ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

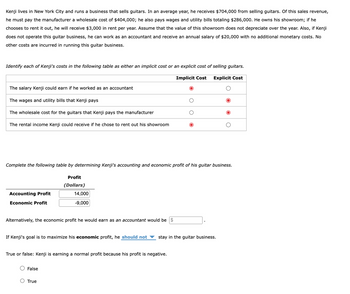

Transcribed Image Text:Kenji lives in New York City and runs a business that sells guitars. In an average year, he receives $704,000 from selling guitars. Of this sales revenue,

he must pay the manufacturer a wholesale cost of $404,000; he also pays wages and utility bills totaling $286,000. He owns his showroom; if he

chooses to rent it out, he will receive $3,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Kenji

does not operate this guitar business, he can work as an accountant and receive an annual salary of $20,000 with no additional monetary costs. No

other costs are incurred in running this guitar business.

Identify each of Kenji's costs in the following table as either an implicit cost or an explicit cost of selling guitars.

Implicit Cost

Explicit Cost

The salary Kenji could earn if he worked as an accountant

The wages and utility bills that Kenji pays

The wholesale cost for the guitars that Kenji pays the manufacturer

The rental income Kenji could receive if he chose to rent out his showroom

Complete the following table by determining Kenji's accounting and economic profit of his guitar business.

Accounting Profit

Economic Profit

Profit

(Dollars)

Alternatively, the economic profit he would earn as an accountant would be $

14,000

-9,000

If Kenji's goal is to maximize his economic profit, he should not stay in the guitar business.

False

True or false: Kenji is earning a normal profit because his profit is negative.

O True

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Antonio lives in Denver and runs a business that sells boats. In an average year, he receives $842,000 from selling boats. Of this sales revenue, he must pay the manufacturer a wholesale cost of $452,000; he also pays wages and utility bills totaling $301,000. He owns his showroom; if he chooses to rent it out, he will receive $38,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Antonio does not operate this boat business, he can work as an accountant, receive an annual salary of $48,000 with no additional monetary costs, and rent out his showroom at the $38,000 per year rate. No other costs are incurred in running this boat business. Identify each of Antonio's costs in the following table as either an implicit cost or an explicit cost of selling boats. Implicit Cost Explicit Cost The wholesale cost for the boats that Antonio pays the manufacturer The wages and utility bills that Antonio pays The rental income Antonio could…arrow_forwardA savings and loan charges 2.225 points for a home buyer to obtain a loan of $275,000. Calculate the discount points (in dollars). (Enter a number.)arrow_forwardYakov lives in Montreal and runs a business that sells boats. In an average year, he receives $793,000 from selling boats. Of this sales revenue, he must pay the manufacturer a wholesale cost of $430,000; he also pays wages and utility bills totalling $301,000. He owns his showroom; if he chooses to rent it out, he will receive $15,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Yakov does not operate this boat business, he can work as a financial advisor and receive an annual salary of $50,000 with no additional monetary costs. No other costs are incurred in running this boat business. Identify each of Yakov's costs in the following table as either an implicit cost or an explicit cost of selling boats. Implicit Cost Explicit Cost The rental income Yakov could receive if he chose to rent out his showroom The wholesale cost for the boats that Yakov pays the manufacturer The salary Yakov could earn if he worked as a financial…arrow_forward

- Felix lives in San Francisco and runs a business that sells pianos. In an average year, he receives $711,000 from selling pianos. Of this sales revenue, he must pay the manufacturer a wholesale cost of $411,000; he also pays wages and utility bills totaling $279,000. He owns his showroom; if he chooses to rent it out, he will receive $1,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Felix does not operate this piano business, he can work as a financial advisor and receive an annual salary of $31,000 with no additional monetary costs. No other costs are incurred in running this piano business. Identify each of Felix's costs in the following table as either an implicit cost or an explicit cost of selling pianos. Implicit Cost Explicit Cost The salary Felix could earn if he worked as a financial advisor The wages and utility bills that Felix pays The rental income Felix could receive if he chose to rent out his showroom The…arrow_forwardI asked this question it was not answered and I was charged please issue me a refund and answer this question. Dina is working for a consulting firm making $60,000 per year but considers starting her own consulting company. Dina has determined that to launch the business, she needs to invest $100,000 of her own funds. The annual cost of running the business will include $70,000 for the rent of the office space, $210,000 for employee wages, and $5,000 for materials and utilities. Dina plans to manage the business, which means that she will have to quit her current job. Suppose that the interest rate (or rate of return) on investments in the economy is 6%. Dina's total implicit cost per year is . Dina's total cost per year is .arrow_forwardSam quits his job as an airline pilot and opens his own pilot training school. He was earning $40,000 as a pilot. He withdraws $10,000 from his savings where he was earning 6 percent interest and uses the money in his new business. He uses a building he owns as a hanger and could rent it out for $5,000 per year. He rents a computer for $1,200, buys office supplies for $500, rents an airplane for $6,000, pays $1,300 for fuel and maintenance, and hires one worker for $30,000. Sam's total revenue from pilot training classes this year equaled $90,400. Sam's explicit costs this year equals:arrow_forward

