FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

b. What is the change in net

Change in net working capital

c. In year t, Parrothead Enterprises had capital expenditure of £1,350. How much in non-current assets did Parrothead Enterprises sell?

Non-current assets sold

d. What is the

Cash flow from investing activities

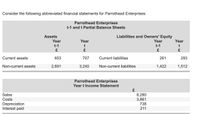

Transcribed Image Text:Consider the following abbreviated financial statements for Parrothead Enterprises:

Parrothead Enterprises

t-1 and t Partial Balance Sheets

Assets

Liabilities and Owners' Equity

Year

Year

Year

Year

t-1

t-1

Current assets

653

707

Current liabilities

261

293

Non-current assets

2,691

3,240

Non-current liabilities

1,422

1,512

Parrothead Enterprises

Year t Income Statement

8,280

3,861

738

Sales

Costs

Depreciation

Interest paid

211

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Why does the company add back depreciation to compute net cash flows from operating activities? 2. Why are there changes in accounts receivable and inventories as adjustments to net earnings. Are accounts receivable and inventories balances increasing or decreasing during the year? 3. It is reported that the company invested $572 million in property, plant, and equipment. Is this an appropriate type of expenditure for the company to make? What relation should expenditures for PPE have with depreciation expense? 4. Stryker paid $300 million to repurchase its common stock in fiscal 2018 and, in addition, paid dividends of $703 million. Thus, it paid $1.003 million of cash to its stockholders during the year. How do we evaluate that use of cash relative to other possible uses for the company's cash? 5. Provide an overall assessment of the company's cash flows for fiscal 2018. In the analysis, consider the sources and uses of cash.arrow_forwardFinance is Fun, Inc recently reported net income of $4.2 million, depreciation of $750,000, and amortization of $100,000. What was its net cash flow?arrow_forwardPlease answer this question correctly. Thank you.arrow_forward

- Given the following information calculate the relevant annual Net Cash Flow After Tax [NCFAT], needed to calculate NPV. Forecast Annual Income $ Cash Revenue 360,000 Less Cash Operating Expenses 160,000 Admin Cash Flow Expenditure 60,000 Depreciation 36,000 Interest 24,000 Net Profit Before Tax Tax @30% 24,000 Net Profit After Tax 56,000arrow_forwardMake sure you provide complete answers, and show your work with calculation problems Given the following information, calculate the Net Free Cash Flow. Net income = $25,000; Capital expenditures = $4,000; Cash dividends paid to shareholders = $2,500; Repayment of Long-term debt = $1,500; Depreciation, Depletion & Amortization = $5,000; Increase in current assets = $250; Increase in current liabilities = $750;arrow_forwardmin.4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education