MACROECONOMICS

14th Edition

ISBN: 9781337794985

Author: Baumol

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Answer in step by step with explanation.

Don't use

Transcribed Image Text:→

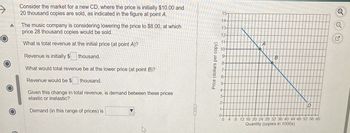

Consider the market for a new CD, where the price is initially $10.00 and

20 thousand copies are sold, as indicated in the figure at point A

The music company is considering lowering the price to $8.00, at which

price 28 thousand copies would be sold.

What is total revenue at the initial price (at point A)?

Revenue is initially $ thousand.

What would total revenue be at the lower price (at point B)?

Revenue would be $ thousand.

Given this change in total revenue, is demand between these prices

elastic or inelastic?

Demand (in this range of prices) is

Price (dollars per copy)

15-

14+

13-

12-

11-

10-

9-

7-

4-

3-

2-

1-

B

D

04 8 12 16 20 24 28 32 36 40 44 48 52 56 60

Quantity (copies in 1000s)

Q

Q

G

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please refer to the table below Price of iPhones. $700.00 $650.00 $500.00 $450.00 $300.00 $275.00 $250.00 $100.00 $50.00 Christy's Demand OA) 5 OB) 8 OC) 28 OD) 45 0 1 1 2 4 5 6 7 10 Lori's Demand. 0 0 1 2 3 4 4 5 Assume that the market for iPhone has only two consumers: Christy and Lori. According the table above, if the price of an iPhone is $275, the market will demand iPhones.arrow_forwardWhat is the current price of gasoline and how many gallons of gasoline do you currently buy per month? How many gallons would you buy next month and how would your behavior change if the price fell by $1.25 per gallon? Also, based on that information, what is your price elasticity of demand for gasoline? Be sure to show how you calculated your price elasticity of demand. current price of gas = $2.53 gallons of gas per month = 72 gallons no change for next month On the average I fill my tank up 3 times a month each time I go I spend $60-$65arrow_forwardA 10 percent increase in income leads to a 15% decrease in the quantity of Cheetos demanded but no change in the price of Cheetos. From this information, we can assume: O Cheetos are an inferior good and price elasticity of demand is less than 1. O Cheetos are a normal good and price elasticity of demand is greater than 1. Cheetos are an inferior good and price elasticity of supply is equal to zero. Cheetos are an inferior good and price elasticity of supply is infinite.arrow_forward

- An individual sets aside a certain amount of his income per month to spend on his two hobbies, collecting wine and collecting books. Given the information below illustrate the demand curve for wine 50- Wine Price Book Price Wine $10 Books Budget $800 40- $8 40 50 $20 $40 $8 $8 20 50 $800 $800 10 50 30어 100- 20- 90- 80- 70- 10- 80- A PCC 50+ 40- 0- 30- 10 40 50 20 30 20- Wine 10- L 2 0+ 0 10 20 30 40 50 60 70 80 90 100 Pricearrow_forwardSuppose the own price elasticity of demand for good X is −4, its income elasticity is 3, its advertising elasticity is 4, and the cross-price elasticity of demand between it and good Y is 4. Determine how much the consumption of this good will change if:Instructions: Enter your responses as percentages. If you are entering a negative number, be sure to use a (−) sign.a. The price of good X decreases by 4 percent. percentb. The price of good Y increases by 9 percent. percentc. Advertising decreases by 2 percent. percentd. Income increases by 3 percent. percentarrow_forwardIn this question, you'll have to solve for price elasticity of demand using the percent change formula. When the old price of a food package was $4.64 per package, the old quantity was 1,081 packages were sold each day. After the price increased to the new price $10.89 per package, sales dropped to a new quantity of 447 packages per day. Using these numbers, what is the price elasticity of demand for food packages? Round your answer to 3 decimal places.arrow_forward

- Asaparrow_forwardYou have just opened a new grocery store. Every item you carry is generic (generic beer, genericbread, generic chicken, etc.). You recently read an article in the Wall Street Journal reporting thatthe price of recreation is expected to increase by 15 percent and cross price elasticity is 0.15. will this affect your store’s salesof generic food products?arrow_forwardRefer to the figure below. If Mallory and Rick are the only two consumers in this market and the price of soda is $0.75 per can, then what will be the market demand for soda each month? Mallory's Demand for Sodal Rick's Demand for Soda Price ($/can) 1.50 1.25 1.00 0.75 0.50 0.25 0 0 10 20 30 40 50 60 70 Quantity (cans of soda/month) rev: 02_01_2018_QC_CS-116371 O 70 50 O 30 O 20 Price ($/can) 1.50 1.25 1.00 0.75 0.50 0.25 0 0 10 20 30 40 50 60 70 Quantity (cans of soda/month)arrow_forward

- Solve the attachmentarrow_forwardOnline the timing and tailoring of prices to specific products is the key to successful pricing in online markets. And " Thanks to the ready availability of data in online markets, a pricing manager can easily approximate the elasticity of demands for the different products it sells online." Assuming a 10 percent decrease in price increases sales by 30 percent, calculate the price elasticity of demand? If the wholesale price of the online product is $50 and sells at a price comparison site that charges $0.50 per click and boasts a conversation rate of 5 percent ( an average of 20 percent clicks are needed to generate sale), the incremental cost of each sale is $50. What price should you change for the product? What is the markup? B) . The authors assert that price sensitivity is affected by (1) product cycle, and (2) number of competitors. In fact, " When the number of competing sellers doubles, a firm's elasticity of demand is expected to double ( you should be able to verify this…arrow_forwardFigure 4.2 P3 P2 P1 A Q Q2 Q3 Q. Qs Qs Qr Refer to Figure 4.2. The demand curve A has a price elasticity O consumers can purchase any quantity they want regardless of the price. O there is no change in quantity demanded as the price changes. O the smallest price change will cause consumers to change their consumption by a large amount. O the smallest price increase will cause consumers to switch to the producer with the lowest prices.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning