FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I Want Answer

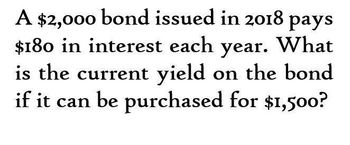

Transcribed Image Text:A $2,000 bond issued in 2018 pays

$180 in interest each year. What

is the current yield on the bond

if it can be purchased for $1,500?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the current yield on the bond if it can be purchased for $800 on these general accounting question?arrow_forwardA bond pays $50,000 per year and has a face value of $500,000 at theend of 8 years when it has to be redeemed. If its current discounted priceis $390,000, what true interest could be earned on the bond? Ans. (14.9%)arrow_forwardA bond has a face value of $10,000 and matures on August 24 2030 with a bond rate of 3.1% compounded semi-annually. If the bond was purchased on February 24 2020 at a market rate of 3.7% compounded semi-annually, what was the purchase price of the bond?arrow_forward

- How much will a $49,200 EE savings bond cost when you initially purchase it? Assuming the bond earns 2.69 percent annually, approximately how long will it take for the bond to reach its stated face value? When you initially purchase it, the EE saving bond will cost $ 24,600. (Round to the nearest dollar.) Assuming the bond earns 2.69 percent annually, the length of time it will take for the bond to reach its stated face value is years. (Round to one decimal place.)arrow_forwardA bond pays P342 interest per year and has face value of P9,964 at the end of 15 years, when it has to be redeemed. If the interest of the bond is 0.13. What is the current value of the bond?arrow_forward2. A 15-year $12,000 bond at 5.2% compounded semi-annually was issued on May 15, 2015. The bond is purchased on February 26, 2018 to yield 4.1% compounded semi-annually. a. What is the purchase (flat) price of the bond? b. What is the accrued interest? c. What is the quoted price of the bond? d. What is the quoted price as a percentage of face value?arrow_forward

- If a one-year bond with a face value of $100 (the bond pays the bearer $100 one year from now) sells today for $85, what is the interest rate on the bond? 0 15% 17.6% 1.18% It depends on what the Federal Reserve sets as its target rate for the Federal Funds Rate.arrow_forwardDetermine the Purchase Price of a Bond that is purchased on the Coupon Date. A $500 bond matures on March 1, 2026, interest is 6.7% payable semi-annually. Determine the purchase price of the bond on September 1, 2020, to yield 8.7% compounded semi-annually. Will this bond sell at a premium or at a discount? discount a.) Determine the value of the coupon. b.) Determine the number of coupons left on the bond. 11 c.) Determine the Present Value of the Bond. d.) Determine the Present Value of the Coupons. e.) What is the purchase price of the Bond on September 1, 2020? >arrow_forwardThe Saleemi Corporation's $1,000 bonds pay 6 percent interest annually and have 11 years until maturity. You can purchase the bond for $1,155. a. What is the yield to maturity on this bond? b. Should you purchase the bond if the yield to maturity on a comparable-risk bond is 3 percent?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education