Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

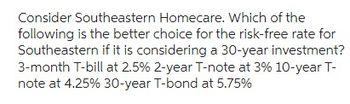

Transcribed Image Text:Consider Southeastern Homecare. Which of the

following is the better choice for the risk-free rate for

Southeastern if it is considering a 30-year investment?

3-month T-bill at 2.5% 2-year T-note at 3% 10-year T-

note at 4.25% 30-year T-bond at 5.75%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the single risk premium (to the nearest whole number) to be charged today on an insurance product that pays claims of $30,000 in 5 years from today, $50,000 in 10 years from today, and $70,000 in 15 years from today. Use an interest rate of 8% per annum.arrow_forwardAfter careful consideration, you decide that you want to diversify your portfolio and invest in the bonds of HCA Healthcare. The bonds pay interest annually, will mature in 25 years, and have a coupon rate of 4% on a face value of $1,000. Currently, the bonds are selling for $910. If you are looking for a required return of 7% for this bond, what is the highest price you would be willing to pay?What is the current yield of these bonds?What is the yield to maturity on these bonds if you purchase them at the current price? (Use the Rate function) If you hold the bonds for two years, and interest rates do not change, what total rate of return will you earn, assuming that you pay the market price? If the bonds can be called in 4 years with a call premium of 6% of the face value, what is the yield to call?arrow_forwardAssume you can buy a bond that has a par value of $1000, matures in 10 years, yielding 6% and has a duration of 5. If you would like to use this bond to form a guaranteed investment contract “GIC” and offer a guaranteed rate of return to investors for certain years. a. what is the maximum yield you can offer? Why? Explain. b. For how many years would you make the guarantee? Explain.arrow_forward

- The Maybe Pay Life Insurance Company is trying to sell you an investment policy that will pay you and your heirs $141,221 per year forever with the first payment coming in 9 years. Assume the required return on this investment is 12.16%. How much will you pay for the policy?arrow_forwardYou manage a pension fund that will provide retired workers with lifetime annuities. You expect a large number of workers to retire in 8 years. You have the following two bonds to invest in and immunize this portfolio. Inputs Bond A Bond B Settlement date 01-01-2020 01-01-2020 Maturity date 01-01-2025 01-01-2040 Coupon rate 0.025 0.0000 Face Value $1,000.00 $1,000.00 Coupons per year 1 1 Obligation Time to Payout 8 Payout $50,000,000 Initial Yield to Maturity 0.0750 Required: Using any necessary data above, calculate the Present value and Macaulay Duration of the obligation. Assume annual payments. Then calculate the Macaulay Duration and the Modified Duration for each bond. Use this information to immunize the portfolio. Then, re-immunize the portfolio 1 year later using the new yield.arrow_forwardAn investor has the opportunity to make an investment that will provide an effective annual yield of 13.0 percent. She is considering two other investments of equal risk that will provide compound interest monthly and quarterly, respectively. Required: a. What must be the equivalent nominal annual rate (ENAR) for an investment that will provide compound interest monthly to ensure that an equivalent annual yield of 13.0 percent is earned?b. What must be the equivalent nominal annual rate (ENAR) for an investment that will provide compound interest quarterly to ensure that an equivalent annual yield of 13.0 percent is earned? Note: For all requirements, do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places. Please answer fast i give you upvote.arrow_forward

- Km for the following Individual or component costs of capital) Your firm is considering a new investment proposal and would like to calculate its weighted average cost of capital. To help in this compute the cost of capital for the a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 11.4 percent mat is paud semiannually. The bond is currently selling for a price of $1,121 and will mature in 10 years The firm's tax rate is 34 percent b. If the firm's bonds are not frequently traded, how would you go about determining a cost of debt for this company? A new common stock issue that paid a $174 dividend last year. The par value of the stock is $15, and the firm's dividends per share have grown at a rate of 81 percent per year. This growth rate is expected to continue into the foreseeable tuture The pnce of this stock is now $27 12 d. A preferred stock paying a 10.7 percent dividend on a $126 par value The preferred shares are currently selling for…arrow_forwardYou have some money to invest and you are considering purchasing unsecured notes which are a bond-type instrument that have been issued by JoJo Inc. The notes has $1,000 par value, mature in five years and have coupon rate of 10.75%, with coupon paid annually. What price(value) would you be prepared to pay for the notes if your alternative is to invest in your friends company who will guarantee you a 10% pa return?arrow_forwardBaghibenarrow_forward

- A portfolio for a pension fund that you manage has payments resembling a perpetuity. You want to immunize the pension fund liability by purchasing 2 bonds: a zero coupon bond maturing in 6 years & a 10% coupon bond with a duration of 25 years. Assume the yield on both bonds & the pension fund is 7%. What percent of your portfolio should you invest in the zero-coupon bonds?arrow_forwardThe American Pharmaceutical Company (APC) has a policy that all capital investments must have a five- year or less discounted payback period in order to be considered for funding. The MARR at APC is 8% per year. Is the above project able to meet this benchmark for funding? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8 ber year. \table[[, ], [End of Year,Cash Flow ], [0,-$285,000 K The American Pharmaceutical Company (APC) has a policy that all capital investments must have a five-year or less discounted payback period in order to be considered for funding. The MARR at APC is 8% per year. Is the above project able to meet this benchmark for funding? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8per year. …. The payback period is years. (Round to the nearest whole number.) End of Year 8123456 0 6-11 Cash Flow -$285,000 - $30,000 $65,000 $160,000 $230,000 $335,000 $95,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education