ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

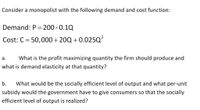

Transcribed Image Text:Consider a monopolist with the following demand and cost function:

Demand: P = 200 -0.10

Cost: C = 50,000+20Q+0.025Q²

a. What is the profit maximizing quantity the firm should produce and

what is demand elasticity at that quantity?

b. What would be the socially efficient level of output and what per-unit

subsidy would the government have to give consumers so that the socially

efficient level of output is realized?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a monopoly with the following marginal cost and demand curves: MC=2Q+200,p=2,600−2Q d. Do the welfare analysis of the equilibrium resulting from the monopolist’s profit-maximization. That is, calculate the consumer surplus, producer surplus, and deadweight loss (if it exists). e. Suppose there is a positive externality associated with the consumption of the good provided by this monopolist. Does the market structure (monopoly) exacerbate or alleviate the inefficiency (deadweight loss) resulting from such externality? Use math or a graph to support your answer. f. Suppose instead that there is a negative externality associated with the production of the good provided by this monopolist. Each unit produced generates a marginal external cost of x dollars. For which value of x does the under-provision inherent to the monopoly completely offset the inefficiency associated with such externality?arrow_forwardThe market demand for a good is P = 90 - Q. The good can be produced at a constant cost of $10. How much deadweight loss is created if the market is served by a monopolist as opposed to a competitive market?Enter as a value.arrow_forwardPlease hand written solutions are strictly prohibited.arrow_forward

- A monopolist produces a certain good. The cost c for producing this good is given by c = 20q, whereq is the quantity produced. The (inverse) demand function for this product is given by p = 30 − 0.01q,where p is the price per unit of the product. We assume that the full produced quantity is sold. Thegovernment taxes the sales of the good and would like to maximize the received tax T .Suppose in first instance that the government introduces a tax of 4 monetary units per unit of theproduct sold. We determine how much the government then receives.arrow_forwardSuppose a monopolist sells a product to faculty members and students on the campus. If the firm sets a single price, the monopolist produces 5000 units and sell them at the price of $3 per unit. At this price, the price elasticity of demand for faculty member is -2.5. And the price elasticity of demand for students is -1.5. The monopolist is considering whether she should set different prices for the faculty members and students and asks for your advice. The monopolist is thinking about charging faculty members a 10% higher price. The quantity demanded by the faculty members would fall by %. The monopolist is thinking about charging students a 10% higher price. The quantity demanded by the students would fall by %. Who should the monopolist charge more? mention faculty and students and how mucharrow_forwardAssuming that the firm is the only producer in a market, the social cost of the output decision of a profit-maximizing monopoly firm. Can you discuss the assumption that the government wants to set a price ceiling that maximizes the monopolist's output? What price should the government set? Thank you!arrow_forward

- Suppose that a monopolist sells a product to men and women. If the firm sets a single price, the monopolist would produce 100000 units and sell them at a price of $5.00 per unit. Suppose that at that price, the price elasticity of demand for men is -0.75 and the price elasticity of demand for women is -2.50. The monopolist is considering whether he should set discriminatory prices and asks for you're advice. Part 1 Suppose the monopolist is thinking about charging men a %10 higher price. If the monopolist does so, the quantity demanded by men would fall by _______% (give answer to one decimal) Part 2. Suppose the monopolist is thinking about charging women a 10% higher price. If the monopolist does so, the quantity demanded by women would fall by ________% (give answer to one decimal)arrow_forwardPlease help to solve question 6 in detail. Thank you!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education