Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

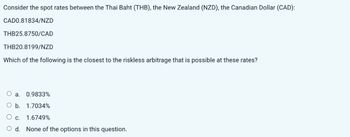

Transcribed Image Text:Consider the spot rates between the Thai Baht (THB), the New Zealand (NZD), the Canadian Dollar (CAD):

CADO.81834/NZD

THB25.8750/CAD

THB20.8199/NZD

Which of the following is the closest to the riskless arbitrage that is possible at these rates?

a. 0.9833%

b. 1.7034%

○ c.

1.6749%

○ d. None of the options in this question.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- D3)arrow_forwardIf the real exchange rates between the USD and CAD, AUD, and BRL respectively are 1.20, 0.90, and 1.40 respectively with the percentage of trade between the US and Canada, US and Australia, and US and Brazil are 50%, 20%, and 30% respectively (assuming these are only countries on the planet!), what is the effective real exchange rate for the USD? Question options: a)0.9 b)1.4 c)1.2 d)1.0arrow_forwardEvaluate the arbitrage opportunity with the triangular arbitrage methods for the following currency pairs and identify the preferred direction of trade Bid CHFUSD 1.0178 Ask 1.0202 USDGBP 0.7434 0.7443 CHFGBP 0.6512 0.6534 Please calculate both directions and provide the answers. In your answer below, you could provide a 3x3 table (see the top right corner of the text box) and add the following: Direction 1 Direction 2 Calculation answer answer Edit View Insert Format Tools Table 12pt v Paragraph BTUAV Preferred direction (Y/N) answer answerarrow_forward

- 6) Based on the following information about the future possible exchange rates and the value of your foreign assets, you have computed Var(S)=0.00666667 and Cov(P,S)=12. If you use the appropriate forward hedge, what will be the value of your hedged position in a situation when the future spot exchange rate is 1.4$/£? State Prob. P* 1 2 3 1/3 £1000 1/3 1/3 £1,000 £1,100 S($/£) 1.4 1.5 1.6 P(=SP*) $1,400 $1,500 $1,760arrow_forwardThe euro is quoted as EUR:USD = 1.1420-1.1425,and the Canadian dollar is quoted as USD$:CAD = 1.3540-1.3545. What is the implicit bid price and ask price of EUR:CAD quotation?arrow_forwardAssume the bid rate of an Yen dollar is $ 1.8 while the ask rate is $ 3.5 at Arab Bank.Assume the bid rate of an Yen dollar is $3.4 while the ask rate is $5.7 at Palestine Bank. Given this information, what would be your gain if you use $8876.7 and execute locational arbitrage? =8876.713.5^ * 3.4b =8876.7/5.7^ * 3.5c =8876.7/3.4^ * 1.8d = 8876.7 /3.5^ * 5.7arrow_forward

- Assume the following information: Spot rate of U.S. dollar Quoted Price AUD1.2500/USD 180-day forward rate of U.S. dollar 180-day Australian interest rate (a periodic rate) 180-day U.S. interest rate (a periodic rate) AUD1.2800/USD 4.75% 3.10% A. What USD-denominated percent rate of return can a US investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) B. What AUD-denominated percent rate of return can an Australian investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) C. Given this information, who has a covered interest arbitrage opportunity? Answer either "Australian investors" or "U.S. investors". D. What changes in the 2 quoted prices above would likely occur to eliminate any further possibilities of covered interest arbitrage? (answer with just or 1) Spot rate of U.S. dollar 180-day forward rate of U.S. dollararrow_forward1) The following table contains exchange rate data for five countries: Country Big Mac Actual Price in Exchange Big Mac Price in $ Implied PPP of $ Over/under valuation (%) Local Rate Currency U.S. $3.20 $1.00/$ Norway K30.00 K10.25/$ Sweden K28.75 K10.10/$ Finland €2.85 €0.95/$ Iceland K410 K145/$ a) Compute the Big Mac price (in dollars) in each country. b) Compute the PPP-implied exchange rate for each currency. c) Compute the percentage over/undervaluation for each currency.arrow_forwardPlease use the data below, to answer the following question. BigMac price in the US BigMac price in Mexico Current Exchange Rate O overvalued by 14.29% O undervalued by 14.29% O overvalued by 12.50% O undervalued by 12.50% USD 3.50 12 MXN 80 Based on PPP, the MXN is 1 USD - MXN 20 140 15 16 (2 hparrow_forward

- Given: So = INR 83/US$ F90 days = INR 83.2834/US$ 90-day iIndia = 6.91% 90-day ius = 5.34% a. there is no interest rate parity O b. there is total interest rate parity Oc. there is a possibility of triangle arbitrage O d. there is approximate interest rate parityarrow_forwardNikularrow_forwardA German MNC, exports to, and imports from Australia. The MNC has accounts receivable totaling AUD178 million, accounts payable of AUD183 million and AUD-denominated debt of AUD95 million. Its transaction exposure denominated in Euros is: O a EUR90 million O b. -EUR100 million O. None of the options in this question are correct O d. EUR266 millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education