Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

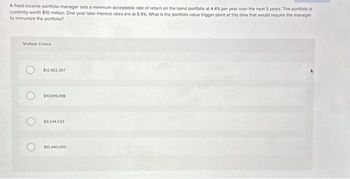

Transcribed Image Text:A fixed-income portfolio manager sets a minimum acceptable rate of return on the bond portfolio at 4.4% per year over the next 5 years. The portfolio is

currently worth $10 million. One year later interest rates are at 5.4%. What is the portfolio value trigger point at this time that would require the manager

to immunize the portfolio?

Multiple Choice

$12,402,307

$10,049,398

$9.534,533

$10,440,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following bond portfolio: Coupon Bond Value Maturity Yield A $300 million 3 years 0% 10% В 300 4 6. 10 400 8 10 a) What is the bond portfolio's duration? b) Calculate the capital loss on this portfolio if the yield increases from 10 to 12 percent. c) Suppose the portfolio is to be immunized over an investment horizon of approximately 5.19 years. Determine the market value of the immunized portfolio at the end of 5.19 years. 4.arrow_forwardNonearrow_forwardPls help with below homeworkarrow_forward

- Liquidity Premium Hypothesis Based on economists' forecasts and analysis, one-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 7.20% E(r2) 8.30% L2 .65% %3D E(r3) = 8.40% L3 = .75% E(r4) = 8.70% L4 = .80% Using the liquidity premium hypothesis, what is the current rate on a four-year Treasury security?arrow_forwardPlease correct answer and step by step solutionarrow_forwardYou manage a pension fund that will provide retired workers with lifetime annuities. You expect a large number of workers to retire in 8 years. You have the following two bonds to invest in and immunize this portfolio. Inputs Bond A Bond B Settlement date 01-01-2020 01-01-2020 Maturity date 01-01-2025 01-01-2040 Coupon rate 0.025 0.0000 Face Value $1,000.00 $1,000.00 Coupons per year 1 1 Obligation Time to Payout 8 Payout $50,000,000 Initial Yield to Maturity 0.0750 Required: Using any necessary data above, calculate the Present value and Macaulay Duration of the obligation. Assume annual payments. Then calculate the Macaulay Duration and the Modified Duration for each bond. Use this information to immunize the portfolio. Then, re-immunize the portfolio 1 year later using the new yield.arrow_forward

- .Question A This is a question about portfolio Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line .arrow_forwardYou Answered orrect Answer A company is promising a coupon payment of $46 in 2.03 years. A risk free government bond of the same maturity is yielding 1.66% per year. The credit spread for the promised payment by the company is 1.24% per year. Both the yield and the spread are stated on a continuously compounded basis. What is the present value of the expected loss on the promised payment? 1.11 margin of error +/-50arrow_forwardCan you please walk me through this? Problem 6-11 DEFAULT RISK PREMIUM A company’s 5-year bonds are yielding 7.75% per year. Treasury bonds with the same maturity are yielding 5 2% per year, and the real risk-free rate (r*) is 2.3%. The average inflation premium is 2 5%; and the maturity risk premium is estimated to be 0.1 x (t 1) %, where t = number of years to maturity. If the liquidity premium is 1%, what is the default risk premium on the corporate bonds?arrow_forward

- Solve these 2 practice problemsarrow_forwardUsing duration and convexity approximation, compute the percentage price change on a 10-year fixed coupon bond, if the interest rate increases by 1%. The modified duration of the bond is 6 years, and convexity is 200 year2. Group of answer choices -6% -5% 7% -7%arrow_forwardA short question 4) You are managing a portfolio of $1 million. Your target duration is 10 years, and you can choose from two bonds: a zero-coupon bond with maturity of 5 years, and a perpetuity*, each currently yielding 5%. a. How much of each bond will you hold in your portfolio? b. How will these ratios change next year if target duration is now 9 years? *: Perpetuity: a specal case of annuity, where n-> Inf, thus the maturity of the instrument is perpetual.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education