- Andrew has decided to open an online store that sells home and garden products. After searching around, he chooses the software company Initech to provide the software for his website since their product required the least amount of specialized investments for him to use it. They agreed upon price of $5,000. To use Initech’s software, Andrew makes $2,500 in sunk capital investments and spends 55 hours learning how to use Initech’s software, which is very different from other software packages. Both Andrew and Initech view Andrew’s time as worth $22 per hour and Initech is fully aware of the investments Andrew must make to use their product. After Andrew’s investments were made, Initech came to Andrew and asked for more money. What do you think is the new price Initech requested Andrew to pay? $arrow_forwardSean owns a condo that he values at $500, 000. Sean hosts a dinner party, and invites Mo, a friend of a friend, who recently moved home to Halifax. Mo hates the apartment she just moved into. She thinks she will be a lot happier if she finds a place she can buys. Over dinner, Sean mentions he is moving to Toronto and looking to sell his condo. Mo has $1,000,000 in cash and values the condo at $600,000. The next morning, Mo understands that Colin, another friend, made an offer of $550,000. What is Sean's threat value? Question 17 options: $500,000 $1,600,000 $1,000,000 $550,000arrow_forwardMilo is the young, likable, optimistic, and generous son of a prominent public official. He has a master's degree in business and is the business partner of Kent and Lily in an oil drilling and exploration business. Milo also serves as a director on the board of the Corley Savings and Loan Association. While serving on the Corley Board, Milo votes to approve major loans to Kent and Lily without disclosing to the other directors that he is a business partner of Kent and Lily. Milo also personally arranges for a $900,000 line of credit from Corley for an oil drilling venture in which he is a partner with Kent. The drilling venture is unsuccessful and Kent and Lily both default on their loans to Corley, which then causes the S & L to become insolvent. Federal banking officials seize Corley and liquidate its assets to pay creditors and depositors. Because Corley is federally insured, tax money is also used to pay off depositors whose deposits are insured under federal programs. Corley…arrow_forward

- Tim lives in Vancouver and runs a business that sells pianos. In an average year, he receives $733,000 from selling pianos. Of this sales revenue, he must pay the manufacturer a wholesale cost of $433,000; he also pays wages and utility bills totalling $257,000. He owns his show room; if he chooses to rent it out, he will receive $13,000 in rent per year. Assume that the value of this show room does not depreciate over the year. Also, if Tim does not operate this piano business, he can work as a paralegal, receive an annual salary of $23,000 with no additional monetary costs, and rent out his show room at the $13,000 per year rate. No other costs are incurred in running this piano business.arrow_forwardDana was dating Wade, a wealthy real estate entrepreneur. Wade was much older than Dana and knew he needed to offer something “special” to make her stay. Wade told Dana that if she continued dating him, he would pay her $10,000 a month. Wade paid Dana for two years when suddenly, for no apparent reason, he stopped the monthly payments. Dana stayed with Wade for another six months, but decided enough was enough and left. She wanted the $60,000 she was owed for the six months; Wade refused to pay her. Is Dana entitled to the $60,000?arrow_forwardKenji lives in Mississauga and runs a business that sells pianos. In an average year, he receives $723,000 from selling pianos. Of this sales revenue, he must pay the manufacturer a wholesale cost of $423,000; he also pays wages and utility bills totalling $267,000. He owns his show room; if he chooses to rent it out, he will receive $2,000 in rent per year. Assume that the value of this show room does not depreciate over the year. Also, if Kenji does not operate this piano business, he can work as a financial advisor, receive an annual salary of $20,000 with no additional monetary costs, and rent out his show room at the $2,000 per year rate. No other costs are incurred in running this piano business. Identify each of Kenji's costs in the following table as either an implicit cost or an explicit cost of selling pianos. Implicit Cost The wages and utility bills that Kenji pays The salary Kenji could earn if he worked as a financial advisor The rental income Kenji could receive if he…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education