Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

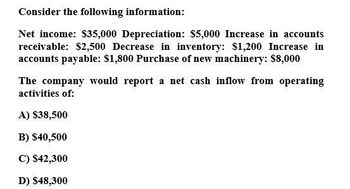

Transcribed Image Text:Consider the following information:

Net income: $35,000 Depreciation: $5,000 Increase in accounts

receivable: $2,500 Decrease in inventory: $1,200 Increase in

accounts payable: $1,800 Purchase of new machinery: $8,000

The company would report a net cash inflow from operating

activities of:

A) $38,500

B) $40,500

C) $42,300

D) $48,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the current year, Harrisburg Corporation had net income of 35,000, a 9,000 decrease in accounts receivable, a 7,000 increase in inventory, an 8,000 increase in salaries payable, a 13,000 decrease in accounts payable, and 10,000 in depreciation expense. Using the indirect method, prepare the operating activities section of its statement of cash flows based on this information.arrow_forwardCalculate the operating cash flows from the following data: Sales: $2,190,000 Cost: $815,000 Depreciation: $290,000 Tax rate: 21% Life: 3 years $857,150 O $1,147,150 O$1,085,000 O s1,375,00arrow_forwardGet correct answer general accountingarrow_forward

- Fitz Company reports the following information. Selected Annual Income Statement Data Net income Depreciation expense Amortization expense Gain on sale of plant assets Selected Year-End Balance Sheet Data $ 412,000 Accounts receivable decrease 47,000 Inventory decrease 7,300 Prepaid expenses increase 6,200 Accounts payable decrease Salaries payable increase $ 123,200 50,500 5,800 9,000 2,200 Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from operating activities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities $arrow_forwardCash Flows from (Used for) Operating Activities The income statement disclosed the following items for the year: Depreciation expense $42,700 Gain on disposal of equipment 24,890 Net income 328,300 The changes in the current asset and liability accounts for the year are as follows: Increase (Decrease) Accounts receivable $6,650 Inventory (3,780) Prepaid insurance (1,420) Accounts payable (4,510) Income taxes payable 1,420 Dividends payable 1,000 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial)arrow_forwardQuick answer of this accounting questionsarrow_forward

- Need answer the questionarrow_forwardHarding Corporation reports the following information: Net income $530,000 Depreciation expense 140,000 Increase in accounts receivable 60,000 Harding should report cash provided by operating activities of $330,000. $450,000. $610,000. $730,000.arrow_forwardCash flow from operating activity????arrow_forward

- Cash Flows from (Used for) Operating Activities The income statement disclosed the following items for the year: Depreciation expense $41,700 Gain on disposal of equipment 24,350 Net income 312,200 The changes in the current asset and liability accounts for the year are as follows: Increase(Decrease) Accounts receivable $6,500 Inventory (3,700) Prepaid insurance (1,390) Accounts payable (4,410) Income taxes payable 1,390 Dividends payable 970 Question Content Area a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from (used for) operating activities: $- Select - Adjustments to reconcile net income to net cash flows from (used for) operating activities: - Select - -…arrow_forwardThe following details are provided by a manufacturing company: Investment Useful life Estimated annual net cash inflows for first year Estimated annual net cash inflows for second year Estimated annual net cash inflows for next ten years Residual value Product line OA. 2.74 years OB. 6.36 years O c. 6.71 years OD. 2.24 years $1,030,000 12 years $460,000 $430,000 $190,000 $50,000 Depreciation method Straight-line 12% Required rate of return Calculate the payback period for the investment. (Round your answer to two decimal places.) ...arrow_forwardFitz Company reports the following information. Selected Annual Income Statement Data Net income Depreciation expense Amortization expense Gain on sale of plant assets Selected Year-End Balance Sheet Data $ 421,000 Accounts receivable decrease 48,600 Inventory decrease 7,300 Prepaid expenses increase 7,900 Accounts payable decrease Salaries payable increase $ 133,100 44,500 7,000 10,300 1,800 Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Cash flows from operating activities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilitiesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning