Managerial Economics: A Problem Solving Approach

5th Edition

ISBN: 9781337106665

Author: Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Do not use Ai

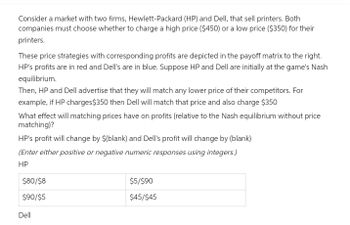

Transcribed Image Text:Consider a market with two firms, Hewlett-Packard (HP) and Dell, that sell printers. Both

companies must choose whether to charge a high price ($450) or a low price ($350) for their

printers.

These price strategies with corresponding profits are depicted in the payoff matrix to the right.

HP's profits are in red and Dell's are in blue. Suppose HP and Dell are initially at the game's Nash

equilibrium.

Then, HP and Dell advertise that they will match any lower price of their competitors. For

example, if HP charges $350 then Dell will match that price and also charge $350

What effect will matching prices have on profits (relative to the Nash equilibrium without price

matching)?

HP's profit will change by $(blank) and Dell's profit will change by (blank)

(Enter either positive or negative numeric responses using integers.)

HP

$80/$8

$90/$5

Dell

$5/$90

$45/$45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider a market with two firms, Hewlett-Packard (HP) and Dell, that sell printers. Both companies must choose whether to charge a high price ($500) or a low price ($350) for their printers. These price strategies with corresponding profits are depicted in the payoff matrix to the right. HP's profits are in red and Dell's are in blue. Suppose HP and Dell are initially at the game's Nash equilibrium. Then, HP and Dell advertise that they will match any lower price of their competitors. For example, if HP charges $350, then Dell will match that price and also charge $350. What effect will matching prices have on profits (relative to the Nash equilibrium without price matching)? (Enter either positive or negative numeric HP's profit will change by $ and Dell's profit will change by responses using integers.) Price = $500 Dell Price $350 HP Price = $500 Price = $350 $80 $100 $80 $15 $15 $50 $100 $50arrow_forwardConsider a market with two firms, Hewlett-Packard (HP) and Dell, that sell printers. Both companies must choose whether to charge a high price ($400) or a low price ($350) for their printers. These price strategies with corresponding profits are depicted in the bavoli matris to the right. HP's profits are in red and Dell's are in blue. Suppose HP and Dell are initially at the game's Nash equilibrium. Then, HP and Dell advertise that they will match any lower price of their competitors. For example, if HP charges $350, then Dell will match that price and also charge $350. What effect will matching prices have on profits (relative to the Nash equilibrium without price matching)? Assuming HP and Dell can coordinate to maximize profits, HP's profit will change by $ and Dell's profit will change by (Enter either positive or negative numeric responses using integers.) Price $400 Dell Price $350 HP Price = $400 Price $350 $80 $90 $80 $20 $20 $50 $90 $50 Garrow_forwardConsider a market with two firms, Kellogg and Post, that sell breakfast cereals. Both companies must choose whether to charge a high price ($4.00) or a low price ($2.50) for their cereals. These price strategies, with corresponding profits, are depicted in the payoff matrix to the right. Kellogg's profits are in red and Post's are in blue. Kellogg What is the cooperative equilibrium for this game? $4.00 Price = $2.50 Price = O A. The cooperative equilibrium is for Kellogg to choose a price of $2.50 and $800 $50 Post to choose a price of $4.00. Price = $4.00 $800 %3D OB. The cooperative equilibrium is for Kellogg and Post to both choose a price 006$ of $2.50. Post C. The cooperative equilibrium is for Kellogg and Post to both choose a price of $4.00. Price = $2.50 $350 OD. The cooperative equilibrium is for Kellogg to choose a price of $4.00 and Post to choose a price of $2.50. %3D $50 $350 OE. A cooperative equilibrium does not exist for this game. Is the cooperative equilibrium likely…arrow_forward

