Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Multiple Choice

O

O

O

O

9.19%

5.69%

10.50%

6.00%

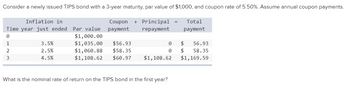

Transcribed Image Text:Consider a newly issued TIPS bond with a 3-year maturity, par value of $1,000, and coupon rate of 5.50%. Assume annual coupon payments.

Coupon + Principal

payment

repayment

Inflation in

Time year just ended

0

1

2

3

3.5%

2.5%

4.5%

Par value

$1,000.00

$1,035.00

$1,060.88

$1,108.62 $60.97 $1,108.62

$56.93

$58.35

What is the nominal rate of return on the TIPS bond in the first year?

0

0

=

Total

payment

$ 56.93

58.35

$1,169.59

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a bond portfolio with the following two bonds under an annual effective interest rate of 3%: 3-year zero-coupon bond with face value of $1,000 • 3-year coupon bond with face value of $1,000 and annual coupons paid at the end of each year, currently priced at par Calculate the Macaulay duration of the bond portfolio. 2.83 3.00 O 2.91 O2.02 O 3.12arrow_forwardRequired to show your work:Bond ABC:Coupon rate(%): 4.5% (annual payment)Current market:??Tenior:15 YearsSuppose the yield to maturity of bond E is 3.7% and face value equals to $1,000,calculate the current market price of bond ABC.arrow_forwardA 5-year bond with 10% coupon rate and P1000 face value is selling for P1,054.30. Calculate the yield to maturity on the bond assuming annual interest payments. Use 5 decimal places in your computation Format: 1.11%arrow_forward

- Question 1?arrow_forward4) A 10 year bond with $50, 000 face value has semiannual coupon rate 4% and semiannual yield rate 2%. Fill out the following amortization table. Principle Outstanding t Payment Interest герaid Balance 1 2 3 12arrow_forwardBond valuation-Semiannual interest Calculate the value of each of the bonds shown in the following table, all of which pay interest semiannually. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Bond A B C The value of bond A is $ Par Value $500 500 100 Coupon interest rate 9% 12 13 (Round to the nearest cent.) Years to maturity 10 15 5 Required stated annual return 10% 10 16arrow_forward

- Using the following information, determine the maturity risk premium on 10 year bonds: Rate % inflation 0.74 T-bill 5.00 10y T-Bond 6.00 10y AAA Corporate 6.37 10y AA Corporate 7.62arrow_forwardBond Coupon Rate (%) Number of Years to Maturity Price TII $884.20 $948.90 $967.70 $456.39 W X Y 7 8 9 0 5 7 4 10 Calculate the yield to maturity for the four bonds. SOLCE USING BA2 CALC.arrow_forwardA bond has the following terms: Principal amount $1,000 Semi-annual interest $45 Maturity 15 years a. What is the bond's price if comparable debt yields 11%? b. What would be the price if comparable debt yields 11% and the bond matures after ten years? c. What would be the bond's price in a. and b. if interest rates declined to 8 % ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education