ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:**Consider a lake found in the town of Center Barnstead, and then answer the questions that follow.**

---

The town has a campground whose visitors use the lake for recreation. The town also has a research lab that dumps industrial waste into the lake. This pollutes the lake and makes it a less desirable vacation destination. That is, the research lab's waste decreases the campground's economic profit.

---

Suppose that the research lab could use a different production method that involves recycling water. This would reduce the pollution in the lake to levels safe for recreation, and the campground would no longer be affected.

- If the research lab uses the recycling method, then the research lab's economic profit is $2,200 per week, and the campground's economic profit is $3,200 per week.

- If the research lab does not use the recycling method, then the research lab's economic profit is $3,000 per week, and the campground's economic profit is $2,000 per week.

These figures are summarized in the following table.

| Action | Profit Research Lab (Dollars) | Profit Campground (Dollars) | Total Profit (Dollars) |

|------------------|------------------------------|----------------------------|------------------------|

| No Recycling | 3,000 | 2,000 | |

| Recycling | 2,200 | 3,200 | |

Complete the following table by computing the total profit (the research lab's economic profit and the campground's economic profit combined) with and without recycling.

**Total economic profit is highest when the recycling production method is** ____________.

---

**Explanation of Tables and Figures:**

- The table lists two actions: No Recycling and Recycling. For each action, it shows the profit for the research lab and campground and requires the total profit to be calculated.

- The scenario indicates a trade-off in profits between the research lab and the campground depending on the recycling decision.

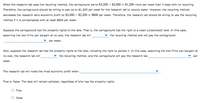

Transcribed Image Text:When the research lab uses the recycling method, the campground earns $3,200 − $2,000 = $1,200 more per week than it does with no recycling. Therefore, the campground should be willing to pay up to $1,200 per week for the research lab to recycle water. However, the recycling method decreases the research lab's economic profit by $3,000 − $2,200 = $800 per week. Therefore, the research lab should be willing to use the recycling method if it is compensated with at least $800 per week.

**Scenario 1: Campground with Property Rights**

Suppose the campground has the property rights to the lake. That is, the campground has the right to a clean (unpolluted) lake. In this case, assuming the two firms can bargain at no cost, the research lab will use the recycling method and will pay the campground $800 per week.

**Scenario 2: Research Lab with Property Rights**

Now, suppose the research lab has the property rights to the lake, including the right to pollute it. In this case, assuming the two firms can bargain at no cost, the research lab will not use the recycling method, and the campground will pay the research lab $1,200 per week.

**Economic Profit Maximization**

The research lab will make the most economic profit when the recycling method is not used.

**True or False Question**

True or False: The lake will remain polluted, regardless of who has the property rights.

- O True

- O False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Northern Mexico faces the worst drought in its history. Its effects will exceed those caused by El Niño in 1998. The Mexican government is expected to declare the 12 northern states a disaster zone in the coming days. Juan Figueroa Fuentes, president of Agrobarzón, warned that if it does not rain in the next few days, more than 250,000 hectares sown with wheat, corn and sorghum will be lost. In addition, 170,000 hectares will stop being planted with other crops since it will be too late when it rains. In the same way, 50,000 cattle will die. On the other hand, drought and high temperatures have contributed this year to an increase in the number of forest fires. An estimated 10,000 hectares of forest have been lost due to fires. What will happen to the equilibrium price and quantity in the beef market?Response option group (a) Price and quantity will increase (b) Price and quantity will decrease (c) Price will decrease and quantity will increase (d) The price is higher and the…arrow_forwardPlease read the article attached below titled “Notable & Quotable: Gouging” (March 31, 2020) and answer the given question. Note: The phrase “price-gouging” refers to a situation where some sellers are charging prices (e.g., for health equipment and supplies) that are well above the market price charged by other sellers. If firms are reluctant to raise prices and/or earn an economic profit in response to the coronavirus outbreak, explain why the usual mechanism for achieving “allocative” (or social) economic efficiency in a perfectly competitive industry breaks down. What does Professor Romer recommend to improve “allocative” efficiency during this extraordinary time of a pandemic? In your answer, be sure to explain what economists mean by “allocative” efficiency.arrow_forwardBob's Bee Emporium makes organic honey, which Bob sells at farmers' markets. The value of his Bee Emporium in its current location is $100,000. Unfortunately, Bob's bee's frequently fly to the neighboring property, Daisy's Daycare Center, and sting the small children, some of whom have allergic reaction to the bee stings. Daisy's Daycare Center business is worth $100,000, before the cost of treating any of the children, which the Daycare Center has to pay. The cost of treating the children for the bee stings is $15.000. Relocating the Bee Emporium would reduce its value by $25,000. Relocating the Daycare Center would cost $10,000. The table below shows the value of the businesses under the above conditions. Daisy's Daycare Center Present Location Relocate Bob's Bee Emporium Present Location $85,000 $90.000 $100,000 $100,000 Relocate $100,000 $90.000 S75.000 $75.000 Which situation is economically efficient? O Daycare remains in present location, bee farm relocates O Daycare remains in…arrow_forward

