Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

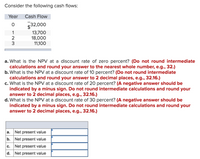

Transcribed Image Text:Consider the following cash flows:

Year

Cash Flow

$32,000

13,700

18,000

11,100

a. What is the NPV at a discount rate of zero percent? (Do not round intermediate

calculations and round your answer to the nearest whole number, e.g., 32.)

b. What is the NPV at a discount rate of 10 percent? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

c. What is the NPV at a discount rate of 20 percent? (A negative answer should be

indicated by a minus sign. Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.)

d. What is the NPV at a discount rate of 30 percent? (A negative answer should be

indicated by a minus sign. Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.)

а.

Net present value

b.

Net present value

C.

Net present value

d. Net present value

123

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate to at least four decimal places, answers should be stated as percentages to two places for example, 0.0956 = 9.56.Do not label the answer (%, $) %3D Given the following cash flows, the internal rate of return is: Cash Year Flows 0 - 192,000 29,000 33,000 3 41,000 4 55,000 63,000 6. 59,000arrow_forwardYear Cash Flow 0 -$ 17,400 1 9,700 8,600 5,100 2 3 a. What is the profitability index for the set of cash flows if the relevant discount rate is 11 percent? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) b. What is the profitability index for the set of cash flows if the relevant discount rate is 16 percent? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) c. What is the profitability index for the set of cash flows if the relevant discount rate is 23 percent? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) a. Profitability index b. Profitability index c. Profitability indexarrow_forwardWhat is the future value in year 5 of the following cash flows given a discount rate of 9%? Year 2 4 5 Cash Flow $862 $669 $905 (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).)arrow_forward

- Mendez Company has identified an investment project with the following cash flows. Year Cash Flow 1 2 3 $780 1,050 1,310 1,425 a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the present value at 17 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the present value at 25 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Present value at 8% b. Present value at 17% c. Present value at 25%arrow_forwardExplain Well all question with proper answer.arrow_forward3. Find the internal rate of returnarrow_forward

- a. Find the present values of the following cash flow streams at an 8% discount rate. Do not round intermediate calculations. Round your answers to the nearest cent. 0 1 2 3 4 5 Stream A $0 $100 $350 $350 $350 $300 Stream B $0 $300 $350 $350 $350 $100 Stream A: $ Stream B: $ b. What are the PVs of the streams at a 0% discount rate? Round your answers to the nearest dollar. Stream A: $ Stream B: $arrow_forwarda. Find the present values of the following cash flow streams at a 6% discount rate. Do not round intermediate calculations. Round your answers to the nearest cent. 1 3 4 Stream A $0 $150 $400 $400 $400 $300 Stream B $0 $300 $400 $400 $400 $150 Stream A: $ Stream B: $ b. What are the PVs of the streams at a 0% discount rate? Round your answers to the nearest dollar. Stream A: $ Stream B: $arrow_forward16)For the following stream of free cash flows, calculate the internal rate of return. Year 0 1 2 3 4 5 Free Cash Flows -45,452 10,005 14,921 12,537 10,452 21,455 Group of answer choices 14.5% 12.7% 13.9% 11.5%arrow_forward

- Given a the following set of cash flows, what is the payback period? CF0: -10,411 CF1: 3,442 CF2: 4,606 CF3: 9,711 CF4: 9,565 CF5: 1,138 Answer with two decimals.arrow_forward(a) Calculate the equivalent amount P at the present time. The equivalent amount P at the present time is $ (b) Calculate the single-payment equivalent to F at n = 5. The single-payment equivalent to Fat n = 5 is $ (Round to the nearest dollar.) (c) Calculate the equivalent equal-payment series cash flow A that runs from n=1 to n = 5. The equivalent equal-payment series cash flow A is $ (Round to the nearest dollar.) (Round to the nearest dollar.)arrow_forwardAssume the appropriate discount rate for the following cash flows is 10.2 percent. Year Cash Flow 1234 2 3 $2,100 2,000 1,700 1,500 What is the present value of the cash flows? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Present valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education