ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Please write your answer as precise as possible. Long answers are not necessary.

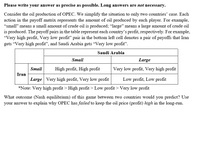

Consider the oil production of OPEC. We simplify the situation to only two countries' case. Each

action in the payoff matrix represents the amount of oil produced by each player. For example,

"small" means a small amount of crude oil is produced; “large" means a large amount of crude oil

is produced. The payoff pairs in the table represent each country's profit, respectively. For example,

"Very high profit, Very low profitť" pair in the bottom left cell denotes a pair of payoffs that Iran

gets "Very high profit", and Saudi Arabia gets “Very low profit".

Saudi Arabia

Small

Large

Small

High profit, High profit

Very low profit, Very high profit

Iran

Large Very high profit, Very low profit

Low profit, Low profit

*Note: Very high profit > High profit > Low profit >Very low profit

What outcome (Nash equilibrium) of this game between two countries would you predict? Use

your answer to explain why OPEC has failed to keep the oil price (profit) high in the long-run.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose we’ve modelled a firm’s entry decision with a one-shot, simultaneous move game, determined payoffs and found the Nash equilibrium. Suppose with the payoffs we came up with, both firms have a clear dominant strategy such that there is a Nash equilibrium in which both firms play their dominant strategy. However, when we observe the actual actions of the firms, we see that they don’t choose the strategy wepredicted and the outcome of the game doesn’t match the Nash equilibrium. What are 4 reasons this might be? (Hint: The firms are rational.)arrow_forwardMake sure you clearly write your name and submission:. 1. Consider the 2-player, zero-sum game "Rock, Paper, Scissors". Each player chooses one of 3 strategies: rock, paper, or scissors. Then, both players reveal their choices. The outcome is determined as follows. If both players choose the same strategy, neither player wins or loses anything. Otherwise: • "paper covers rock": if one player chooses paper and the other chooses rock, the player who chose paper wins and is paid 1 by the other player. • "scissors cut paper": if one player chooses scissors and the other chooses paper, the player who chose scissors wins and is paid 1 by the other player. • "rock breaks scissors": if one player chooses rock and the other player chooses scissors, the player who chose rock wins and is paid 1 by the other player. We can write the payoff matrix for this game as follows: rock paper -1 0 1 rock 0 paper 1 scissors -1 (a) Show that this game does not have a pure Nash equilibrium. 1 X 3 (b) Show that…arrow_forwardQuestion 3: Represent Rock-Paper-Scissors 1 point, the loser gets -1 and in case of a tie each player gets 0. What are the dominant strategies? What is the Nash equilibrium? game in a matrix format. Note that the winner getsarrow_forward

- Suppose that both Apple and Samsung simultaneously choose A or S. Depict the game played by the two tech firms in matrix form.arrow_forwardIf Bean Bruuer advertises, Hatte Latte makes a higher profit if it chooses If Bean Bruuer doesn't advertise, Hatte Latte makes a higher profit if it chooses Suppose that both firms start off by deciding not to advertise. If the firms act independently, what strategies will they end up choosing? Hatte Latte will choose not to advertise and Bean Bruuer will choose to advertise. Both firms will choose not to advertise. Both firms choose to advertise. Hatte Latte will choose to advertise and Bean Bruuer will choose not to advertise. Again, suppose that both firms start off not advertising. If the firms decide to collude, what strategies will they end up choosing? Hatte Latte will choose to advertise and Bean Bruuer will choose not to advertise. Hatte Latte will choose not to advertise and Bean Bruuer will choose to advertise. Both firms will choose to advertise. Both firms will choose not to advertise.arrow_forwardIn the game shown below, Player 1 can move Up or Down, and Player 2 can move Left or Right. The players must move at the same time without knowledge of the other player’s move. The first payoff is for the row player (Player 1) and the second payoff is for the column player (Player 2). Solve each game using game theoretic logic. Player 2 Player 1 Left Right Up 7, 7 2, 9 Down 9, 2 1, 3arrow_forward

- suppose that the world is comprised of two countries: X and Y. Because of the absence of centralized world governance, the control of global externalities is particularly challenging, which is the case with greenhouse gases linked to climate change. The entries in the following Payoff Table describe each country's well-being under different abatement patterns: X\Y No Abate Abate No Abate 12,12 24,8 Abate 8,24 20,20 Now suppose that the game is repeated indefinitely. Define the concepts of Trigger Strategies and also the concept of Business as Usual Strategies for the repeated game. Verify that trigger strategies supporting cooperative payoffs (20,20) constitute a non-cooperative equilibrium of the repeated game when δ=0.8. Are trigger strategies still an equilibrium when δ=0.30? Explain intuitively why and verify that Business as Usual still is an equilibrium in this case.arrow_forwardPlease help with #2arrow_forwardPlease help with #1arrow_forward

- For the R & D game that Kimberly-Clark(Kleenex) and Procter & Gamble (Puffs) Play. Each firm has two strategies: Do R&D or do not R&D. If neither firm does R&D, Kimberly-Clark makes $30 million and Procter & Gamble makes $70 million. If both does R&D, Kimberly-Clark makes $5 million and Procter & Gamble makes $45 million. if only Procter & Gamble does R&D, it makes $85 million and Kimberly-Clark makes -$10 million, and if only Kimberly-Clark does R&D it makes $85 million and Procter & Gamble makes -$10 million. 7) Create the payoff matrix for this game?arrow_forwardAnswer to image?arrow_forwardWhat would be the correct answer in this case? I was surprised that "B. The Nash equilibrium is for Saudi Arabia to produce a high output and for Kuwait to produce a high output" was incorrect.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education