- Consider a market with two firms, Kellogg and Post, that sell breakfast cereals. Both companies must choose whether to charge a high price ($4.00) or a low price ($2.50) for their cereals. These price strategies, with corresponding profits, are depicted in the payoff matrix to the right. Kellogg's profits are in red and Post's are in blue. Kellogg What is the cooperative equilibrium for this game? Price = $4.00 Price = $2.50 O A. The cooperative equilibrium is for Kellogg to choose a price of $2.50 and Post to choose a price of $4.00. $800 Price = $4.00 $50 %3D O B. The cooperative equilibrium is for Kellogg and Post to both choose a price of $2.50. Post of $4.00. OC. The cooperative equilibrium is for Kellogg and Post to both choose a price $350 O D. The cooperative equilibrium is for Kellogg to choose a price of $4.00 and $350 Price = $2.50 $50 Post to choose a price of $2.50. O E. A cooperative equilibrium does not exist for this game. Clear all Chec 88,092 2 47arrow_forwardIntel and AMD are the two dominant producers of microchip processors. The following matrix gives the payoffs (in millions of dollars) of the two firms for different combinations of their pricing strategies. The first number is Intel's payoff and the second AMD's. AMD Intel Low Price High Price Low Price 35, 30 30, 60 High Price 70,25 65,55 O If this game is played sequentially, the Nash equilibrium will not change irrespective of who moves first. If this one-shot game is repeated for 10 times, the Nash equilibrium is for both firms to choose High Price. O In this game, Pareto criterion leads both firms to choose High Price. This game is an example of coordination game.arrow_forwardTwo firms must simultaneously decide whether to enter a market. The payoffs resulting from their decisions are illustrated in the figure to the right. Determine the mixed-strategy Nash equilibrium for this game. The mixed-strategy Nash equilibrium is for Firm 1 to not enter with probability 0₁ = probability 0₂ =. (Enter your responses rounded to two decimal places.) and for Firm 2 to not enter with Don't enter Firm 2 Enter Don't enter 0 4 0 Firm 1 0 Enter 0 -4 2 - 2arrow_forward

- Consider a market with two firms, Target and Wal-Mart, that sell CDs in their music department. Both stores must choose whether to charge a high price ($30) or a low price (s13) for the new Miley Cyrus CD. These price strategies with corresponding profits are depicted in the payoff matrix to the right. Target's profits are in red and Wal-Mart's are in blue. Target Target's dominant strategy is to pick a price of S Price = $30 Price = $13 $7,000 $2.500 Price = $30 S7,000 $15,000 Wal - Mart $15.000 $5,000 Price = $13 $2,500 $5,000 Wal-Mart's dominant strategy is to pick a price of $ The new equilibrium market wage will be and the new equilibrium market employment level will be higher unchanged lower higher lower unchangedarrow_forwardConsider the following simultaneous-move game that represents the payoffs from different advertising campaigns (low, medium, and high spending) for two political candidates that are running for a particular office. The values in the payoff matrix represent the share of the popular vote earned by each candidate is given below. The equilibrium in dominant strategies Candidate A-low Candidate A-medium Candidate A-high Ois (low. low). O is (medium, medium). O is (high, high). O is (medium, high) O does not exist. Candidate B-low Candidate B-medium Candidate B-high 50, 50 60,40 80, 20 40, 60 50, 50 65, 35 20, 80 35,65 50, 50arrow_forwardConsider the following information for a simultaneous move game: If you advertise and your rival advertises, you each will earn £5 million in profits. If neither of you advertises, you will each earn £10 million in profits. However, if one of you advertises and the other does not, the firm that advertises will earn £15 million and the non-advertising firm will earn £1million. Answer the following questions: a)Please draw the payoff matrix for the game b)What is the outcome of this game? What payoff will each firm earn? c)What is the reasoning that you have followed in order to arrive at this outcome? d)Is this a Prisoner's Dilemma? Why or why not? e)Suppose that this game is played sequentially instead of simultaneously and that you decide first. Draw the game tree of this game. What is the equilibrium of this sequential game? How did you arrive to this conclusion?arrow_forward

- Untied and Air ’R’ Us are the only two airlines operating flights between Collegeville and Bigtown. Each airline can charge either a high price or a low price for a ticket. The accompanying matrix shows their payoffs, in profits per seat (in dollars), for any choice that the two airlines can make. Suppose the two airlines play a one-shot game—that is, they interact only once and never again. What will be the Nash (noncooperative) equilibrium in this one-shot game? Explain why this is the likely outcome. Now suppose the two airlines play this game twice. Each airline then considers the future and decides on a “tit-for-tat” strategy, that is, it starts off charging the high price in the first period, and then in the second period it does whatever the other airline did in the previous period. If both play this…arrow_forwardImagine that there are two snowboard manufacturers (FatSki and WideBoard) in the market. Each firm can either produce ten or twenty snowboards per day. The table below (see attached) shows the profit per snowboard for each firm that will result given the joint production decisions of these two firms. Draw the game payoff matrix for this situation. Does either player have a dominant strategy? If so, what is it? What is the Nash equilibrium solution and how many boards should each player produce each day? Since FatSki and WideBoard must play this game repeatedly (i.e. make production decisions every day), what strategy would you advise them to play in order to maximize their payoff over the long term?arrow_forwardConsider the following information for a simultaneous-move game: two discount stores (megastore and superstore) are interested in expanding their market share through advertising. The table below depicts the profits of both stores with and without advertising. Payoffs for Megastore are in bold A Nash Equilibrium Superstore Advertise Don't Advertise Megastore Advertise $95, $80 $305, $55 Don't Advertise $65, $285 $165, $115 If firms could collude, then it would be optimal. for the Megastore to advertise and for the Superstore to advertise for the Megastore to advertise and for the Superstore not to advertise for the Megastore to not advertise and for the Superstore to advertise for the Megastore to not advertise and for the Superstore to not advertisearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc