Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

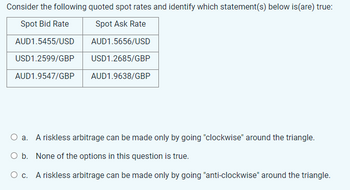

Transcribed Image Text:Consider the following quoted spot rates and identify which statement(s) below is(are) true:

Spot Bid Rate

Spot Ask Rate

AUD1.5455/USD

AUD1.5656/USD

USD1.2599/GBP

USD1.2685/GBP

AUD1.9547/GBP

AUD1.9638/GBP

O a. A riskless arbitrage can be made only by going "clockwise" around the triangle.

O b. None of the options in this question is true.

O c. A riskless arbitrage can be made only by going "anti-clockwise" around the triangle.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume a company needs to hedge payables. Which of the following conditions has to be met so a company would choose the options hedge? The break-even spot exchange rate is greater than the forward exchange rate. The break-even spot exchange rate is less than the forward exchange rate. The break-even spot exchange rate is less than the spot exchange rate. The break-even spot exchange rate is greater than the spot exchange rate.arrow_forwardh) discuss the relationship between the prices of puts, calls, and forward/futures contracts on the same underlying asset using the put-call-forward/futures parity. i) discuss the boundary conditions on the prices of American and European call option contracts on futures. j) explain and discuss the use of interest rate parity in pricing foreign currency forwards and futures. k) describe how spot prices are determined using the cost-of-carry model.arrow_forward7. You have been provided with the following data on three firms and the market: Security Firm A Firm B Firm C The Market The risk-free asset Fill in the missing values (i-vi) in the table. Oi 0.12 [ii] 0.24 0.10 0.01 Pi,M [i] 0.4 0.75 [iv] 0 Bi 0.90 1.10 [iii] [v] [vi]arrow_forward

- Q9. How would you hedge the risk of a price rise using a derivative? Group of answer choices 1. You would take out a spot contract to sell the underlying. 2. You would take out a forward contract to sell the underlying. 3. You would take out a spot contract to buy the underlying. 4. You would take out a forward contract to buy the underlying.arrow_forwardTo hedge payables, the firm will purchase a currency call option on the payable foreign currency. The firm can use the call option to buy foreign currency at a specified price. Why should the company, in this case, purchase a call option than a Forward contract? Maybe to make it easy on me, you can illustrate the answer by highlighting the situations suitable for options and Forward contracts. For example, "when this situation occurs....., then that hedging we should use .... because of XYZ reasons/effects on profitability".arrow_forwardProvide a numerical example of an arbitrage strategy for situations where the forward is trading above, and below the theoretical forward price.arrow_forward

- If the forward rate is expected to be an unbiased estimate of the future spot rate, and interest rate parity holds, then: a. the international Fisher effect (IFE) is refuted. b. the international Fisher effect (IFE) is supported. c. covered interest arbitrage is feasible. d. the average absolute error from forecasting would equal zero.arrow_forwardConsider the following two scenarios whereby the cost-of-carry model is violated. You are required to select appropriate missing words and fill in question 1. a. long b. spot c. over priced d. short arbitrage e. under priced f. long arbitrage g. futures h. short Question 1 a. If ft >S0 (1 + rf - d)^t, then the( ) is ( )relative to ( ) or equivalently, the quoted futures price is higher than what it should be. Thus, the correct arbitrage strategy should be: ( ) the futures contract and ( )the spot market. This strategy is also known as ( ). b. If ft <S0 (1 + rf - d)^t, then the( ) is ( )relative to ( ) or equivalently, the quoted futures price is lower than what it should be. Thus, the correct arbitrage strategy should be: ( ) the futures contract and ( )the spot market. This strategy is also known as ( ).arrow_forwardThe formula Co >= 0 if (So - E) correctly describes the boundary values for an American call option. True or False True Falsearrow_forward

- Hello Can you help with the explanation with thisarrow_forwardI'll give you multiple upvote..hand written plzarrow_forwardQ (a) A put and a call have the same maturity and strike price. If they have the same price, which one is in the money? Prove your answer and provide an intuitive explanation. (b) You find a put and a call with the same exercise price and maturity. What do you know about the relative prices of the put and call? Prove your answer and provide an intuitive explanation. Please explain step by step. I have seen other answers but still very confused.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education