Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

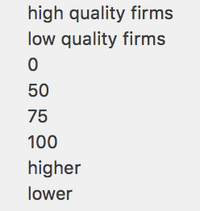

Transcribed Image Text:high quality firms

low quality firms

50

75

100

higher

lower

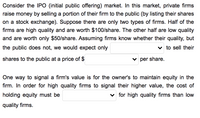

Transcribed Image Text:Consider the IPO (initial public offering) market. In this market, private firms

raise money by selling a portion of their firm to the public (by listing their shares

on a stock exchange). Suppose there are only two types of firms. Half of the

firms are high quality and are worth $100/share. The other half are low quality

and are worth only $50/share. Assuming firms know whether their quality, but

the public does not, we would expect only

v to sell their

shares to the public at a price of $

v per share.

One way to signal a firm's value is for the owner's to maintain equity in the

firm. In order for high quality firms to signal their higher value, the cost of

holding equity must be

v for high quality firms than low

quality firms.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Tennis Shoe Company has concluded that additional equity financing will be needed to expand operations and that the needed funds will be best obtained through a rights offering. It has correctly determined that as a result of the rights offering, the share price will fall from $56 to $54.30 ($56 is the rights-on price; $54.30 is the ex-rights price, also known as the when-issued price). The company is seeking $17.5 million in additional funds with a per-share subscription price equal to $41. How many shares are there currently, before the offering? (Assume that the increment to the market value of the equity equals the gross proceeds from the offering.) (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)arrow_forwardYour firm is selling 6 million shares in an IPO. You are targeting an offer price of $19.13 per share. Your underwriters have proposed a spread of 6.9%, but you would like to lower it to 5.4%. However, you are concerned that if you do so, they will argue for a lower offer price. Given the potential savings from a lower spread, how much lower can the offer price go before you would have preferred to pay 6.9% to get $19.13 per share? The offer price would need to drop to $. (Round to the nearest cent.)arrow_forwardIn a few sentences, answer the following question as completely as you can. You are discussing stock valuation techniques with your broker. You mention that your Finance professor stated that “a stock that will never pay a dividend is valueless.” Your broker says this is not true because you can always sell the stock to someone else (thus, a capital gain is possible) a share of stock represents a share of ownership in something tangible (i.e., the issuing firm).Argue for or against your broker’s position.arrow_forward

- Suppose you are an enterprising and creative entrepreneur who is considering a takeover of Itronic Listening Co. (ILC). You believe that under your management Itronic could sustain a dividend growth rate of 6% into the foreseeable future (they just paid a dividend of $2). But the takeover and subsequent changes to ILC's business will add more risk, so you will require a 14% return on your investment. What is the maximum price you should be willing to pay for the ILC stock? $23.50 $25.00 $26.50 $28.50 $29.50arrow_forward7. Diversification and risk The graph shows the relationship between risk, measured as the standard deviation of a stock portfolio's return, and the number of different stocks in the portfolio for a hypothetical stock market. RISK (Standard deviation of portfolio return) 60 20 01 4 True 10 20 30 NUMBER OF STOCKS IN PORTFOLIO True or False: Increasing the number of stocks in a portfolio reduces firm-specific risk. False 40 ?arrow_forwardYou have been hired as a financial consultant by Himalaya Ltd. The CEO, Ms. Natasha Romanoff has just returned from a conference of top managers, held at a prestigious University in Australia where the issue of share buy-backs, dividends, and earnings per share (EPS) were debated. She was particularly puzzled after hearing the quote below: Share buybacks (repurchases) are going into the market and pumping up the price of your shares by using your own cash, not to invest in business. - (Elizabeth Warren, U.S. Senator,2021)Required:In light of the above statement write a short memorandum format report to the CEO, Natasha Romanoff to answer the following four questions raised by Ms. Romanoff.i. Discuss what dividends, EPS and share buybacks are?ii. Discuss at least TWO reasons why companies pay dividends to shareholders?iii. Based on the statement above by Elizabeth Warren (U.S. Senator) criticallyevaluate why companies may consider buying back its own shares. iv. Discuss at least TWO…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education