FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

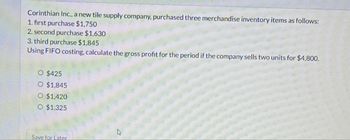

Transcribed Image Text:Corinthian Inc., a new tile supply company, purchased three merchandise inventory items as follows:

1. first purchase $1,750

2. second purchase $1,630

3. third purchase $1,845

Using FIFO costing, calculate the gross profit for the period if the company sells two units for $4,800.

O $425

O $1,845

O $1,420

O $1,325

Save for Later

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginninginventory on May 1. Blankets Units Purchase 5 Date Cost May 3 May 10 May 17 May 20 May 23 May 30 $20 Sale Purchase 10 Sale Sale 3 $24 6 3 Purchase 10 $30 a. Determine the gross profit, cost of goods sold, and endinginventory for the month of May using the LIFO method b. Determine the gross profit, cost of goods sold, and ending inventory for the month of May using the FIFO cost method c. Determine the gross profit, cost of goods sold, and endinginventory for the month of May using the weighted average cost methodarrow_forwardAssume that three identical units of merchandise are purchased during October, as follows: Units Cost October 5 Purchase 1 $5 12 Purchase 1 13 28 Purchase 1 15 Total 3 $33 Assume one unit is sold on October 31 for $28. Determine cost of goods sold, gross profit, and ending inventory under the FIFO method. October 31 Sales $fill in the blank 1 Cost of Goods Sold fill in the blank 2 Gross Profit $fill in the blank 3 Ending Inventory $fill in the blank 4arrow_forwardThe following amounts and costs of platters were available for sale by Sierra Pottery during the year: Beginning inventory 10 units at $41 First purchase 15 units at $55 Second purchase 30 units at $70 Third purchase 25 units at $65 Sierra Pottery has 35 platters on hand at the end of the year. How much is cost of goods sold in dollars at the end of the year according to the weighted-average cost method? Select one: a. $4,960 b. $1,732.50 C. $2,790 d. $1,860arrow_forward

- Quick Stop Dairy had beginning inventory of Heavy Cream of 200 units at a cost of $2 each. During the month, they had the following purchases: 1st purchase: 500 units at $3 each 2nd purchase: 400 units at $4 each Quick Stop Dairy sold 1,000 units to a customer. Using a FIFO cost flow assumption, determine the cost of goods sold for this sale as well as the balance in ending inventoryarrow_forwardNigam & Roy, Incorporated began operating on June 26 with no inventory on hand. It then made the purchases listed below. Nigam & Roy, Incorporated sold and delivered 52 units on June 30. Description Date June 27 June 28 June 29 Purchase Purchase Purchase Units 16 40 24 Unit Cost $ 8.80 9.80 11.80 Total Cost $ 140.80 392.00 283.20 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory at June 30. 3. Calculate the cost of ending inventory and the cost of goods sold under FIFO.arrow_forwardThe following data applies to a particular item of merchandise: On hand at start of period $5.10 300 1st purchase 500 5.20 2nd purchase 700 5.30 3rd purchase 600 5.50 Number of units available for sale 2,100 On hand at end of period 500 Number of units sold during period 1,600 Of the 1,600 units sold during the period, 300 were from the beginning inventory; 500 from the first purchase; 600 from the second purchase; and 200 from the last purchase. Using the weighted-average costing method and rounding the average unit cost to the nearest whole cent, the value of the inventory on hand at the end of the period would be Oa. $2,650. Ob. $2,530. Oc. $2,730. Od. $2,750.arrow_forward

- During the year, Wright Company sells 510 remote-control airplanes for $100 each. The company has the following inventory purchase transactions for the year. Number of Unit Total Date January 1 Transaction, Beginning inventory Units Cost Cost 50 $64 $3,200 May 5 Purchase 290 67 19,430 240 580 72 17,280 $39,910 November 3 Purchase Calculate ending inventory and cost of goods sold for the year, assuming the company uses FIFO. Cost of Goods Available for Sale Number Cost per FIFO Cost of Goods Number of units unit Available for Sale of units Cost of Goods Sold Cost per unit Cost of Goods Number Sold of units Ending Inventory Cost per unit Ending Inventory Beginning Inventory 50 $ 64 $ 3,200 $ 이 Purchases May 5 290 67 19,430 0 November 3 240 72 17.280 0 Total 580 $ 39,910 ° $ о $ 0arrow_forwardThe following data applies to a particular item of merchandise: On hand at start of period 300 $5.10 1st purchase 500 5.20 2nd purchase 700 5.30 3rd purchase 600 5.50 Number of units available for sale 2,100 On hand at end of period 500 Number of units sold during period 1,600 Of the 1,600 units sold during the period, 300 were from the beginning inventory; 500 from the first purchase; 600 from the second purchase; and 200 from the las purchase. Using the specific identification costing method, the amount of the costiof goods sold would be Oa. $2,730. Ob. $8,410. Oc. S11,140. Od. S13,870.arrow_forwardThe following data applies to a particular item of merchandise: On hand at start of period 300 $5.10 1st purchase 500 5.20 2nd purchase 700 5.30 3rd purchase 5.50 600 Number of units available for sale 2,100 On hand at end of period 500 Number of units sold during period 1,600 Of the 1,600 units sold during the period, 300 were from the beginning inventory; 500 from the first purchase; 600 from the second purchase; and 200 from the last purchase. Using the last-in, first-out costing method, the cost of goods sold would be Oa. $8,390. Оb. $2,530. Oc. S8,570. Od. $8,410.arrow_forward

- Assume Ava Co. has the following purchases of inventory during the first month of operations Number of Units Cost per unit First Purchase 140 2.4 Second Purchase 105 4.7 Assuming Ava Co sells 120 units at $14 each, what is the cost of goods sold if they use LIFO?arrow_forwardAt the beginning of the current period, Chen carried 1,000 units of its product with a unit cost of $32. A summary of purchases during the current period follows. Units Unit Cost Cost Beginning Inventory 1,000 $32 $32,000 Purchase #1 1,800 34 61,200 Purchase #2 800 38 30,400 Purchase #3 1,200 41 49,200 During the current period, Chen sold 2,800 units. (a) Assume that Chen uses the first-in, first-out method. Compute both cost of good sold for the current period and the ending inventory balance. Use the financial statement effects template to record cost of goods sold for the period.arrow_forwardPlease introduce and explanation step by step without plagiarism please andarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education