ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

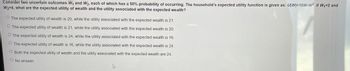

Transcribed Image Text:Consider two uncertain outcomes W₁ and W₂, each of which has a 50% probability of occurring. The household's expected utility function is given as: U(M)=10W-W². If W₁-2 and

W₂=4, what are the expected utility of wealth and the utility associated with the expected wealth?

O The expected utility of wealth is 20, while the utility associated with the expected wealth is 21.

O The expected utility of wealth is 21, while the utility associated with the expected wealth is 20.

O The expected utility of wealth is 24, while the utility associated with the expected wealth is 16.

O The expected utility of wealth is 16, while the utility associated with the expected wealth is 24.

O Both the expected utility of wealth and the utility associated with the expected wealth are 24.

O No answer.

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Help me pleasearrow_forwardHugo has a concave ubility function of U(W)=√W. His only asset is shares in an Internet start-up company. Tomorrow he will learn the stock's value. He belleves that it is worth $225 with probability 80% and $256 with probability 20%. What is his expected utsty? What risk premium would he pay to avoid bearing this risk? The stock's expected utility (EU) is EU = (Enter a numeric response using a real number rounded to two decimal places.) han froarrow_forwardJanet's broad attitude to risk (risk averse, risk neutral, or risk loving) is independent of her wealth. She has initial wealth w and is offered the opportunity to buy a lottery ticket. If she buys it, her final wealth will be either w + 4 or w – 2, each equally likely. She is indifferent between buying the ticket and not buying it. Janet offers her friend Sam (who has identical preferences and initial wealth) the following proposition: They buy the ticket together, and share the cost and proceeds equally. Sam has another idea: They buy two tickets (that have independent outcomes) and share the costs and proceeds equally. Suppose that Janet's and Sam's utility of income is given by u(x) = In x and the initla wealth of each one of them is equal to w = 4. Which of the following statements is true? O a. Both agents prefer Sam's solutions to Janet's solution. b. Both agents prefer Janet's solutions to Sam's solution. The agents are indifferent between Janet's solutions to Sam's solution.…arrow_forward

- Please answer question on screenshot (which of the folowing statements....) q1) Janet offers her friend Sam (who has identical preferences and initial wealth) the following proposition: They buy the ticket together, and share the cost and proceeds equally.arrow_forwardJanet’s broad attitude to risk (risk averse, risk neutral, or risk loving) is independent of her wealth. She has initial wealth w and is offered the opportunity to buy a lottery ticket. If she buys it, her final wealth will be either w+4 or w−2, each equally likely. She is indifferent between buying the ticket and not buying it. Janet offers her friend Sam (who has identical preferences and initial wealth) the following proposition: They buy the ticket together, and share the cost and proceeds equally. Sam has another idea: They buy two tickets (that have independent outcomes) and share the costs and proceeds equally. Suppose that Janet's and Sam's utility of income is given by u(x)=lnx and the initIal wealth of each one of them is equal to w=4. Recall the proposal made by Janet, and the solution put forward by Sam. Which of the following statements is true? a. Both agents prefer Sam's solutions to Janet's solution. b. Both agents prefer Janet's solutions to Sam's solution.…arrow_forwardMillicent’s utility function is U(w) = W0.5 , where W is her wealth. She owns a “pure water” producing firm that will be worth GH100 or 0 Ghana cedis next year with equal probability. a. Suppose her firm is the only asset she has. What is the lowest price at which she will agree to sell her pure water? (Hint: price=amount that will give her the same expected utility) b. Assume that she has GH200 safely stored under her mattress, find the new lowest price at which she will agree to sell her “pure water” producing firm c. From your answers in parts (a) and (b), what is the relationship between her wealth and her degree of risk aversion?arrow_forward

- Consider an individual with an expected utility function of the form u(w) = √wwhere wrep-resents this individual’s wealth. This individual currently has wealth of $100. This individualfaces a risk of losing $64 with a probability of (1/2). The maximum price that this individualwould pay for insurance that covers the entire $64 loss is?arrow_forwardAlice prefers having more money to less. She is an expected utility maximiser with a wealth of W = 800. She faces a lottery where she will be left with - of her wealth with probability p • 4 times her wealth with probability p 4 where 0>p>. She will keep her initial wealth with remaining probability 1 – 2p. Consider a Marschak triangle with the probability of the "worst" event on the horizontal axis and the probability of the "best" event on the vertical axis. Alice is risk-averse if the slope of her indifference curves is greater than (fill in the blank)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education