Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

do fast i will 10 upvotes.

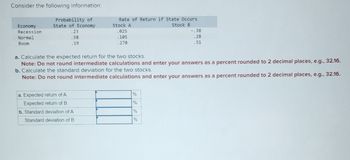

Transcribed Image Text:Consider the following information:

Economy

Recession

Normal

Boom

Probability of

State of Economy

.23

.58

.19

Rate of Return if State Occurs

Stock B

a. Expected return of A

Expected return of B

b. Standard deviation of A

Standard deviation of B

Stock A

.025

.105

.270

a. Calculate the expected return for the two stocks.

Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.

b. Calculate the standard deviation for the two stocks.

Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.

-.38

.28

.51

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A fire station fields emergency calls from its community with an expected rate of 10 emergencies per day (assume a Poisson distribution). What is the probability (expressed in a number between 0 and 1) fewer than 5 hours elapse between emergencies any day?arrow_forwardHow do you calculate quarterly hour system?arrow_forwardWhich of the following would indicate the BEST Average Collection Period? 30 days 20 days 25 days 15 daysarrow_forward

- The collection of a 1200 account after the 2 percent discount period will result in aarrow_forwardYour paycheck was just deposited and you noticed that had overdrawn your bank account 10 days ago. Your What is the Effective Annual account was overdrawn by $176 and have been charged an overdraft fee of $39. Rate? Convert to a percent and round to 2 decimal places.arrow_forwardIs there any chance you could add future values and explain how the calculations for caculating accumulated saves were made and include the values like 6200 x 18 x 7arrow_forward

- Please see below. Need this asap please and thank you.arrow_forward9. Calculating Opportunity Cost. What is the annual opportunity cost of a checking account that requires a $300 minimum balance to avoid service charges? Assume an interest rate of 3 percent. Type here to search 73 14 I0I 1s 40 17 fo 17 * %23 7. 3 4. E R T H. %2arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!!!!!!arrow_forward

- Answer the given question with a proper explanation and step-by-step solution. Please provide the answer using the math tool otherwise I give the downvote. how long will it take $833.00 to accumulate to $1033.00 at 3% p.a. compounded quarterly? state your answer in years and months (from 0 to 11 ml tbs) the investment will take _____ years and ____ months to maturearrow_forward10arrow_forwardGive your answer as a rate, accurate to five decimal places.What discount would exactly offset a 10% surcharge?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education