FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

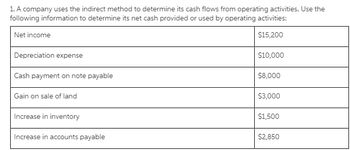

Transcribed Image Text:1. A company uses the indirect method to determine its cash flows from operating activities. Use the

following information to determine its net cash provided or used by operating activities:

Net income

$15,200

Depreciation expense

$10,000

Cash payment on note payable

$8,000

Gain on sale of land

$3,000

Increase in inventory

$1,500

Increase in accounts payable

$2,850

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following excerpts from Nutmeg Company's financial records to determine net cash flows from operating activities and net cash flows from investing activities. Net income this year Purchased land this year Sold investments this year Original cost of investments that were sold $83,700 20,000 31,500 33,000 PLEASE NOTE: All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Net cash flows from operating activities Net cash flows from investing activitiesarrow_forwardOo.25. Subject :- Accountarrow_forwardD. MATCHING In the following statement of cash flows, each letter represents a specific item which may appear on the statement, using the indirect method. Match the appropriate letter(s) with each transaction listed below. More than one letter may be used for each transaction. 1) 2) 3) 4) 5) 6) 7) 8) 9) Statement of Cash Flows Cash Flows from Operating Activities: Net Income Adjustments to Net Income: Add Deduct Cash Flows from Investing Activities Add Deduct Cash Flows from Financing Activities Add Deduct Significant Non-Cash Transactions Not on the Statement of Cash Flows (A) (B) (D) 30 000€ (H) Sold a short-term, available-for-sale investment at a gain. Temporarily borrowed money by signing a short-term, promissory trade notes payable. Treasury stock was purchased with cash. Declared cash dividends (but did not pay them yet). Purchased land by giving shares of common stock held in treasury. Amortized the premium on bonds payable. Paid off bonds payable before maturity and incurred a…arrow_forward

- Concord Ltd. had the following 2023 income statement data: Revenues Expenses In 2023. Concord had the following activity in selected accounts: 1/1/23 Revenues $107,000 46,100 $60,900 12/31/23 Accounts Receivable 18,500 107,000 30,360 1,140 94,000 Allowance for Expected Credit Losses 1,230 Write-offs Write-offs 1,140 Collections. 1,420 1,510 1/1/23. Loss on impairment 12/31/23 Prepare Concord's cash flows from operating activities section of the statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a negative sign e.g.-10,000 or in parenthesis eg. (10,000).)arrow_forwardCOTB MC Qu. 15-48 (Algo) Assume that a company provided... Assume that a company provided the following statement of cash flows (all sales are on account): Operating activities: Net income Adjustments to convert net income to a cash basis: Depreciation Decrease in accounts receivable Increase in inventory Increase in accounts payable Net cash provided by (used in) operating activities Investing activities: Additions to property, plant, & equipment Net cash provided by (used in) investing activities Financing activities: Issuance of common stock Cash dividends paid Net cash provided by (used in) financing activities Net increase in cash and cash equivalents Beginning cash and cash equivalents Ending cash and cash equivalents How much is the company's free cash flow? $ 15 2 (10) 4 (40) 5 (16) $ 47 11 58 (40) (11) 7 6 $ 13arrow_forwardBarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education