FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

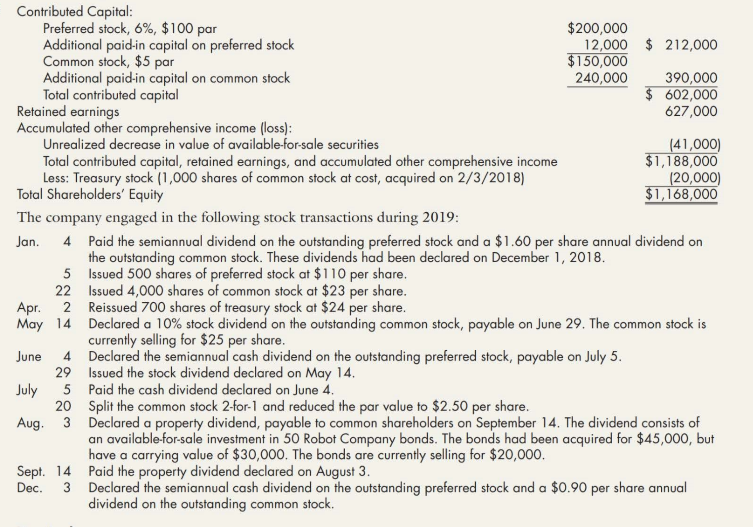

Included in the December 31, 2018, Jacobi Comapany

1. Prepare

Transcribed Image Text:Contributed Capital:

Preferred stock, 6%, $100 par

Additional paid-in capital on preferred stock

Common stock, $5 par

Additional paid-in capital on common stock

Total contributed capital

Retained earnings

Accumulated other comprehensive income (loss):

Unrealized decrease in value of available-for-sale securities

Total contributed capital, retained earnings, and accumulated other comprehensive income

Less: Treasury stock (1,000 shares of common stock at cost, acquired on 2/3/2018)

Total Shareholders' Equity

$200,000

12,000 $ 212,000

$150,000

240,000

390,000

$ 602,000

627,000

(41,000)

$1,188,000

(20,000)

$1,168,000

The company engaged in the following stock transactions during 2019:

4 Paid the semiannual dividend on the outstanding preferred stock and a $1.60 per share annual dividend on

the outstanding common stock. These dividends had been declared on December 1, 2018.

5 Issued 500 shares of preferred stock at $110 per share.

22 Issued 4,000 shares of common stock at $23 per share.

2 Reissued 700 shares of treasury stock at $24 per share.

Jan.

Apr.

May 14 Declared a 10% stock dividend on the outstanding common stock, payable on June 29. The common stock is

currently selling for $25 per share.

4 Declared the semiannual cash dividend on the outstanding preferred stock, payable on July 5.

29 Issued the stock dividend declared on May 14.

June

5 Paid the cash dividend declared on June 4.

20 Split the common stock 2-for-1 and reduced the par value to $2.50 per share.

July

Aug. 3 Declared a property dividend, payable to common shareholders on September 14. The dividend consists of

an available-for-sale investment in 50 Robot Company bonds. The bonds had been acquired for $45,000, but

have a carrying value of $30,000. The bonds are currently selling for $20,000.

Sept. 14 Paid the property dividend declared on August 3.

Dec.

