Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

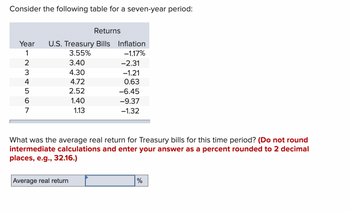

Transcribed Image Text:Consider the following table for a seven-year period:

Returns

Year U.S. Treasury Bills Inflation

3.55%

-1.17%

1234567

3.40

4.30

4.72

2.52

1.40

1.13

Average real return

-2.31

-1.21

0.63

-6.45

-9.37

-1.32

What was the average real return for Treasury bills for this time period? (Do not round

intermediate calculations and enter your answer as a percent rounded to 2 decimal

places, e.g., 32.16.)

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

6.03 is not the answer

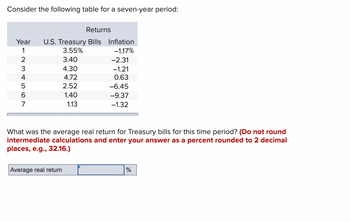

Transcribed Image Text:Consider the following table for a seven-year period:

Returns

Year U.S. Treasury Bills Inflation

3.55%

-1.17%

3.40

4.30

4.72

2.52

1.40

1.13

1234567

-2.31

-1.21

0.63

-6.45

-9.37

-1.32

What was the average real return for Treasury bills for this time period? (Do not round

intermediate calculations and enter your answer as a percent rounded to 2 decimal

places, e.g., 32.16.)

Average real return

%

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

6.03 is not the answer

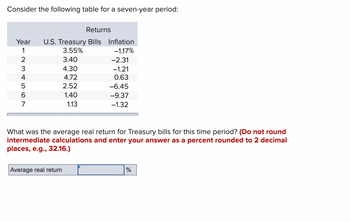

Transcribed Image Text:Consider the following table for a seven-year period:

Returns

Year U.S. Treasury Bills Inflation

3.55%

-1.17%

3.40

4.30

4.72

2.52

1.40

1.13

1234567

-2.31

-1.21

0.63

-6.45

-9.37

-1.32

What was the average real return for Treasury bills for this time period? (Do not round

intermediate calculations and enter your answer as a percent rounded to 2 decimal

places, e.g., 32.16.)

Average real return

%

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Round to the nearest cent.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Today is February 15, 2008 Issue Date Coupon Rale Maturity Date Current Type Price YTM Rating Yield Note Feb 2006 7.25% 2-15-2016 5.722% AAA Print Done %24arrow_forwardBetween the years 1974 and 1984, the average annual inflation rate was 3%. Find the salary in the year 1974 that would be equivalent to a $30,000 salary in 1984. The salary in the year 1974 that would be equivalent to a $30,000 salary in 1984 is:arrow_forwardTreasury bills are currently paying 7 percent and the inflation rate is 3.8 percent. What is the approximate real rate of interest? What is the exact real rate? Round your answer to 2 decimal places.arrow_forward

- dollars of the February 2005 Treasury note? nearest cent.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Today is February 15, 2008 Current Сoupon Rate Maturity Date Typo Issue Price YTM Rating Date Yield Note Feb 2005 8.00% 2-15-2015 5.301% AAA Print Donearrow_forwardAssume the CPI increases from 139.2 to 142.6 over the period. What is the inflation rate implied by this CPI change over this period? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardAssume that over the past 88 years, U.S. Treasury bills had an average return of 3.5% as compared to 6.1% on long-term government bonds. What was the average risk premium on the long-term government bonds?arrow_forward

- please give me answer relatablearrow_forwardYou observe that the current interest rate on short-term U.S. Treasury bills is 4.86 percent. You also read in the newspaper that the GDP deflator, which is a common macroeconomic indicator used by market analysts to gauge the inflation rate, currently implies that inflation is 1.65 percent. What is the approximate real rate of interest on short-term Treasury bills? (Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardThe real rate is 4 percent and the inflation rate is 5.6 percent. What rate would you expect to see on a Treasury bill? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- 4 - Based on economistsAc€?c forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = .90% E(2r1) = 2.05% L2 = 0.09% E(3r1) = 2.15% L3 = 0.12% E(4r1) = 2.45% L4 = 0.14% Using the liquidity premium theory, plot the current yield curve. Make sure you label the axes on the graph and identify the four annual rates on the curve both on the axes and on the yield curve itself. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year Current (Long-term) Rates 1 % 2 % 3 % 4 % 6 - On March 11, 20XX, the existing or current (spot) 1-, 2-, 3-, and 4-year zero coupon Treasury security rates were as follows: 1R1 = 0.90%, 1R2 = 1.50%, 1R3 = 1.90%, 1R4 = 2.05% Using the unbiased…arrow_forward5. Which of the following statements is FALSE about interest rates? A) As interest rates may be quoted for different time intervals, it is often necessary to adjust the interest rate to a time period that matches that of cash flows. B) The effective annual rate indicates the amount of interest that will be earned at the end of one year. C) The annual percentage rate indicates the amount of simple interest earned in one year. D) The annual percentage rate indicates the amount of interest including the effect of compounding.arrow_forwardSuppose on January 15, 2018, the U.S. Treasury issued a ten-year inflation indexed note with a coupon of 7%. On the date of issue, the CPI (consumer price index) was 215. By January 15, 2028, the CPI index had decreased to 165. What principal and coupon payment was made on January 15, 2028? (Note: U.S. Treasury pays semi-annual coupons) The CPI index deppreciated by The principal payment is $ The coupon payment is $ . (Round to five decimal places.) (Round to the nearest cent.) (Round to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education