FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Q.13 coronado industries sells its product for $80 per unit…

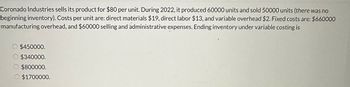

Transcribed Image Text:Coronado Industries sells its product for $80 per unit. During 2022, it produced 60000 units and sold 50000 units (there was no

beginning inventory). Costs per unit are: direct materials $19, direct labor $13, and variable overhead $2. Fixed costs are: $660000

manufacturing overhead, and $60000 selling and administrative expenses. Ending inventory under variable costing is

$450000.

O $340000.

O $800000.

O $1700000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PA5arrow_forwardQuestion 54arrow_forwardD% A company has three products-Beta, Chi, and Delta-that emerge from a joint process. The selling prices and amount of output for each product at the split-off point are as follows: Amount of Selling Price Output 14,000 pounds 18,000 pounds 19,000 pounds apse Product Beta $33 per pound points Chi $29 per pound Delta $24 per pound 8 00:36:54 Each product can be processed further beyond the split-off point. The additional processing costs for each product and their respective selling prices after further processing are as follows: Additional Selling Price $37 per pound $34 per pound $30 per pound Product Processing Costs $65,000 Beta Chi $75,500 Delta $70,000 What is financial advantage (disadvantage) of further processing Product Chi?arrow_forward

- pter 11 Assignment i Requlred Informatlon The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product Its average cost per unit for each product at this level of activity are given below. Alpha $ 42, vて $ 24 Direct labor Variable manufacturing overhead Traceable fFixed manufacturing overhead Variable selling expenses Common fixed expenses 42. 34 31. 34 Total cost per unit $173 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 15. Assume that Cane's customers would buy a maximum of99,000 units of Alpha and 79,000 units of Beta. Also assume that the raw material available for production…arrow_forward2 S Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $77 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $ 27 $ 10 $2 $3 Foundational 7-10 (Algo) $ 1,298,000 $ 662,000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The…arrow_forwardEC 3 Question 3 Hometown Bakery sells three types of doughnuts: glazed, jelly, and cake. The following table shows the sales price and variable costs for each type. The bakery incurs $331,000 a year in fixed expenses. Assume that it sells 3 glazed doughnuts for every 1 jelly doughnut and every 1 cake doughnut. DOUGHNUT TYPE SALES PRICE VARIABLE COST Glazed $0.40 $0.29 Jelly $0.52 $0.49 Cake $0.47 $0.29 (a) How many doughnuts of each type will be sold at the breakeven point? (Round intermediate calculations and final answers for the number of doughnuts to the nearest whole, e.g. 5,275.) Jelly doughnuts Cake doughnuts Glazed doughnuts b. What amount of revenue would need to be generated by each type of doughnut for the company to earn $74,100 in operating income?arrow_forward

- H5. Accountarrow_forwardNonearrow_forwardQx MUX QY MUY 15 56 10 108 30 48 20 72 45 40 30 48 60 32 40 36 75 24 50 30 90 16 60 105 12 70 120 8 80 220 24 21 18 4 Seks Suppose Fred's income is $240 and he buys 75 units of X and 30 units of Y. If Fred buys $1's worth less of X and $1's worth more of Y, then his utility will increase by 16 utils. increase by 4 utils. decrease by 4 utils. increase by 24 utils. decrease by 45 utils. decrease by 24 utils. decrease by 16 utils. O not change. increase by 45 utils.arrow_forward

- PROBLEM 7–18 Relevant Cost Analysis in a Variety of Situations [LO 7–2, LO 7–3, LO 7–4]Andretti Company has a single product called a Dak. The company normally produces and sells 60,000 Daks each year at a selling price of $32 per unit. The company’s unit costs at this level of activity are given below: Direct materials................................$10.00 Direct labor ...................................4.50 Variable manufacturing overhead................2.30 Fixed manufacturing overhead ..................5.00($300,000 total) Variable selling expenses.......................1.20 Fixed selling expenses ......................... 3.50($210,000 total) Total cost per unit..............................$26.50 1. Assume that Andretti Company has sufficient capacity to produce 90,000 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its sales by 25% above the present 60,000 units each year if it were willing to increase the fixed selling…arrow_forward1 2 3 4 Fixed cost: LO A Selling price: Unit cost: B $ $ $ 1. What is Pete's breakeven point in units? Pete Corporation produces bags of peanuts. Its fixed cost is $17,280. Each bag sells for $2.99 with a unit cost of $1.55. 17,280.00 2.99 1.55 C 5 6 7 8 9 10 11 Note: Use cells A4 to B6 from the given information to complete this question. 12 13 14 Required: Using the information given above, answer the following question: E bags F G Harrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education