FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

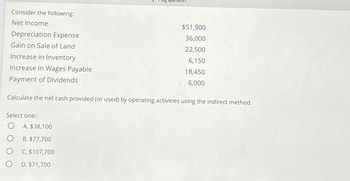

Transcribed Image Text:Consider the following:

Net Income

Depreciation Expense

Gain on Sale of Land

Increase in Inventory

Increase in Wages Payable

Payment of Dividends

Calculate the net cash provided (or used) by operating activities using the indirect method.

Select one:

O

O

O

O

$51,900

36,000

22,500

6,150

18,450

6,000

A. $38,100

B. $77,700

C. $107,700

D. $71,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash Flows from Operating Activities—Indirect Method Staley Inc. reported the following data: Net income $480,300 Depreciation expense 69,400 Loss on disposal of equipment 37,600 Increase in accounts receivable 10,300 Increase in accounts payable 10,300 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Staley Inc. Statement of Cash Flows (partial) Cash flows from operating activities: Net income $fill in the blank 2 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation fill in the blank 4 Loss on disposal of equipment fill in the blank 6 Changes in current operating assets and liabilities: Increase in accounts receivable fill in the blank 8 Increase in accounts payable fill in the blank 10 Net cash flow…arrow_forwardUsing Excel to Calculate Cash Flows from Operations Using the Indirect Method PROBLEM The following is financial information for three companies. Sales revenue Cost of goods sold Selling and administrative Depreciation expense Interest expense Income tax expense Dividends paid Increase /(Decrease) in Accounts receivable Inventory Property, plant, and equipment Accounts payable Interest payable Income tax payable Notes payable Common shares Blue spruce $ Marx Ltd. Tamarisk Ltd. 458,300 $ 689,500 $1,123,600 250,900 79,800 7,500 2,700 23,000 11,000 (2,900) 3,400 60,900 6,400 (1,400) 396,900 112,200 21,900 1,200 42,000 6,200 7,200 (10,100) (13,400) (10,500) 1,800 4,200 (2,800) 23,300 (47,800) 35,300 (4,400) 743,400 126,500 34,400 4,200 56,800 31,400 (9,900) 18,600 71,300 3,940 (500) 9,100 10,000 (95,200)arrow_forwardA draft statement of cash flows contains the following: £ i Profit before tax 22 ii Depreciation 8 iii Increase in inventories -4 iv Decrease in receivables -3 v Increase in payables -2 Net cash inflow from operating activities 21 Which Two of the following corrections needs to be made to the calculation? a. ii and v b. iv and iii c. i and ii d. iv and varrow_forward

- Need Help.arrow_forwardD. MATCHING In the following statement of cash flows, each letter represents a specific item which may appear on the statement, using the indirect method. Match the appropriate letter(s) with each transaction listed below. More than one letter may be used for each transaction. 1) 2) 3) 4) 5) 6) 7) 8) 9) Statement of Cash Flows Cash Flows from Operating Activities: Net Income Adjustments to Net Income: Add Deduct Cash Flows from Investing Activities Add Deduct Cash Flows from Financing Activities Add Deduct Significant Non-Cash Transactions Not on the Statement of Cash Flows (A) (B) (D) 30 000€ (H) Sold a short-term, available-for-sale investment at a gain. Temporarily borrowed money by signing a short-term, promissory trade notes payable. Treasury stock was purchased with cash. Declared cash dividends (but did not pay them yet). Purchased land by giving shares of common stock held in treasury. Amortized the premium on bonds payable. Paid off bonds payable before maturity and incurred a…arrow_forwardNeed answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education