Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

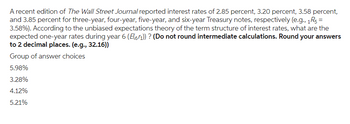

Transcribed Image Text:A recent edition of The Wall Street Journal reported interest rates of 2.85 percent, 3.20 percent, 3.58 percent,

and 3.85 percent for three-year, four-year, five-year, and six-year Treasury notes, respectively (e.g., 1R5 =

3.58%). According to the unbiased expectations theory of the term structure of interest rates, what are the

expected one-year rates during year 6 (E(6₁)) ? (Do not round intermediate calculations. Round your answers

to 2 decimal places. (e.g., 32.16))

Group of answer choices

5.98%

3.28%

4.12%

5.21%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose the interest rate on a 1-year government bond is 3.00%, on a 4-year government bond is 3.50% and that on a 6-year government bond is 4.90%. What is the market's forecast for 2-year rates 4 years from now, assuming the pure expectations theory is correct? Show your work.arrow_forward"If Treasury bills are currently paying 4.6 percent and the inflation rate is 1.9 percent, what is the approximate real rate of interest? The exact real rate?" Thank you :)arrow_forwardAssume that over the past 88 years, U.S. Treasury bills had an average return of 3.5% as compared to 6.1% on long-term government bonds. What was the average risk premium on the long-term government bonds?arrow_forward

- please give me answer relatablearrow_forwardA recent edition of The Wall Street Journal reported interest rates of 11.25 percent, 11.60 percent, 11.98 percent, and 12.25 percent for 3-, 4-, 5-, and 6-year Treasury security yields, respectively. According to the unbiased expectation theory of the term structure of interest rates, what are the expected 1-year forward rates for years 4, 5, and 6? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Years Forward Rates 4 5 6 %arrow_forwardYou observe that the current interest rate on short-term U.S. Treasury bills is 4.86 percent. You also read in the newspaper that the GDP deflator, which is a common macroeconomic indicator used by market analysts to gauge the inflation rate, currently implies that inflation is 1.65 percent. What is the approximate real rate of interest on short-term Treasury bills? (Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

- someone please help me with this!arrow_forward5. Which of the following statements is FALSE about interest rates? A) As interest rates may be quoted for different time intervals, it is often necessary to adjust the interest rate to a time period that matches that of cash flows. B) The effective annual rate indicates the amount of interest that will be earned at the end of one year. C) The annual percentage rate indicates the amount of simple interest earned in one year. D) The annual percentage rate indicates the amount of interest including the effect of compounding.arrow_forwardSuppose on January 15, 2018, the U.S. Treasury issued a ten-year inflation indexed note with a coupon of 7%. On the date of issue, the CPI (consumer price index) was 215. By January 15, 2028, the CPI index had decreased to 165. What principal and coupon payment was made on January 15, 2028? (Note: U.S. Treasury pays semi-annual coupons) The CPI index deppreciated by The principal payment is $ The coupon payment is $ . (Round to five decimal places.) (Round to the nearest cent.) (Round to the nearest cent.)arrow_forward

- The Wall Street Journal reports that the rate on 3-year Treasury securities is 7.10 percent, and the 6-year Treasury rate is 7.35 percent. From discussions with your broker, you have determined that expected inflation premium is 2.60 percent next year, 2.85 percent in Year 2, and 3.05 percent in Year 3 and beyond. Further, you expect that real interest rates will be 3.55 percent annually for the foreseeable future. What is the maturity risk premium on the 6-year Treasury security?arrow_forwardPlease type the following questions in full detail. The image has the questionarrow_forwardConsider the following information for a period of years: Arithmetic Mean Long-term government bonds 7.6% Long-term corporate bonds 7.7 Inflation 4.6 What is the real return on long-term government bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. What is the real return on long-term corporate bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education