College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

???

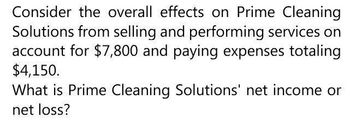

Transcribed Image Text:Consider the overall effects on Prime Cleaning

Solutions from selling and performing services on

account for $7,800 and paying expenses totaling

$4,150.

What is Prime Cleaning Solutions' net income or

net loss?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is prime cleaning solutions net income or net loss?arrow_forwardConsider this income statement: Green Valley Nursing Home, Inc. Statement of Income Revenue: Year Ended December 31, 2015 Patient service revenue $3,163,258 Less provision for bad debts Net patient service revenue Other revenue Net operating revenues Expenses: Salaries and benefits Medical supplies and drugs Insurance and other Depreciation Interest (110,000) $3,053,258 106,146 $3,159,404 a. How does this income statement differ from the ones presented in Exhibit 3.1 and Problem 3.2? b. Why does Green Valley show a provision for income taxes while the other two income statements do not? c. What is Green Valley's total profit margin? How does this value compare with the values for Sunnyvale Clinic and BestCare? d. The before-tax profit margin for Green Valley is operating income divided by total revenues. Calculate Green Valley's before-tax profit margin. Why might this be a better measure of expense control when comparing an investor-owned business with a not- for-profit business?…arrow_forwardDopler Inc. has only two retail and two wholesale customers. Information relating to each customer for 2020 follows: (Click the icon to view the data.) Requirement Calculate customer-level operating income. Begin by calculating each customer's gross margin. Then calculate the operating income for each customer. (Use parentheses or a minus sign to enter a negative gross margin or a customer-level operating loss. Abbreviations used: cust= customer, oper. = operating.) Gross margin Customer-level operating income (loss) Wholesale West Region Wholesaler Retail East Region Wholesaler Hudson Inc. Conway Corp Data table Wholesale Customers West Region Wholesaler East Region Wholesaler Hudson Inc. Retail Customers Conway Corp Revenues at list prices $ 760,000 $ Discounts from list prices 51,800 1,280,000 $ 78,600 320,000 $ 300,000 20,500 6,110 Cost of goods sold 600,000 1,100,000 301,000 200,000 Delivery costs 28,800 23,490 16,540 14,230 Order processing costs 12,690 16,960 9,440 7,270 Cost of…arrow_forward

- Mason Inc. has only two retail and two wholesale customers. Information relating to each customer for 2020 follows: (Click the icon to view the data.) Requirement Calculate customer-level operating income. Begin by calculating each customer's gross margin. Then calculate the operating income for each customer. (Use parentheses or a minus sign to enter a negative gross margin or a customer-level operating loss. Abbreviations used: cust = customer; oper. = operating.) Wholesale Gross margin Customer-level operating income (loss) West Region Wholesaler East Region Wholesaler Sloan Inc. Retail Snyder Corparrow_forwardWhat is the gross margin on these accounting question?arrow_forwardAxler Inc. has only two retail and two wholesale customers. Information relating to each customer for 2020 follows: (Click the icon to view the data.) Requirement Calculate customer-level operating income. Begin by calculating each customer's gross margin. Then calculate the operating income for each customer. (Use parentheses or a minus sign to enter a negative gross margin or a customer-level operating loss. Abbreviations used: cust = customer; oper. = operating.) Wholesale Gross margin West Region Wholesaler East Region Wholesaler Smile Inc. Retail Slide Corparrow_forward

- Please prepare a cost by nature/expense by nature income statement for the following points. In particular please explain whether point a) (first point) should be included in the income statement. In point a), Is there sufficient information for write-off expenses to be recorded in the income statement and should write-off of assets be included in the income statement? a) Write off (in minus) of short-term financial assets 9 000b) Other costs by nature 4 000c) Change in inventories of traded goods + 2 000d) Revenue from sale of building 50 000e) Income tax 10%f) Revenue from sale of traded goods 12 000g) Retained profits from previous years 10 000h) Accumulated depreciation of building 49 000i) Historical cost of building 102 000arrow_forwardWhat would be the net income for Floress Catering? a. 45,500 b. 16,800 c. 19,800 d. 10,800arrow_forwardhere are the choices: what is the gross profit: a. 241000 b. 151000 c. 141000 d. none e. 177000 how much is the operating expense? a. none b. 141000 c. 151000 d. 241000 e.177000 How much is the operating income? a. 136150 b. none c. 124450 d. 130950 e. 137450arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,