ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

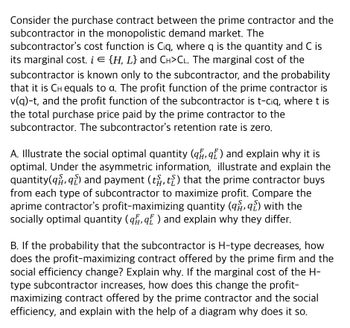

Transcribed Image Text:Consider the purchase contract between the prime contractor and the

subcontractor in the monopolistic demand market. The

subcontractor's cost function is Ciq, where q is the quantity and C is

its marginal cost. i = {H, L} and CH>CL. The marginal cost of the

subcontractor is known only to the subcontractor, and the probability

that it is CH equals to a. The profit function of the prime contractor is

v(q)-t, and the profit function of the subcontractor is t-ciq, where t is

the total purchase price paid by the prime contractor to the

subcontractor. The subcontractor's retention rate is zero.

A. Illustrate the social optimal quantity (q, q) and explain why it is

optimal. Under the asymmetric information, illustrate and explain the

quantity(q, q) and payment (t), t) that the prime contractor buys

from each type of subcontractor to maximize profit. Compare the

aprime contractor's profit-maximizing quantity (99) with the

socially optimal quantity (q, q) and explain why they differ.

B. If the probability that the subcontractor is H-type decreases, how

does the profit-maximizing contract offered by the prime firm and the

social efficiency change? Explain why. If the marginal cost of the H-

type subcontractor increases, how does this change the profit-

maximizing contract offered by the prime contractor and the social

efficiency, and explain with the help of a diagram why does it so.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A store estimates is customer inverse demand is P= 6.1 - 2.6Q, and the marginal cost of each rental is $0.48. If they use block pricing, what should the price be for the entire package?arrow_forwardSuppose Bang Bang is the only local swimming pool. She believes that there are 10 potential customers. Each of them has an identical demand function of QI = 250 – 0.02P, with QI as the unit of services of each customer. She operates with a constant variable cost of $500 per unit of service. If Bang Bang can practice a two-part tariff with a membership arrangement, suggest the optimal pricing strategy. Show your calculationsarrow_forwardA firm with market power has an individual consumer demand of Q 10 P and total costs of C = 2Q. What is the optimal amount of this product to package in a single block? Multiple Choice 2 8 64 =arrow_forward

- A city has two newspapers. Demand for either paper depends on its own price and the price of its rival. Demand functions for papers A and B respectively, measured in tens of thousands of subscriptions, are 21-2Pa + Pb and 21 + Pa-2Pb The marginal cost of printing and distributing an extra paper just equals the extra advertising revenue one gets from another reader, so each paper treats marginal costs as zero. Each paper maximizes its revenue assuming that the other's price is independent of its own choice of price. If the papers enter a joint operating agreement where they set prices to maximize total revenue, by how much will newspaper prices rise? (a) 3 (b) 2 (c) 0 (d) 3.5 (e) 2.5arrow_forwardThree oligopolistic banks operate in the loan market with the inverse demand functiongiven by r (Q) = a-Q, where r is the interest rate per unit of loan and Q = q1 +q2 +q3and qi>=0 is the total amount of loans issued by bank i = 1, 2, 3. Also, a > 0 is aconstant. The cost of funds for bank i is given by cqi, where c belongs (0, a) is a constant.A bank's profit from loans is (r -c)qi. (1) Suppose the banks engage in Cournot competition. Find the symmetricNash equilibrium. How much profit does each bank make? (2) Now suppose banks compete in the following sequential manner: Bank1 chooses q1. Then banks 2 and 3 observe q1 and then simultaneously choose q2and q3, respectively. Find the subgame perfect equilibrium. How much profit doeseach bank make here? Does bank 1 enjoy an advantage being the first mover?arrow_forwardTwo identical firms compete as a Cournot duopoly. The demand they face is P = 100-2Q. The cost function for each firm is C(Q)= 40. In equilibrium, the deadweight loss is Multiple Choice $256. $512 $128 5394arrow_forward

- true or false The oligopolist reduces the price of the good by 10%, but the competitors reduced their prices by 8%. As a result, the oligopolist only attracts only an additional 5% consumers from his competitors, This will reduce the total revenue of the oligopolist.arrow_forwardQ4-11: Suppose we have a monopolist supplying two different markets. The demand in these markets is given by two types of consumers, each buying exactly one unit of the product a monopolist is selling so long as their consumer surplus is non-negative. If the consumer has a choice, she or he will buy the product that gives them the highest consumer surplus. the monopolist has estimated the indirect utility (CS) of each type of consumer as V₁ = 7z₁ - P₁ V₂ = 222 - P2 == where = {1,2} is the quality chosen by the monopolist i.e. vertical differentiation. The monopolist does not know each consumer's type. There are 397 type one consumers and 107 type two consumers. Finally suppose the marginal cost for all quantities is given by e(z) = 2. Q4-1: What are the lowest qualities type 1 and 2 consumers will demand. Q4- 3: What are the incentive compatibility constraints for type 1 and 2 Q4-4: The monopolist has three options: ■Sell only to high type consumers ■ Sell to both consumers the same…arrow_forwardSuppose that a Monopolist is attempting to pioneer the market for a new good. This product is unique enough that there are no close substitutes, and there is no threat of entry. The monopolist anticipates facing the demand function P=80-Q. The monopolist has a fixed cost of 900 and a total variable cost of VC=10Q and marginal cost of MC=10. Suppose the firm considers setting a uniform price to maximize its profit. Will the firm be profitable? Now suppose that the realized demand is lower than the firm anticipated: P=60-Q. Is the firm profitable? Continue to assume that the demand curve is P=60-Q. Fans of the product worry that the firm might go under, and to help save it every consumer agrees to pay his willingness to pay for each unit of output. Is perfect first degree price discrimination enough to save the firm (is the firm profitable under first-degree price discrimination)? Continue to assume that the demand curve is P= 60-Q. Suppose the new good is a Golf Course (so units of…arrow_forward

- The average consumer at a firm with market power has an inverse demand function of P = 10 − Q. The firm's total cost function is C = 2Q. If the firm engages in two-part pricing, what is the optimal price to charge a consumer for each unit purchased? Multiple Choice $2 $0 $1 $4arrow_forwardA private golf club has two types of members. Serious golfers each have the demand curve Q = 250 - 10P, where Q represents the number of rounds played per year and P is the per- round price. Casual golfers have the demand curve Q = 100 - 10P. The club has 5 serious and 60 casual golfing members and faces a constant marginal cost and average cost of $ 5 per round played by either type of member. The club cannot distinguish high demanders from low demanders but is considering deploying a 2-part tariff pricing system? Specifically, the club is considering a per-unit price of $5 and a per-unit price of $6. What should they do and what are the profits they will earn? Be very clear in how you arrive at your answer.arrow_forwardTopside Tiles, which produces roofing tiles, is a local monopoly. Its inverse demand function is p=140-2Q, and its constant marginal cost is 10. The owner has delegated the decision of how much output to produce to the plant manager. The manager's income, Y, is 5% of revenue: Y=0.05R. Show that a manager who wishes to maximize income, Y, will choose an output that exceeds the profit-maximizing level. Is there a conflict of interest between the owner and manager? Is this situation an agency problem? (Hint: This problem can be solved using a graph, by using calculus, or by using the rule that the MR curve has twice the slope of the demand curve.) The output that maximizes profit is (Enter your response rounded to one decimal place.) units.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education