Economics:

10th Edition

ISBN: 9781285859460

Author: BOYES, William

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

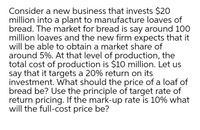

Transcribed Image Text:Consider a new business that invests $20

million into a plant to manufacture loaves of

bread. The market for bread is say around 100

million loaves and the new firm expects that it

will be able to obtain a market share of

around 5%. At that level of production, the

total cost of production is $10 million. Let us

say that it targets a 20% return on its

investment. What should the price of a loaf of

bread be? Use the principle of target rate of

return pricing. If the mark-up rate is 10% what

will the full-cost price be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What are the- most common ways for start-up firms to raise financial capital?arrow_forwardHighFlyer Airlines wants to build new airplanes with greatly increased cabin space. This will allow HighFlyer Airlines to give passengers more comfort and sell more tickets at a higher price. However, redesigning the cabin means rethinking many other elements of the airplane as well, like engine and luggage placement, and the most efficient shape of the plane for moving through the air. HighFlyer Airlines has developed a list of possible methods to increase cabin space, along with estimates of how these approaches would affect the planes operating costs and ticket sales. Based on these estimates, Table 13.5 shows the value of R, how much should the firm invest in R on top of the private return; that is, an R private return to HighFlyer Airlines would have a 9 social return. How much investment is socially optimal at the 6 interest rate?arrow_forwardBased on your answers to the WipeOut Ski Company in Exercise 7.3, now imagine a situation where the firm produces a quantity of 5 units that it sells for a price of 25 each. What will be the companys profits or losses? How can you tell at a glance whether the company is making or losing money at this price by looking at average cost? At the given quantity and price, is the marginal unit produced adding to profits?arrow_forward

- Jane and Bill are apprehended for a bank robbery. They are taken into separate rooms and questioned by the police about their involvement in the crime. The police tell them each that if they confess and turn the other person in, they will receive a fighter sentence. If they both confess, they will be each be sentenced to 30 years. If neither confesses, they will each receive a 20-year sentence. If only one confesses, the they will receive 15 years and the one who stayed silent will receive 35 years. Table 10.7 below represents the choices available to Jane and Bill. If Jane trusts Bill to stay silent, what should she do? If Jane thinks that Bill will confess, what should she do? Does Jane have a dominant strategy? Does Bill have a dominant strategy? A = Confess; B = Stay Silent. (Each results entry lists Janes sentence first (in years), and Bills sentence second.)arrow_forwardWhat is an externality?arrow_forwardWonopoly and natural resource prices Suppose that a firm is the sole owner of a stock of a natural resource. a. How should the analysis of the maximization of the discounted profits from selling this resource (Equation 17.63 be modified to take this fact into account? b. Suppose that the demand for the resource in question had a constant elasticity form q(t)=a[p(t)]b . How would this change the price dynamics shown in Equation 17.67? c. How would the answer to Problem 17.7 be changed if the entire crude oil supply were owned by a single firm?arrow_forward

- What legal mechanisms protect intellectual property?arrow_forwardShould a firm shut down immediately if it is making losses?arrow_forwardReturn to Figure 9.2. Suppose P0 is 10 and P1 is 11. Suppose a new firm with the same LRAC curve as the incumbent tries to bleak into the market by selling 4,000 units of output. Estimate from the graph what the new firms average cost of producing output would be. If the incumbent continues. to produce 6,000 units, how much output would the two films supply to the market? Estimate what would happen to the market price as a result of the supply of both the incumbent firm and the new entrant. Approximately how much profit would each firm earn? Figure 9.2 Economics of Scale and Natural Monoployarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning