ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

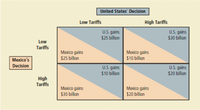

Consider trade relations between the United States and Mexico. Assume that the leaders of the two countries believe the payoffs to alternative trade policies are shown in the image attached.

a) What is the dominant strategy for the United States? For Mexico? Explain.

b) Define Nash equilibrium. What is the Nash equilibrium for trade policy?

c) In 1993, the U.S. Congress ratified the North American Free Trade Agreement, in which the United States and Mexico agreed to reduce trade barriers simultaneously. Do the perceived payoffs shown here justify this approach to trade policy? Explain.

Transcribed Image Text:United States' Decision

Low Tariffs

High Tariffs

U.S. gains

$25 billion

U.S. gains

$30 billion

Low

Tariffs

Меxico gains

$25 billion

Mexico gains

$10 billion

Mexico's

Decision

U.S. gains

$10 billion

U.S. gains

$20 billion

High

Tariffs

Меxico gains

$30 billion

Меxico gains

$20 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In an exchange economy, there are two agents, A and B, and there are 330 total units of x and 330 total units of y. The two consumers have utility functions u(x, y) = x²y and u(x, y) = zy, respectively. The equation of the contract curve in terms of the allocations of agent A can be written as УА 330z A V-ZA where the value for V is V =arrow_forwardTwo firms, Incumbent & Entrant, can produce the same good. The market demand for the good is given by P = 180 – Q, where P is the market price and Q is the market quantity demanded. The firms must pay w = 45 per unit of output for labour and r = 45 per unit of output for capital (one unit of capital is used per unit of output), but Incumbent may choose capacity KI units of capital before Entrant decides whether to enter the market. Suppose firms each have fixed costs FI =600, FE=500. Incumbent chooses (as a Stackelberg leader) capacity KI equal to the monopoly profit- maximizing quantity. When you answer the following questions, show your work. a. Would Incumbent be able to prevent entry by choosing capacity KI equal to the monopoly profit-maximizing quantity? Explain. b. What is the Incumbent’s equilibrium choice of capacity KI in this Dixit game? c. Does the Incumbent’s choice of capacity KI in part (b) qualify as predatory conduct (here, limit output)? Explain.arrow_forward1. Chapter 10 (a) In a pure exchange economy with two goods, G and H, the two traders have Cobb-Douglas utility functions. Suppose that Tony's utility function is U₁ = G, H, and Margaret's utility function is Um Gm (Hm)2. Between them, they own 100 units of G and 50 units of H. Solve for their contract curve. determine p, the competitive price of G, where the price of (b) = H is normalized to equal one.arrow_forward

- The author describes the case of the "Prisoner's Dilemma" to demonstrate which of the following? Competition and the pursuit of unfettered self-interest result in greater efficiency, and benefits everyone involved equally. Effective policy can place incentives in such a manner that the very pursuit of unfettered self-interest of the prisoners results in the desired outcome of getting both to confess to the crime. Just as in the case of the prisoner's dilemma, the pursuit of unfettered self-interest will cause the fishermen who fish Atlantic swordfish (a common resource) to harvest them wisely and limit the number of fish each fisherman catches. Thus the fishermen's ability to pursue unfettered self-interest will allow the population of swordfish to remain stable and even grow. The fishermen trust each other to behave responsibly and in the interest of the common good.arrow_forwardAnswer to the image?arrow_forward1) Which is the Nash equilibrium if Boeing produces and why ? 2) Suppose home is a small exporter of wheat. At the price of $100 per ton, home growers exports 20 tons. Now Suppose the home government decides to support its domestic producer with an export subsidy of $40 per ton. Use the following figure to answer these questions. 2) Suppose home is a small exporter of wheat. At the price of $100 per ton, home growers exports 20 tons. Now Suppose the home government decides to support its domestic producer with an export subsidy of $40 per ton. Use the following figure to answer these questions. 2) Suppose home is a small exporter of wheat. At the price of $100 per ton, home growers exports 20 tons. Now Suppose the home government decides to support its domestic producer with an export subsidy of $40 per ton. Use the following figure to answer these questions. a) What is the quantity exported under free trade and with the export subsidy? b) Calculate the effect…arrow_forward

- An economy with many consumers (Amy, Hao, ...), many producers, two goods (A and B) and two inputs (L and K) is in a competitive general equilibrium. Which of the following conditions are satisfied in this economy? (Select all that apply) The absolute value of the slope of PPF (with good A on the horizontal axis) is equal to MCA / MCB, the ratio of marginal costs of producing goods A and B, at any point on PPF MRSAB = PA / PB for all consumers For every possible redistribution of goods among the consumers, some of them will be better off and some of them will be worse off. MRS = MRT MRS MRTS PA = MCA and PB = MCB MUAmy = MUHao A = PA MRTS = PA / PB MUAmy A = MCA and MUAmy B = MCB MRTS between labour and capital is the same for all firms, whether producing good A or good B. the ratio of input marginal products must be equal to the ratio of input prices MRT = MRTS for all firms, whether producing good A or good B For every possible redistribution of inputs among the firms, the quantity…arrow_forwardUsing the Surplus Approach, describe how tendencies for concentration emerge from the regular functioning of competition between capitalist firms.arrow_forwardTwo countries decide to specialize in producing certain goods to export to other countries, and in return they import different goods from these other countries. The advantage of these exports and imports is: Group of answer choices the country will be able to produce at a point outside your production possibilities frontier. the country will be able to consume at a point outside your production possibilities frontier. the countries will be able to produce and consume at a point outside your production possibilities frontier. the country's production possibilities frontier will shift outward.arrow_forward

- Two firms, A and B, are contemplating exporting a local fruit called durian to another country that has strong demand for durian. If both firms export their durians, each firm can earn an export revenue of $25 million. If both firms do not export, each firm can earn a revenue of $12 million from their own domestic market. If one of them exports durians and the other does not export, the firm that exports durians can earn an export revenue of $50 million. But the non-exporting firm will earn a revenue of $18 million. (a)If both firms make a decision simultaneously, construct and analyse a payoff matrix and solve for the Nash equilibrium. Explain whether this is the prisoner’s dilemma game. (b) Suppose Firm A can make a decision before Firm B. Construct and analyse a decision tree model and determine the payoffs to both firms. Does timing matter in this game?arrow_forward5. Given that excess demands are continuous and satisfy Walras' law, use Brouwer's Fixed Point Theorem to establish the existence of competitive equilibrium in a simple exchange economy. Suppose that an apple orchard is located next to a bee keeper. If the orchard produces x apples and the bee keeper produces y honey and the cost functions of the two are as follows: C(x) = x² + 10x +9 C(y) = y² - 8x What will be the socially optimal amount of apples that can be produced? How does this compare to privately optimal amount?arrow_forwardIn a pure exchange economy with two goods, G and H, the two traders have Cobb-Douglas utility functions. Suppose that Tony’s utility function is UT = GTHT and that Margaret’s utility function is UM = GM(HM)2. Between them, they own 100 units of G and 50 units of H. a. Please solve for their contract curve. b. Please solve for the demand functions for the two goods for both Tony and Margaret, assuming p is the competitive price of G, and the price of H is normalized to equal one.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education