ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

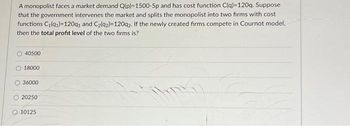

Transcribed Image Text:A monopolist faces a market demand Q(p)=1500-5p and has cost function C(q)-120q. Suppose

that the government intervenes the market and splits the monopolist into two firms with cost

functions C₁(91)=120q1 and C₂(92)=120q2. If the newly created firms compete in Cournot model,

then the total profit level of the two firms is?

40500

18000

36000

20250

10125

TRG

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose the demand functions facing the wireless telephone monopolist in Worked-Out Problem 18.4 (page 647) are Q = 50-50P for each low-demand consumer and Q = 140 - 50P for each high-demand consumer, where P is the per-minute price in dollars. The marginal cost is $0.10 per minute. Suppose the monopolist offers only a single two-part tariff. Instructions: Round your answers to 2 decimal places as needed. a. What will be the monopolist's profit from each type of consumer if it charges a per-minute price of $0.10 and a fixed fee that causes both types of consumers to make a purchase? Profitlow = $ Profit high = $ b. What if it charges a per-minute price of $0.20? Profitlow = $ Profit high = $ c. If there are 200 high-demand consumers, how many low-demand consumers can there be for the monopolist to find the $0.20 price more attractive than the $0.10 price? low-demand consumers.arrow_forward2) An industry consists of three firms with identical total cost functions C(q) = 20q+q². Market demand is Q(P) = 140 - P. a) Find the Cournot-Nash equilibrium quantity, price and profits for this industry. b) Suppose a monopolist controlled the three firms. What would its cost function be? c) What would be this monopolist's quantity, price and profits?arrow_forwardConsider a downstream monopolist producing a final good that requires two inputs in fixed proportions. Input 1 is produced by upstream monopolist U1 and input 2 is produced by upstream monopolist U2. Suppose that the demand function for the final product is linear and the marginal costs of production for the upstream producers and final producer (other than for the two inputs) are equal to zero. What is the effect of a merger between the two upstream producers? a) The merger reduces the quantity of the final product sold to consumers and the merged firm's profits. b) The merger reduces the quantity of the final product sold to consumers and increases the merged firm's profits c) The merger increases the quantity of the final product sold to consumers and the merged firm's profits. d) The merger increases the quantity of the final product sold to consumers and decreases the merged firm's profits. e) Cannot be determined given the information provided.arrow_forward

- only question #4 pleasearrow_forwardWhen a monopolist faces two types of outwardly indistinguishable consumers, one with a higher willingness to pay then the other, then, by using non-linear pricing, the monopolist will extract the entire consumer surplus from the customer with the high willingness to pay and only part of the surplus from the customer with the lower willingness to pay. True Falsearrow_forwardKalamazoo Competition-free Concrete (KCC) is a local monopolist of ready-mix concrete. Its annual demand function is Qd = 16,000 – 200P.Suppose that Kalamazoo's marginal cost is $20 per cubic yard and its avoidable fixed cost $100,000 per year What is the deadweight loss from monopoly pricing in above?arrow_forward

- Q1. Consider a monopolist which produces two different products, each having the following demand functions: - P₁, 91 = 14- 1 92 = 24- P2. where 9₁ and 92 represent the output levels of product 1 and product 2 and p₁ and p2 represent their prices. The monopolist's joint cost function is given as C (91, 92) = 91 +59192 +92². Write out the monopolist's profit function.arrow_forwardA monopolist produces a homogeneous good in two factories, each with its own distinct marginal cost (MC) function. The marginal costs for Factory 1 and Factory 2 are given by MC₁ 4*Q1 and MC2 = 2*Q2 +2 respectively, where 1 and 2 represent the quantity of goods produced by Factory 1 and Factory 2. The monopolist faces a market demand represented by Q 64 P,where is the total quantity demanded, and P is the price of the good. The profit-maximizing output levels for each factory of the monopolist are: = 194 25 OQ1 = 61 and Q2 = 33 194 and Q2 23 Q1 = OQ1 = = = = and Q2 OQ1 11 and Q2 = - = 308 25 308 23 21arrow_forwardThere are two types of consumers: one half of consumers are type 1 (low type) and the other half are type 2 (high type). Type l's demand curve is q1 = 8 – P, while type 2's demand is given by q2 = 12 – P. Consider a monopolist selling its product to these consumers. Assume that the marginal cost is equal to zero. 1.1. Suppose that the firm can charge only one price, P, for each unit. (1) What is the market demand, Q? (Note: Q should be equal to q1 + q2.) What should be P that maximizes the monopoly's profit? For the profit- (2) maximizing P, will both types of consumers purchase the product, or only high type con- sumers purchase? (3) Given the price in (2), what is the resulting social surplus?arrow_forward

- Monopolists, unlike competitive firms, have some market power. A monopolist can increase price, within limits, without the quantity demanded falling to zero. The main way it retains its market power is through barriers to entry-that is, other companies cannot enter the market to create competition in that particular industry. Complete the following table by indicating which barrier to entry appropriately explains why a monopoly exists in each scenario. Barriers to Entry Economies of Scale Scenario In the natural gas industry, low average total costs are obtained only through large-scale production. In other words, the initial cost of setting up all the necessary pipes and hoses makes it risky and, most likely, unprofitable for competitors to enter the market. The Aluminum Company of America (Alcoa) formerly controlled all U.S. sources of bauxite, a key component in the production of aluminum. Given that Alcoa did not sell bauxite to any other companies, Alcoa was a monopolist in the…arrow_forwardThere are two ice-cream parols on a beach. The dayly demand for ice-creams is given by Q = 3079 - 3p. The average variable cost of an ice-cream is 70, while the rent of the place is 966. How many ice-creams is the 'Leader' company selling if the two ice-cream stands operate as Stackelberg duopolists? (Please use 2 decimals in your answer.)arrow_forwardSuppose that a unique technology is developed that allowed for the production of lightsabers. The inspired entrepreneur (let's say, Lucas George) who developed the technology immediately slaps a patent on the design and hoards kyber crystals (necessary input). Demand and production costs are given below: P(Q) = 14,000 - 600Q C(Q) = 3,000 + 100² 1. How much profit does Lucas the monopolist earn? 2. Solve for the market failure of Lucas operating as a monopolist relative to what would be observed if Lucas operated as a competitive firm. Martin the Martian (not to be confused with any other martian that might be copyrighted...) observes the profits being made by Lucas. Determining that ray guns are not that different from lightsabers, Martin begins competing with Lucas: P'(Q) = 12,000 - 600Q' 3. A third potential business owner, Dr. When, has watched this market carefully and is trying to decide whether or not to market her Sonic Screwdriver (a near-substitute). Based on your previous…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education