- The market for concession tickets (C)! Consider the following simplified scenario. Imagine that the Australian national rugby union (for short, Rugby AU) has exclusive rights to organize the games played by the national team. Rugby AU decides that the next match, between the Wallabies and the All Blacks (i.e., the Australian and the New Zeeland national rugby teams), will be hosted at the Marvel Stadium in Melbourne. Rugby AU has no fixed costs for organizing the game, but it must pay a marginal cost MC of $20 per seat to the owners of the Marvel Stadium. Two types of tickets will be sold for the game: concession and full fare. Based on any official document that attests to their age, children and pensioners qualify to purchase concession tickets that offer a discounted price; everyone else pays the full fare. The demand for full-fare tickets is QF(P) = 120 – 2P. The demand for concession tickets is QC(P) = 80 – 2P. 1a) Calculate the inverse demand, write the profit maximizing…arrow_forwardA firm has a division which produces chemical Y, whose average total costs are ATC = 50 + 2Q (where Q is the quantity of Y), and a marketing division which adds its own average total costs of ATC = 20 + 3Q. There is no external market price of Y. The transfer price of Y should be $50 + 4Q. $30 + $2Q. $5Q. $4Q. $50.00arrow_forwardA city of Hayward has a water reservoir that agricultural user (A) and recreational user (B) have access rights to. Both users A and B want to consume water from the reservoir. The total supply of water there is limited to 18 due to a dry weather this year. User A has inverse demand function: P = 30-Q. User A has marginal cost of pumping water from the reservoir: MC=2. For user B, her inverse demand function is P =20-Q. User B has marginal cost of pumping water (so that she can grow fish in her water garden): MC=2. Efficient allocations are QA- and user B's net benefit is and QB= When the water allocation is efficient, user A's net benefit is Thus, economic surplus isarrow_forward

- As a manager of a monopoly, you face potential government regulations. your inverse demand is P=60 - 2Q, and your cost are C(Q) =8Q. Determine the monopoly price and output. Determine the socially efficient price and output.arrow_forwardConsider a firm that produces glass. Glass production involves melting sand, soda ash, and limestone at a very high temperature. Consider the following factors that a glass manufacturer faces, and determine whether each represents a technological constraint or a market constraint: Items (7 items) (Drag and drop into the appropriate area below) The number of buyers in the market Categories Cost per hour of keeping the furnace at the required temperature The number of other firms selling similar products Market constraint Drag and drop here Cost per pound of limestone Cost per pound of sand Technology constraint Drag and drop here Maximum amount of output per hour that can be produced Hourly wage of workers in the industryarrow_forwardThe figure to the right shows the market for one-bedroom apartments in Calgary. If this market is initially unregulated, thousand units will rent for a price of $ per month. Suppose however, the city imposes the controlled price shown in the figure. In this case, in the short run, the market experiences an excess of thousand units. In the long run, if the controlled price remains in place, the market will show a of thousand units. This analysis indicates that as time passes, rent controls will cause housing shortages to Rental Price ($ per month) 905 610 Rental Housing Market Sshort run Slong run Controlled Price 24 50 60 Quantity of Rental Units (Thousands)arrow_forward

- Nantgwynfaen Organic Farm (NOF) is a farm growing a range of fruit and vegetables. It has a farm shop and offers accommodation with breakfast. It was set up by Amanda and Ken Edwards in West Wales, UK. NOF supports farmers by selling local organic produce in its farm shop. The produce from the farm shop is served to the visitors staying overnight at the farm. NOF is committed to being environmentally friendly by recycling, avoiding the use of packaging and reducing the use of electricity. NOF is looking to expand its product range by making and selling tubs of ice cream. A tub of ice cream will sell for £2.50. Variable costs will be £1.10 per tub of ice cream with fixed costs of £77 per day. Calculate the number of tubs of ice cream NOF will have to sell each day to break-even. You are advised to show your working.arrow_forwardKnoebel's Amusement park is a free entrance park that charges per ride. Suppose that there are two types of visitors to Knoebel's, senior citizens and teenagers. Their demand curves are given by: Seniors: P=4-qs Teenagers: P=5-qt Combined: P=4.5-0.5q Suppose once the rides are built there are no additional costs per ride. Please use this information to answer the following questions. What is the optimal price to charge if Knoebel's does not price discriminate? What is the Total Revenue?arrow_forwardThe Broadway show Hamilton is coming to perform for one night. There are two types of consumers interested in the show- current students and rich alumni. The demand curve for the student market is Q= 300-0.4P with marginal revenue MR= 750-5Q. The demand curve for the alumni market segment is Q=600-0.1P with marginal revenue MR=6000-20Q. If the two types of consumers are in the market, the MR=1800-4Q. The cost function is C(Q)=200Q and the marginal cost of serving either customer is MC=200. 1. Assume the show knows there are different types of consumers but can not tell the difference so they must sell tickets at a single price. At what price do all consumers enter the market? What profit-maximizing price and quantity are the tickets sold at?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education