Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

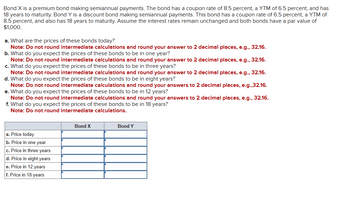

Transcribed Image Text:Bond X is a premium bond making semiannual payments. The bond has a coupon rate of 8.5 percent, a YTM of 6.5 percent, and has

18 years to maturity. Bond Y is a discount bond making semiannual payments. This bond has a coupon rate of 6.5 percent, a YTM of

8.5 percent, and also has 18 years to maturity. Assume the interest rates remain unchanged and both bonds have a par value of

$1,000.

a. What are the prices of these bonds today?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

b. What do you expect the prices of these bonds to be in one year?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

c. What do you expect the prices of these bonds to be in three years?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

d. What do you expect the prices of these bonds to be in eight years?

Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g.,32.16.

e. What do you expect the prices of these bonds to be in 12 years?

Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.

f. What do you expect the prices of these bonds to be in 18 years?

Note: Do not round intermediate calculations.

a. Price today

b. Price in one year

c. Price in three years

d. Price in eight years

e. Price in 12 years

f. Price in 18 years

Bond X

Bond Y

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- A 15-year bond with a face value of $1,000 currently sells for $850. Which of the following statements is most correct? The bond's yield to maturity is greater than its coupon rate. If the yield to maturity stays constant until the bond matures, the bond's price will remain at $850. The bond's current yield is equal to the bond's coupon rate. The bond's yield to maturity is the same as capital gain yield. All of the statements above are correct. None of the above are correctarrow_forwardSuppose that a short-term government bond has a face value of $100. If the price of that bond is $95. What is the insterest rate of that bond? 5.3% 9.0% 10.0% 1.0%arrow_forward5) Bond A is a 10-year, 8 percent annual coupon bond with a $1,000 par value. Bond B is a 10-year, 6 percent annual coupon bond with a $1,000 par value. Both bonds currently have a yield to maturity of 4 percent. Which of the following statements is correct if the market yield decreases to 2 percent? 1. Bond A will increase in value by a greater percentage than Bond B. 2. Bond B will increase in value by a greater percentage than Bond A. 3. Both bonds would decrease in value by 8.27 percent. 4. Bond B will decrease in value by a greater percentage than Bond A. 5. Both bonds will increase in value by 8.27 percent.arrow_forward

- A bond with a 8-year duration is worth $1,074, and its yield to maturity is 7.4%. If the yield to maturity falls to 7.30%, you would predict that the new value of the bond will be approximately _________. a)$1,082.06 b)$1,075.07 c)$1,074.00 d) $1,072.93arrow_forwardBond X is a premium bond making semiannual payments. The bond has a coupon rate of 11 percent, a YTM of 9 percent, and 15 years to maturity. Bond Y is a discount bond making semiannual payments, This bond has a coupon rate of 9 percent, a YTM of 11 percent, and also has 15 years to maturity. Both bonds have a par value of $1,000 a. What is the price of each bond today? b. If interest rates remain unchanged, what do you expect the price of these bonds to be 1 year from now? In 6 years? In 10 years? In 14 years? In 15 years? Note: For all requirements, do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Bond X Bond Y a. Price today b. Price in 1 year Price In 6 years Price in 10 years Price in 14 years Price in 15 yearsarrow_forwardA bond sells for $894.17 and has a coupon rate of 6.20 percent. If the bond has 13 years until maturity, what is the yield to maturity of the bond? Assume semiannual compounding. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

- A 10-year bond with a face value of $1,000 currently sells for $1,110. Which of the following statements is correct? Select one: a. The bond's current yield is equal to its coupon rate. b. The bond's coupon rate exceeds its current yield to maturity. c. None of the given answers is correct. d. The bond's yield to maturity is greater than its coupon rate.arrow_forwardRefer to Table 10-2. a. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. Using column 2, indicate what the bond price will be with a 10-year, a 20-year, and a 25-year time period. b. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. Using column 3, indicate what the bond price will be with a 10-year, a 20-year, and a 25-year period. c. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. If interest rates in the market are going down, which bond would you choose to own? multiple choice 1 10 Years 20 Years 25 Years d. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. If interest rates in the market are going up, which bond would you choose to own? multiple choice 2 10 Years 20 Years 25 Yearsarrow_forwardA 10-year bond with a face value of $1,000 currently sells for $1,110. Which of the following statements is correct? Select one: a. The bond's yield to maturity is greater than its coupon rate. b. The bond's coupon rate exceeds its current yield to maturity. c. The bond's current yield is equal to its coupon rate. d. None of the given answers is correct.arrow_forward

- Please give me answer very fast in 5 min saurarrow_forwardBond X is a premium bond making semiannual payments. The bond has a coupon rate of 9 percent, a YTM of 7 percent, and 15 years to maturity. Bond Y is a discount bond making semiannual payments. This bond has a coupon rate of 7 percent, a YTM of 9 percent, and also has 15 years to maturity. Both bonds have a par value of $1,000. a. What is the price of each bond today? b. If interest rates remain unchanged, what do you expect the price of these bonds to be 1 year from now? In 6 years? In 10 years? In 14 years? In 15 years? Note: For all requirements, do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. a. Price today b. Price in 1 year Price in 6 years Price in 10 years Price in 14 years Price in 15 years Bond X Bond Yarrow_forwardBond X is a premium bond making semiannual payments. The bond pays a coupon rate of 7 percent, has a YTM of 5 percent, and has 13 years to maturity. Bond Y is a discount bond making semiannual payments. This bond pays a coupon rate of 5 percent, has a YTM of 7 percent, and also has 13 years to maturity. The bonds have a $1,000 par value. What is the price of each bond today? If interest rates remain unchanged, what do you expect the price of these bonds to be one year from now? In four years? In nine years? In 11 years? In 13 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education