inventory August 31 $? Materials Work in Process Finished Goods The cost of finished goods manufactured $ 66,000 $ 50,000 in August is: August 1 $ 20,000 $ 47,500 $ 43,300 $ 61,000 $ 40,000 $ 15,000 $ 35,000arrow_forwardStatement of Cost of Goods Manufactured for a Manufacturing Company Cost data for Johnstone Manufacturing Company for the month ended March 31 are as f Inventories March 1 March 31 Materials Work in process Finished goods $193,500 129,650 98,690 $166,410 111,490 113,160 Direct labor Materials purchased during March Factory overhead incurred during March: Indirect labor Machinery depreciation Heat, light, and power Supplies Property taxes Miscellaneous costs Direct materials: $348,300 371,520 37,150 22,450 7,740 6,190 5,420 10,060 a. Prepare a cost of goods manufactured statement for March. Johnstone Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended March 31arrow_forward

- The following information is available for the year ended December 31 Beginning raw materials inventory Raw materials purchases Ending raw materials inventory Direct labor expense The amount of direct materials used in production for the year is Multiple Choice $10,100 $5,300 $5,900 $ 4,300 5,800 $5,800 4,800 2,800arrow_forwardRequired information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,250,000 37,000 53,900 62,700 175,600 225,000 47,000 23,000 57,000 94,000 129,300 42,700 41,500 67,300 Prepare its schedule of cost of goods manufactured for the year ended December 31.arrow_forwardRequired information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,500 16,100 7,400 34,750 19,800 21,800 26,200 7,200 12,600 27,000 14,750 4,940 41,500 58,000 296,220 26,000 13,600 Pepper Company $ 17,350 22,050 9,450 25,150 39,400 14,600 20, 200 8,000 15,750 43,000 14,320 3,750 60,500 46,000 388,450 18,700 21,950 1. Prepare income statements for both Garcon Company and Pepper Company. 2. Prepare the current assets section of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education