FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Congress would like to increase tax revenues by 5 percent. Assume that the average taxpayer in the United States earns $40,000 and

pays an average tax rate of 20 percent.

Required:

a. If the income effect is in effect for all taxpayers, what average tax rate will result in a 5 percent increase in tax revenues?

Note: Round your answer to 2 decimal places.

b. This is an example of what type of forecasting?

Complete this question by entering your answers in the tabs below.

Required A Required B

This is an example of what type of forecasting?

< Required A

Required >

Transcribed Image Text:Congress would like to increase tax revenues by 5 percent. Assume that the average taxpayer in the United States earns $40,000 and

pays an average tax rate of 20 percent.

Required:

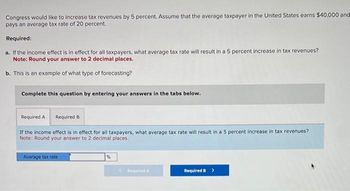

a. If the income effect is in effect for all taxpayers, what average tax rate will result in a 5 percent increase in tax revenues?

Note: Round your answer to 2 decimal places.

b. This is an example of what type of forecasting?

Complete this question by entering your answers in the tabs below.

Required A

If the income effect is in effect for all taxpayers, what average tax rate will result in a 5 percent increase in tax revenues?

Note: Round your answer to 2 decimal places.

Required B

Average tax rate

Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose you are a manager for a certain company. You earn $50,000 per year and are in the 28% federal income tax bracket. Each year you contribute $5,500 tax free to your individual retirement account, IRA. The account earns 7% annual interest. In addition, the amount of tax that you save each year by making these "pre-tax" contributions is invested in a taxable aggressive growth mutual fund averaging 16%. a)How much tax do you save (in $) each year by making the retirement fund contributions? b)Using Table 12-1, much will the retirement fund be worth (in $) in 30 years? (Round your answer to the nearest cent.) c) Although the income from this investment is taxable each year, using Table 12-1, how much will the "tax savings" fund be worth (in $) in 30 years? (Round your answer to the nearest cent.)arrow_forwardIt is with deep regret that I inform you that your rich uncle just passed away. His money is tied up in an investment. However, we can sell the investment and give you $15,000 today, or you will receive $20,000 in 5 years when the investment matures. Which would you choose? Use March 2023’s inflation rate (5%)arrow_forwardYour company sponsors a 401(k) plan into which you deposit 10 percent of your $120,000 annual Income. Your company matches 75 percent of the first 10 percent of your earnings. You expect the fund to yield 12 percent next year. Assume you are currently in the 31 percent tax bracket. a. What is your annual Investment in the 401(k) plan? (Round your answer to 1 decimal place. (e.g., 32.1)) b. What is your one-year return? (Round your answer to 3 decimal places. (e.g., 32.161)) a. Annual investment b. One-year return 184.000 %arrow_forward

- Suppose you are a manager for a certain company. You earn $50,000 per year and are in the 28% federal income tax bracket. Each year you contribute $4,500 tax free to your individual retirement account, IRA. The account earns 6% annual interest. In addition, the amount of tax that you save each year by making these "pre-tax" contributions is invested in a taxable aggressive growth mutual fund averaging 16%. (a)How much tax do you save (in $) each year by making the retirement fund contributions? $ 1260 (b)Using Table 12-1, much will the retirement fund be worth (in $) in 30 years? (Round your answer to the nearest cent.) $ ?arrow_forwardIn 2000, the ratio of people age 65 or older to people ages 20 to 64 in Ecocountry was 38,4 %. In the year 2060, this ratio is expected to be 56,8 %. Assuming a pay- as-you-go Social Security system, a) What change in the payroll tax rate between 2000 and 2060 would be needed to maintain the 2000 ratio of benefits to wages? b) If the tax rate were kept constant, what would happen to the ratio of benefits to wages? c) What other policies can be used for Social Security Reform?arrow_forwardYour employer asks you to consult on the better approach to a decision. What should the corporation pay for an asset that will return them $150,000 at the end of year 1, then zero in year 2, then $400,000 in years 3 & 4, then zero in year 5, then $200,000 in years 6-10, assuming their discount rate is 3% (ignoring taxes) ?arrow_forward

- O SYSTEMS OF EQUATIONS AND MATRICES Solving a tax rate or interest rate problem using a system of... Last year, Charlie had $30,000 to invest. He invested some of it in an account that paid 10% simple interest per year, and he invested the rest in an account that paid 8% simple interest per year. After one year, he received a total of $2640 in interest. How much did he invest in each account? First account: 2$ Second account: $ Explanation Check Terms of Use | Privacy Accessibility 2020 McGraw-Hill Education. All Rights Reserved. MacBook Proarrow_forwardYou give $2.1 million to your college in an irrevocable trust with the stipulation that you receive the earnings from the gift. You are guaranteed an 8% return on your investment. a. What would be the income from your gift? (Enter your answer in dollars, not millions of dollars.) Annual income $ b. How much of your gift would be a tax deduction? (Enter your answer in dollars, not millions of dollars.) Tax deduction $arrow_forwardI solved the problem, but please put the information you provided in an excel spreadsheet to get the answers I have please and explain the steps/formula used. 1. John won a $45 million lottery today. The payout is the following: John gets $1.5 million today and $1.5 million each year for the next 29 years. How much money worth today for the lottery assuming John’s federal tax rate is 39.6%, state tax is 8.5% and his annual discount rate is 12%? Annual Discount Rate = 12% Annual Income = 1.5 million Annual Federal Tax = 39.6% * 1.5 million = 0.594 million Annual State Tax = 8.5% * 1.5 million = 0.1275 million Annual Net Income = 1.5 million - 0.594 million - 0.1275 million = 0.7785 million Calculate Total Present Value by using the PVOA Formula. Annuity Factor i = 12% ; time = 29 years ; Factor = 8.0218 PVOA = PMT x Annuity Factor = 0.7785 x 8.0218 = 6.244971 million Total PV = Initial Net Income + PVOA = 0.7785 million + 6.244971 million = 7.02 millionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education