ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

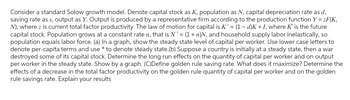

Transcribed Image Text:Consider a standard Solow growth model. Denote capital stock as K, population as N, capital depreciation rate as d,

saving rate as s, output as Y. Output is produced by a representative firm according to the production function Y=zF(K,

N), where z is current total factor productivity. The law motion for capital is K' = (1 - d)K + I, where K' is the future

capital stock. Population grows at a constant rate n, that is N' = (1 + n)N, and household supply labor inelastically, so

population equals labor force. (a) In a graph, show the steady state level of capital per worker. Use lower case letters to

denote per-capita terms and use * to denote steady state.(b) Suppose a country is initially at a steady state, then a war

destroyed some of its capital stock. Determine the long run effects on the quantity of capital per worker and on output

per worker in the steady state. Show by a graph. (C)Define golden rule saving rate. What does it maximize? Determine the

effects of a decrease in the total factor productivity on the golden rule quantity of capital per worker and on the golden

rule savings rate. Explain your results

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider an economy that exhibits both population growth (L grows at rate n) and technological progress (A grows at rate a) described by the production function, Y = F(K,AL) = Kª(AL)¹-α| Here K is capital and Y is output. (a) Show that this production function exhibits constant returns to scale. What is the per-effective-worker production function? (c) Find expressions for the steady-state capital-output ratio, capital stock per effective worker, and output per effective worker, as a function of the saving rate (s), the depreciation rate (8), the population growth rate (n), the rate of technological progress (a), and the coefficient a. (You may assume the condition that capital per effective worker evolves according to Ak = sf (k) − (a +n+8)k.) (d) Show that at the Golden Rule steady state the saving rate for this economy is equal to the parameter a.arrow_forwardan economy is described by the Solow-Swan model with the following variables, E(t)=1 The saving rate is 0.41 per year. Labor's share of income is 0.44. The growth rate of labor efficiency is 0.03 per year. The growth rate of the labor force is 0.02 per year Depreciation is 0.09 per year. calculate the steady-state value of the capital-to-labor ratio, K/L Enter your answer to two places after the decimal.arrow_forwardI need help soon a possible I have one and half.arrow_forward

- a) Consider two countries that have the same parameters and exogenous variables (i.e. they have the same values for s¯, d¯, L¯ etc). Country A starts with a level of capital above the steady state. Country B starts below the steady state. First, plot the Solow diagram, explain why country B will grow but country A will shrink. b) Solve for steady state level of capital per person, k∗.arrow_forwardIn the Solow model, suppose the per worker production function is y = 6 kº.5. Suppose s = 0.08, n = 0.04, and d = 0.08. Calculate the steady-state equilibrium capital-labor ratio. k= (Round to two decimal places.)arrow_forwardWhich of the following is an incorrect statement about the variable ‘s’ in the Solow Growth Model? a.s is the fraction of income that is saved b.s is an exogenous factor c.s is referred to as saving per worker d.s determines how income is allocated between consumption and investmentarrow_forward

- Consider the Solow model with a production function Y(t) = A*K(t)αL(t)1-α, Where A is a fixed technological parameter. Explicitly solve for the steady-state value of the per capita capital stock and per capita income. How do these values change in response to a rise in (a) the technological parameter A, (b) the rate of saving s, (c) α , (d) δ, the depreciation rate, and the population growth rate n?arrow_forwardConsider our graph of the basic Solow growth model. On the graph above: y represents real output (or income) per worker; y=F(k) is the production function; k is the capital stock per worker; s is the savings rate; δ is the rate of depreciation of capital; ‘i’ represents business investment (purchases of capital) per worker); ‘LF’ stands for Loanable Funds. (For purposed of intuition, think of capital as ‘machines.’) If we started out with a capital (per worker) stock lower than the steady-state stock ( , above), we would expect to see which of the following happen over time? Group of answer choices A) Positive growth rates while the capital stock increases. B) Negative growth rates while the capital stock increases. C) Negative growth rates while the capital stock decreases. D) Positive growth rates while the capital stock stays less than the steady-state level. E) Positive growth rates while the capital stock decreases.arrow_forwardConsider a Solow-Swan model with saving rate s - 0.4, labour force growth g, - 0.05. constant productivity A = 1, and depreciation = 0.05. If output per worker is y = Y/L = 200 and capital per worker is k = K/L = 800, which of the following is true? O Efective depreciation per worker is 60, saving per worker is 80 and k will decrease towards the steady state Effective depreciation per worker is 80, saving per worker is 80 and k is at the steady state O Efective depreciation per worker is 60, saving per worker is 80 and k will increase towards the steady state O Effective depreciation per worker is 80, saving per worker is 60 and k will decrease towards the steady statearrow_forward

- Consider a version of the Solow growth model in which output is determined by the production function Y = z(¾½³K + ¾½N) where z = 1. The depreciation rate and the savings rate are given by d = 0.13 and s 0.3. Assume that population N grows at a rate of n = 0.02. Calculate the = steady-state output per capita and consumption per capita, y* and c*, respectively. O (y*, c*) = (0.2, 0.06) ○ (y*, c*) = (0.5, 0.35) ○ (y*, c*) = (0.5, 0.21) ○ (y*, c*) = (1.0, 0.70)arrow_forwardA key assumption of the Solow Growth Model is that: (a) the marginal product of capital diminishes as additional units of capital are added; (b) output per capita declines as a nation’s capital to labor ratio increases; (c) the marginal product of labor tends to rise as additional units of labor are added; (d) capital tends to depreciate at an increasing rate as a nation’s output increases.arrow_forwardThe convergence to a steady-state capital-labour ratio k* is ensured by the fact that if k is at a level Multiple Choice lower than k*, saving will exceed the investment required to maintain constant k, causing k to rise lower than k*, investment will exceed saving, leading to an increase in the capital stock lower than k*, saving will exceed the investment required to maintain a constant k, causing output per capita to decline higher than k*, the rate of depreciation will be higher than the savings rate, causing k to decrease higher than K*, output per capita will continue to increase until a new steady-state equilibrium is reachedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education