FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

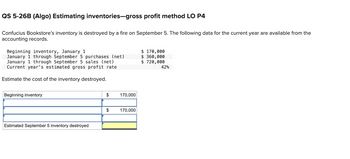

Transcribed Image Text:QS 5-26B (Algo) Estimating inventories-gross profit method LO P4

Confucius Bookstore's inventory is destroyed by a fire on September 5. The following data for the current year are available from the

accounting records.

Beginning inventory, January 1

January 1 through September 5 purchases (net)

January 1 through September 5 sales (net)

Current year's estimated gross profit rate

Estimate the cost of the inventory destroyed.

Beginning inventory

Estimated September 5 inventory destroyed

$

$

170,000

170,000

$ 170,000

$360,000

$ 720,000

42%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Estimating Inventory Loss Using Gross Profit Method On November 15, a fire destroyed Youngstown Inc.'s warehouse where inventory is stored. It is estimated that $12,000 can be realized from sale of usable but damaged inventory. The accounting records concerning inventory reveal the following. Gross profit averaged 35% of net sales. Inventory at Nov. 1 Purchases from Nov. 1 to Nov. 15 Net sales from Nov. 1 to Nov. 15 $144,000 168,000 240,000 Required a. Calculate the estimated loss of inventory using the gross profit method. $ 144,000 b. Assume instead that the markup is 25% of cost. Estimate the loss of inventory using the gross profit method. $ 120,000 Xarrow_forwardPROBLEM 23: The records of Santiago were destroyed by fire at the end of the current year. However, certain statistical data related to the income statement are available: Interest expense P 20,000 Cost of goods sold 2,000,000 Sales discount 100,000 The beginning inventory was P400,000 and decreased 20% during the year. Administrative expenses are 25% of cost of goods sold but only 10% of gross sales. Four fifths of the operating expenses relate to sale activities. 29. Ignoring income tax, what is the net income for the current year?arrow_forwardDO NOT GIVE SOLUTION IN IMAGE FORMATarrow_forward

- On 30 September 20X1 part of the inventory of a company was completely destroyed by fire. The following information is available: Inventory at 1 September 20X1 at cost $49,800 Purchases for September 20X1 $88,600 Sales for September 20X1 $130,000 Inventory at 30 September 20X1 – undamaged items $32,000 Standard gross profit percentage on sales 30% Based on this information, what is the cost of the inventory destroyed?arrow_forwardi need the answer quicklyarrow_forwardA fire completely destroyed the entire inventory of Printing Delight Co. on March 15, 20--. Fortunately, the books were not destroyed in the fire. The following information is taken from the books of Printing Delight Co. for the time period, January 1, 20-- through March 15, 20--: Beginning inventory, January 1, 20-- $45,000 Net purchases, January 1, through March 15, 20-- 252,000 Net sales, January 1, through March 15, 20-- 378,000 Normal gross profit percentage of sales 37% Required: 1. Estimate the cost of goods sold for the time period January 1 through March 15, 20--, using the gross profit method. Estimated cost of goods sold 66,350 x Feedback 2. Estimate the amount of merchandise inventory destroyed in the fire on March 15, 20--, using the gross profit method. Estimated inventory on March 15, 20-- 22,275 x Feedbackarrow_forward

- A hurricane destroyed the inventory and store of a Company. The followinginformation is available:Beginning Inventory $100,000Purchases $400,000Net Sales Revenue $600,000Gross Profit Percentage 20%Compute the amount of inventory lost in the hurricane.arrow_forwardplease answer do not imagearrow_forward7. The inventory was destroyed by fire on December 31. The following data were obtained from the accounting records:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education