ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

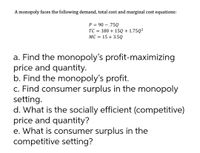

Transcribed Image Text:A monopoly faces the following demand, total cost and marginal cost equations:

P = 90 – .75Q

TC = 180 + 15Q + 1.75Q²

MC = 15 + 3.5Q

a. Find the monopoly's profit-maximizing

price and quantity.

b. Find the monopoly's profit.

c. Find consumer surplus in the monopoly

setting.

d. What is the socially efficient (competitive)

price and quantity?

e. What is consumer surplus in the

competitive setting?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that Comcast has a cable monopoly in Philadelphia. The following table gives Comcast's demand and costs per month for subscriptions to basic cable (for simplicity, we keep the number of subscribers artificially small). Total Marginal Total Marginal Price Quantity 3 Revenue Revenue Cost Cost 68 204 144 64 4 256 52 172 28 60 300 44 204 32 56 336 36 240 36 52 7 364 28 280 40 48 384 20 324 44 Suppose the local government imposes a $99 per month tax on cable companies. What will Comcast do? (Assume fixed costs equal $60.) A. Comcast should produce 6 units in the short run and shut down in the long run. B. Comcast should shut down in the short run and in the long run. c. Comcast should produce 6 units in the short run and in the long run. D. Comcast should shut down in the short run and produce 6 units in the long run. E. None of the above. Suppose that the flat per-month tax is replaced with a tax on the firm of $4 per cable subscriber. (Assume that Comcast will sell only the…arrow_forwardplease help and if it's on paper please please write in a way that is understandable!arrow_forward3arrow_forward

- Rent seeking: The following graph shows the demand, marginal revenue, marginal cost curves for a single - price monopolist that produces a drug that helps relieve arthritis pain.  Place a star symbol in the appropriate location on the graph to indicate the monopoly outcomes such that the dashed lines reveal the profit, maximizing price, and quantity of a single price monopolist. Then use the green rectangle to show the profits earned by the monopolist. Suppose that should the patent on this particular drug expire, the market would become perfectly competitive, with new firms, immediately entering the market with essentially identical products. Further, suppose that, in this case, the original firm will hire lobbyist, and make donations to several key politicians to extend its patent for one more year. The farm is prepared to spend up to -------$ million to extend its patent?arrow_forward#8. If government regulation forces firms in an industry to internalize the externality, then we can expect the equilibrium price of the good to ________ and the equilibrium quantity to ________. a. increase; increase b. increase; decrease c. decrease; decrease d. decrease; increase e. increase; remain unchangedarrow_forwardCan you help with parts d,e, and f please? Assume the following equations describe the conditions for a monopoly: Qd = 2,000 - 100P TC = 3,500 + 5q + .005q2 Where Qd is the quantity demanded, P is the commodity's price in dollars, TC is the firm's total cost in dollars and q is the quantity of output produced. Based upon these equations, answer the following questions:a. What is the firm's equation for total revenue expressed as a function of quantity? b. What is the firm's equation for marginal revenue expressed as a function of quantity? What is the firm's equation for marginal cost expressed as a function of quantity? c. What is the firm's profit maximizing quantity of output? d. What price will the firm charge for the commodity? e. What would be the socially optimal quantity of output? f. What price would regulators have to establish in order to have the firm produce the socially optimal quantity of output?arrow_forward

- The diagram below represents a monopoly market with one privately owned power generator. P 90 75 60 45 30 15 10 20 30 40 ATC 50 b1. Show the expected social losses from having a monopoly. Draw in any extra lines you need to show your solution. b2. If a law is passed requiring marginal cost pricing in the above market, what problem would there be for this privately owned power generator. Support your answer with a diagram.arrow_forward2. A monopolist faces demand p = 10 - Q and has costs TC = 10 + 2q. a. Provide expressions for marginal revenue and marginal cost. b. Maximize the firm's profit to determine the equilibrium price, quantity, and profit. c. The monopolist faces the prospect of entry by competitor with the same cost function. If the firm enters, they will compete by choosing quantities. Does the monopolist need to worry about this entry threat? Explain. d. The government is considering a subsidy of 4 for all firms in this industry. Should the monopolist support or oppose this policy? Explain.arrow_forwardDoes a monopoly face any market constraints? Question options: a) No. A monopoly can produce as much as it wants and charge whatever price it chooses. b) Yes. To sell a larger quantity, the monopoly must set a lower price. c) Yes. It can't charge a higher price unless demand for its good or service increases. d) Yes. It must produce at its minimum efficient scale to maximize profit. e) No. A monopoly determines demand and supply.arrow_forward

- 1. Refer to the figure below when the firm is a monopolist. Price P MC L K J ATC D T W Quaxtity \MR a) If the monopolist maximizes profit, how many units will it produce? b) What price will the monopolist charge? c) What area measure the monopolist's profit? d) What level of output would be socially efficient? 2. A Monopolist is facing a demand schedule that is shown in the following table. Quantity Total Revenue Average Revenue Marginal Revenue Price $35 $32 1 2 3 $29 14 $26 15 $23 $20 $17 $14 6 7 18 19 $11 10 $8 a) Fill out the rest of the table. b) Assume this monopolist's marginal cost is constant at $11. What quantity of output (Q) will it produce and what price (P) will it charge? ------arrow_forwardThe market for bread is competitive with the demand and supply functions as follow:• Supply: P=1+0.0025Q• Demand: P=5-0.0015Q i. Examine the equilibrium quantity and price of the market. Draw a diagram toillustrate the market equilibrium and size of consumer surplus, producer surplusand total economic surplus.ii. Suppose that the bakeries get together to form a cartel. They agree to raise theprice to $4.5 and jointly cut production to supply the quantity of loaves thatmeets the quantity demanded at the cartel’s fixed price. Compare the newmarket quantity with the one without cartel and measure the sizes of consumersurplus, producer surplus, and deadweight loss caused by the cartel. You mustillustrate the welfare loss with an appropriate diagram. Round your answers to2 decimal places if necessary.arrow_forward#9arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education