3 Declared the semiannual cash dividend on the outstanding preferred stock and a $0.90 per share annual

dividend on the outstanding common stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comparative Statements of Shareholders' Equity for Locke Intertechnology Corporation were reported as follows for the fiscal years ending December 31, 2019, 2020, and 2021. Balance at January 1, 2019 sale of preferred shares sale of common shares, 7/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2019 Retirement of common shares, 4/11 Cash dividend, preferred Cash dividend, common 3-for-2 split effected in the form of a common stock dividend, 8/12 Net income Balance at December 31, 2020 18% common stock dividend, 5/1 sale of common shares, 9/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2021 Year 2019 2020 2021 LOCKE INTERTECHNOLOGY CORPORATION statements of shareholders' Equity For the Years Ended Dec. 31, 2019, 2020, and 2021 ($ in millions) Numerator / Denominator = Earnings per share 1 1 1 = Preferred stock, $10 par 12 12 12 $12 Common stock, $1 par 80 $ 11 91 (4) 43.5 130.5 13.05 3 $146.55 Additional Paid-in…arrow_forwardThe stockholders’ equity accounts of Grouper Company have the following balances on December 31, 2020. Common stock, $10 par, 290,000 shares issued and outstanding $ 2,900,000 Paid-in capital in excess of par—common stock 1,120,000 Retained earnings 5,110,000 Shares of Grouper Company stock are currently selling on the Midwest Stock Exchange at $ 36.Prepare the appropriate journal entries for each of the following cases. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) A stock dividend of 7% is (1) declared and (2) issued. (b) A stock dividend of 100% is (1) declared and (2) issued. (c) A 2-for-1 stock split is (1) declared and (2) issued. No. Account Titles and Explanation Debit Credit (a) (1) enter an account title for case A to record the declaration of stock dividends…arrow_forwardBased on the below information prepare a statement of shareholders’ equity in a proper format for Rams Ltd. for the year ended December 31, 2020. Rams Ltd. reported the following balances at January 1, 2020: Common shares................................................................................ $370,000 Preferred shares................................................................................ 74,000 Contributed surplus ........................................................ 65,000 Retained earnings............................................................................. 70,000 Accumulated other comprehensive income..................................... 71,000 Rams’ corporate tax rate .................................................................. 31.5% During the year, Rams performed the following: 1. The cumulative effect of the change from straight-line to accelerated depreciation resulted in a reduction to retained earnings of $35,000, before tax. 2. Issued common…arrow_forward

- Prepare the note disclosure required (e) On 10 September 2021, the company paid a dividend of $210,000, which was declared on 14 July 2020. The company also declared and paid an interim dividend on 25 March 2022 from the retained earnings. (f) Share capital at 1 July 2021 comprised 1,000,000 ordinary shares. These were issued in April 2019 at an issue price of $3.50 and are fully paid. In relation to this issue $32,000 share issue costs were incurred, and these were paid by the company in May 2019. In November 2021 the company issued a prospectus inviting applications for 2,000,000 ordinary shares at an issue price of $4.00, with $3.00 payable on application and $1.00 due on allotment. All of these shares were issued in January 2022. All of the money required on allotment was received by the end of February 2022. Share issue costs in relation to this issue totalled $22,000 and were paid on 7 March 2022. (g) On 30 June 2022, the directors decided to transfer $4,000,000…arrow_forwardPlease see attached filearrow_forwardComparative statements of shareholders’ equity for Anaconda International Corporation were reported as follows for the fiscal years ending December 31, 2021, 2022, and 2023. ANACONDA INTERNATIONAL CORPORATIONStatements of Shareholders' EquityFor the Years Ended Dec. 31, 2021, 2022, and 2023($ in millions) Preferred Stock$10 par Common Stock$1 par AdditionalPaid-In Capital Retained Earnings TotalShareholders' Equity Balance at January 1, 2021 65 520 1,860 2,445 Sale of preferred shares 30 900 930 Sale of common shares 7 56 63 Cash dividend, preferred (3 ) (3 ) Cash dividend, common (17 ) (17 ) Net income 340 340 Balance at December 31, 2021 30 72 1,476 2,180 3,758 Retirement of shares (2 ) (16 ) (24 ) (42 ) Cash dividend, preferred…arrow_forward

- 1. As of December 31, 2019, XYZ Company reported assets of $7,400,000, liabilities of $2,200,000, share capital of $1,980,000 and retained earnings of $3,220,000. What is Total equity reported on the statement of financial position as of that date?arrow_forwardTamarisk Corporation's adjusted trial balance contained the following accounts at December 31, 2020: Retained Earnings $126,000, Common Stock $765,600, Bonds Payable $109,700, Paid-in Capital in Excess of Par-Common Stock $208,700, Goodwill $59,300, Accumulated Other Comprehensive Loss $154,700, and Noncontrolling Interest $34,200. Prepare the stockholders' equity section of the balance sheet.arrow_forward1. Refer to additional information (b) only Prepare the following general ledger accounts for the year ended 31 July 2022: •Bank •Application and allotment •Share Capital- Class A •Non Current Liability- Class C 2. Refer to additional information (c) Calculate the number of Class B shares in issue at the beginning of the financial year. 3. Refer to additional information (d) Prepare the dividends and shareholders for dividends accounts as it would appear in the general ledger for the year ended 31 July 2022arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education