FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

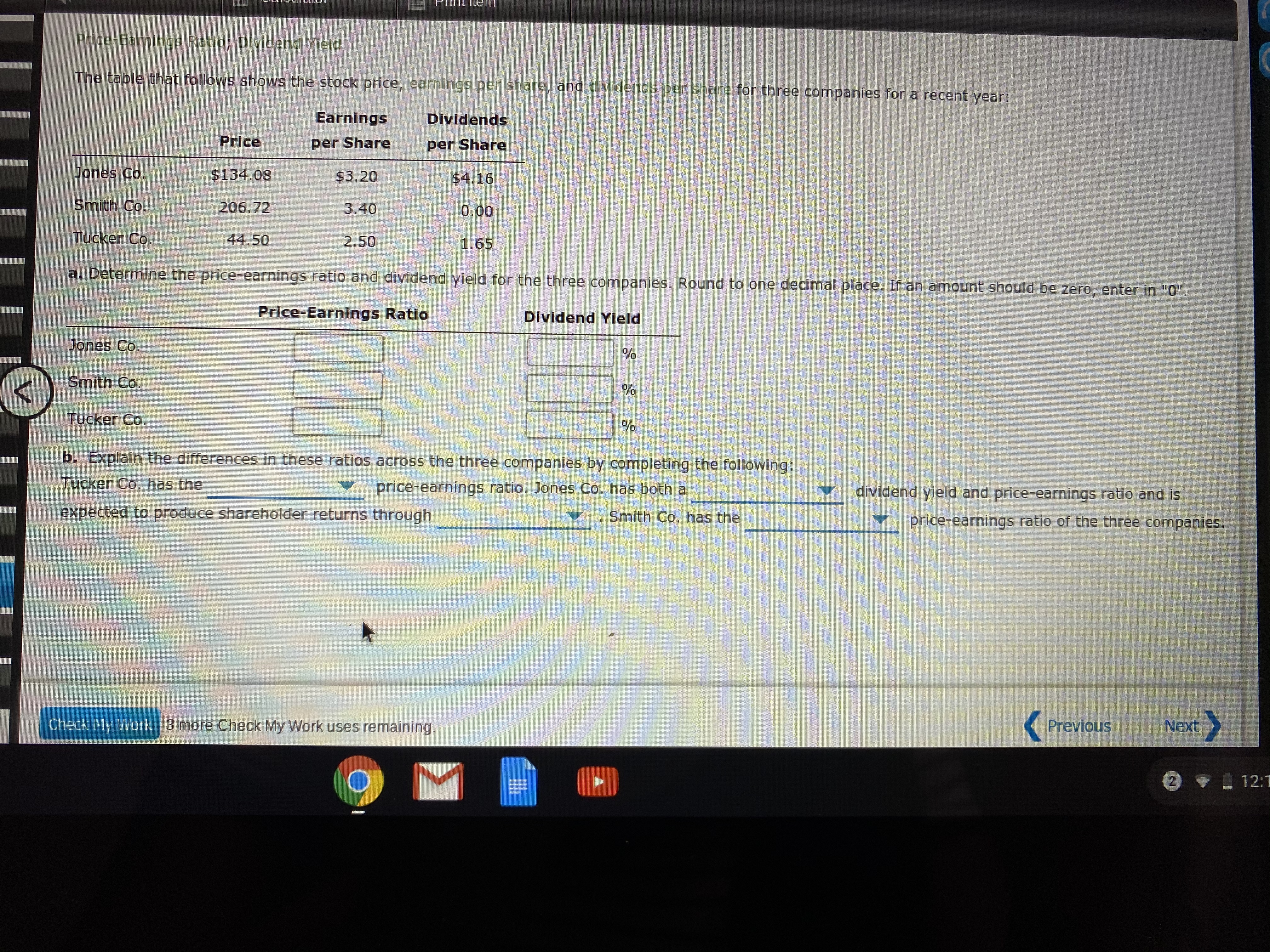

Transcribed Image Text:Price-Earnings Ratio; Dividend Yield

The table that follows shows the stock price, earnings per share, and divVidends per share for three companies for a recent year:

Earnings

Dividends

Price

per Share

per Share

Jones Co.

$134.08

$3.20

$4.16

Smith Co.

206.72

3.40

0.00

Tucker Co.

44.50

2.50

1.65

a. Determine the price-earnings ratio and dividend yield for the three companies. Round to one decimal place. If an amount should be zero, enter in "0".

Price-Earnings Ratio

Dividend Yield

Jones Co.

Smith Co.

Tucker Co.

b. Explain the differences in these ratios across the three companies by completing the following:

Tucker Co. has the

price-earnings ratio, Jones Co. has both a

dividend yield and price-earnings ratio and is

expected to produce shareholder returns through

.Smith Co, has the

price-earnings ratio of the three companies.

Check My Work 3 more Check My Work uses remaining.

