Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

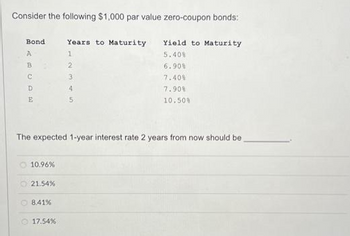

Transcribed Image Text:Consider the following $1,000 par value zero-coupon bonds:

Bond

ABCDE

А

10.96%

21.54%

8.41%

Years to Maturity

1

2

The expected 1-year interest rate 2 years from now should be

17.54%

AWN

3

Yield to Maturity

5.40%

6.90%

7.40%

7.90%

10.50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose a 4-year, 3% annual coupon payment bond has the following sequence of spot rates: Time to maturity Spot rates 1 year 0.39% 2 years 1.40% 3 years 2.50% 4 years 3.60% Assume a par value of $100. What is the yield to maturity for this bond? A. 4.52% B. 3.52% C. 5.12% D. 6.12%arrow_forwardA 9.75% coupon bond with 9 years to maturity yields 10%. What is the bond's price two years from today if the yield to maturity is 9.45%? (Assume semiannual interest payments and $1,000 par value) ○ $985.03 $1,014.87 $283.53 ○ $1,015.11arrow_forwarda $1000 par value bond with 32 years to maturity has an 8.2% coupon rate with semi-annual interest payments. if the yield to maturity is 7.5%, what is the present value of the bond? 1,084.49 1,084.11 1,064.60 1,821.32 1,092.42arrow_forward

- Nonearrow_forwardConsider the following $1,000 par value zero-coupon bonds: Bond Maturity A 1 BU C D Years until Yield to Interest rate 2 3 Maturity (years) 1 2 3 4 Maturity 8.00% 9.00 9.50 10.00 Required: a. According to the expectations hypothesis, what is the market's expectation of the one-year interest rate three years from now? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What are the expected values of next year's yields on bonds with maturities of (a) 1 year; (b) 2 years; (c) 3 years? (Do not round intermediate calculations. Round your answer to 2 decimal places.) YTM Check my work % % % %arrow_forwardPart 1 Consider a five-year, default-free bond with annual coupons of 5% and a face value of $1,000 and assume zero-coupon yields on default-free securities are as summarized in the following table: Maturity 1 year 2 years 3 years 4 years 5 years Zero-Coupon Yields 4.00% 4.30% 4.50% 4.70% 4.80% a. What is the yield to maturity on this bond? b. If the yield to maturity on this bond increased to 5.20%, what would the new price be?arrow_forward

- Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity 1 YTM(%) 5.6% 2 3 4 6.6 7.1 7.6 According to the expectations hypothesis, what is the market's expectation of the yield curve one year from now? Specifically, what are the expected values of next year's yields on bonds with maturities of (a) one year? (b) two years? (c) three years? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) APCO D Bond Years to Maturity YTM (%) B 1 % C 2 % D 3 %arrow_forwardManshukarrow_forwardSunnyfax Publishing pays out all its earnings and has a share price of $37.00. In order to expand, Sunnyfax Publishing decides to cut its dividend from $3.00 to $2.00 per share and reinvest the retained funds. Once the funds are reinvested, they are expected to grow at a rate of 14%. If the reinvestment does not affect Sunnyfax's equity cost of capital, what is the expected share price as a consequence of this decision? O$45.87 $40.14 $68.81 $57.34arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education