ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Can you show the written out work for this problem please

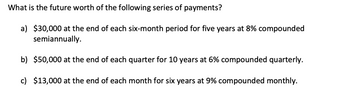

Transcribed Image Text:**Future Worth Calculation of Series of Payments**

The problem here is to determine the future worth of the following series of payments using different compounding frequencies and interest rates:

a) **Semiannual Payments**: $30,000 at the end of each six-month period for five years at 8% compounded semiannually.

b) **Quarterly Payments**: $50,000 at the end of each quarter for 10 years at 6% compounded quarterly.

c) **Monthly Payments**: $13,000 at the end of each month for six years at 9% compounded monthly.

To calculate the future worth of these payments, you would use the future value of an annuity formula adapted to the specific compounding frequencies.

Expert Solution

arrow_forward

Given

Part A

PV annuity = 30000

n = 5 years

r = 8%

Part B

PV annuity = 50000

n = 10 years

r = 6%

Part C

PV annuity = 13000

n = 6 years

r = 9%

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- uestion 10 Your Answer: $ Answer 18 30 25 20 10 100 200 300 Based on the attached graph calculate the total cost if y = 300. units ATC AVC Yarrow_forward5. Costs in the short run versus in the long run Ike's Bikes is a major manufacturer of bicycles. Currently, the company produces bikes using only one factory. However, it is considering expanding production to two or even three factories. The following table shows the company's short-run average total cost (SRATC) each month for various levels of production if it uses one, two, or three factories. (Note: Q equals the total quantity of bikes produced by all factories.) Number of Factories 1 2 3 Q = 100 Q 200 440 280 380 480 620 800 Average Total Cost (Dollars per bike) Q = 300 Q = 400 240 320 240 240 320 240 Q = 500 480 380 280 Q = 600 800 620 440 Suppose Ike's Bikes is currently producing 100 bikes per month in its only factory. Its short-run average total cost is $ per bike. Suppose Ike's Bikes is expecting to produce 100 bikes per month for several years. In this case, in the long run, it would choose to produce bikes using On the following graph, plot the three SRATC curves for…arrow_forwardWhat is the meaning of 'transaction costs"? What the different things that they include?arrow_forward

- A friend offers you a free ticket to a concert, which you decide to attend. The concert takes 4 hours and costs you $15 for transportation. If you had not attended the concert, you would have worked at your part-time job earning $15 per hour. What is the true cost of you attending the concert?arrow_forwardWhat is the cost basis of an asset?arrow_forwardI got the graph correct, but what am I doing wrong to get the two equarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education