Previous

Next

e v 12:1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Common Stockholders' Profitability Analysis A company reports the following: Net income $275,000 Preferred dividends 11,000 Average stockholders' equity 1,978,417 Average common stockholders' equity 1,239,437 Determine (a) the return on stockholders' equity and (b) the return on common stockholders' equity. If required, round your answers to one decimal place. a. Return on Stockholders' Equity b. Return on Common Stockholders' Equityarrow_forwardMeasures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 67 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Retained earnings, January 1 $3,595,450 $3,035,750 Net income 851,200 621,800 Dividends: On preferred stock On common stock (10,500) (10,500) (51,600) (51,600) Retained earnings, December 31 $4,384,550 $3,595,450 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Y1 Sales $4,847,930 $4,466,640 Cost of merchandise sold 1,594,320 1,466,770 Gross profit $3,253,610 $2,999,870 Selling expenses $1,112,980 $1,377,430 Administrative expenses 948,100 808,960 Total operating expenses $2,061,080 $2,186,390 Income from operations $1,192,530 $813,480 Other revenue and expense: Other revenue 62,770 51,920 Other expense (interest) (288,000) (158,400)…arrow_forwardCommon Stockholders' Profitability Analysis A company reports the following: Net income $150,000 Preferred dividends 6,000 Average stockholders' equity 1,127,820 Average common stockholders' equity 738,462 Determine (a) the return on stockholders' equity and (b) the return on common stockholders' equity. If required, round your answers to one decimal place. a. Return on Stockholders' Equity b. Return on Common Stockholders' Equity Feedback X% X% Check My Work a. Divide net income by average stockholders equity b. Divide net income minus preferred dividends by average common stockholders' equityarrow_forward

- Dividend Payout Ratio Net Income Average stockholders' equity Dividend per common share Earnings per share Market price per common share, year-end Previous Year Current Year Previous Year Current Year $45,500 $62,400 1,300,000 1,950,000 The dividend payout 2.47 2.85 24.70 Calculate the dividend payout for Evans & Sons for each year. Did the dividend payout increase? Numerator Denominator ♦ 2.60 3.20 27.30 0 0 ◆ from previous year to the current year. 0 0 Dividend Payout Ratio % %arrow_forwarddevarrow_forwardConsider the following information: Beginning number of shares Ending number of shares Dividend per share Market price per share Net income The dividend yield is 5.8% 6.3% 6.0% 3.0% 149,000 160,000 $1.80 $60.00 $933,000arrow_forward

- Given the following information, which company's stockholders received the highest return in the form of dividends? Company W Company X Company Y Company Z $4.35 $4.75 $4.20 $5.25 25.1 17.2 18.3 22.0 3.0% 3.2% 0.0% 2.8% Earnings per share Price-earnings ratio Dividend yield a. Company Z b. Company X c. Company Y d. Company Warrow_forwardMeasures of liquidity, Solvency and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall Inc. common stock was $ 64 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $ 3,099,650 $ 2,623,250 Net income 681,600 537,300 Total $ 3,781,250 $ 3,160,550 Dividends On preferred stock $ 9,100 $ 9,100 On common stock 51,800 51,800 Total dividends $ 60,900 $ 60,900 Retained earnings, December 31 $ 3,720,350 $ 3,099,650 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 4,210,640 $ 3,879,520 Cost of goods sold 1,554,900 1,430,510 Gross profit $ 2,655,740 $ 2,449,010 Selling expenses $ 893,140 $ 1,089,600 Administrative expenses 760,830…arrow_forwardMatch the following ratio functions with the ratio (place the number of your chosen answer into the box with the border beside the term you think it goes with : Dividend Yield Debt ratio Current Ratio Price/Earnings Ratio Acid-test ratio Earnings per share 1. The amount of net income earned for each share of the company's common stock 2. The percentage of a stock's market value returned to stockholders as dividends each period 3. The ability to pay current liabilities with current assets. 4. The percentage of assets financed with debt. 5. The ability to pay all current liabilities if they come due immediately. 6. The market price of $1 of earnings.arrow_forward

- 1 )arrow_forwardMeasures of liquidity, Solvency and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall Inc. common stock was $ 60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $ 1,024,550 $ 869,250 Net income 233,600 178,000 Total $ 1,258,150 $ 1,047,250 Dividends On preferred stock $ 7,700 $ 7,700 On common stock 15,000 15,000 Total dividends $ 22,700 $ 22,700 Retained earnings, December 31 $ 1,235,450 $ 1,024,550 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 1,456,350 $ 1,341,770 Cost of goods sold 520,490 478,850 Gross profit $ 935,860 $ 862,920 Selling expenses $ 319,920 $ 392,750 Administrative expenses 272,520 230,660 Total…arrow_forwardMeasures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 65 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,173,375 $995,425 Net income 259,200 203,900 Total $1,432,575 $1,199,325 Dividends: On preferred stock $8,400 $8,400 On common stock 17,550 17,550 Total dividends $25,950 $25,950 Retained earnings, December 31 $1,406,625 $1,173,375 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $1,622,790 $1,495,130 Cost of goods sold 611,010 562,130 Gross profit $1,011,780 $933,000 Selling expenses $341,930 $416,290 Administrative expenses 291,280 244,490 Total operating…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education