Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

The condensed financial statements of Vaughn Company for the years 2021 and 2022 are as follows.

|

Vaughn Company

Balance Sheets December 31 (in thousands) |

||||

|---|---|---|---|---|

|

2022

|

2021

|

|||

|

Current assets

|

||||

|

Cash and cash equivalents

|

$350 | $350 | ||

|

Accounts receivable (net)

|

450 | 370 | ||

|

Inventory

|

470 | 420 | ||

|

Prepaid expenses

|

120 | 170 | ||

|

Total current assets

|

1,390 | 1,310 | ||

|

Property, plant, and equipment (net)

|

370 | 340 | ||

|

Investments

|

1 | 10 | ||

|

Other assets

|

490 | 470 | ||

|

Total assets

|

$2,251 | $2,130 | ||

|

Current liabilities

|

$830 | $730 | ||

|

Long-term liabilities

|

391 | 370 | ||

|

Stockholders’ equity—common

|

1,030 | 1,030 | ||

|

Total liabilities and stockholders’ equity

|

$2,251 | $2,130 |

|

Vaughn Company

Income Statements For the Years Ended December 31 (in thousands) |

||||

|---|---|---|---|---|

|

2022

|

2021

|

|||

|

Net sales

|

$3,880 | $3,530 | ||

|

Expenses

|

||||

|

Cost of goods sold

|

950 | 910 | ||

|

Selling and administrative expenses

|

2,420 | 2,340 | ||

|

Interest expense

|

10 | 20 | ||

|

Total expenses

|

3,380 | 3,270 | ||

|

Income before income taxes

|

500 | 260 | ||

|

Income tax expense

|

200 | 104 | ||

|

Net income

|

$300 | $156 |

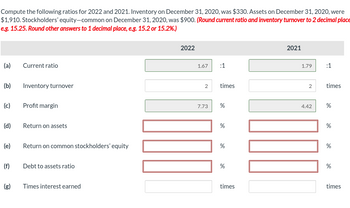

Compute the following ratios for 2022 and 2021. Inventory on December 31, 2020, was $330. Assets on December 31, 2020, were $1,910. Stockholders’ equity—common on December 31, 2020, was $900. (Round current ratio and inventory turnover to 2 decimal places, e.g. 15.25. Round other answers to 1 decimal place, e.g. 15.2 or 15.2%.)

|

2022

|

2021

|

|||||||

|---|---|---|---|---|---|---|---|---|

|

(a)

|

Current ratio

|

enter ratio rounded to 2 decimal places | :1 | enter ratio rounded to 2 decimal places | :1 | |||

|

(b)

|

Inventory turnover

|

enter a number of times rounded to 2 decimal places | times | enter a number of times rounded to 2 decimal places | times | |||

|

(c)

|

Profit margin

|

enter percentages rounded to 1 decimal place | % | enter percentages rounded to 1 decimal place | % | |||

|

(d)

|

|

enter percentages rounded to 1 decimal place | % | enter percentages rounded to 1 decimal place | % | |||

|

(e)

|

Return on common stockholders’ equity

|

enter percentages rounded to 1 decimal place | % | enter percentages rounded to 1 decimal place | % | |||

|

(f)

|

Debt to assets ratio

|

enter percentages rounded to 1 decimal place | % | enter percentages rounded to 1 decimal place | % | |||

|

(g)

|

Times interest earned

|

enter a number of times rounded to 1 decimal place | times | enter a number of times rounded to 1 decimal place | times |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Compute the following ratios for 2022 and 2021. Inventory on December 31, 2020, was $330. Assets on December 31, 2020, were

$1,910. Stockholders' equity-common on December 31, 2020, was $900. (Round current ratio and inventory turnover to 2 decimal place

e.g. 15.25. Round other answers to 1 decimal place, e.g. 15.2 or 15.2%.)

(a)

(b) Inventory turnover

(c)

(d)

(e)

(f)

Current ratio

(g)

Profit margin

Return on assets

Return on common stockholders' equity

Debt to assets ratio

Times interest earned

2022

1.67

2

7.73

:1

times

%

%

%

%

times

2021

1.79

2

4.42

:1

times

de

%

%

%

%

times

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

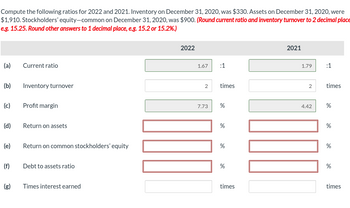

Transcribed Image Text:Compute the following ratios for 2022 and 2021. Inventory on December 31, 2020, was $330. Assets on December 31, 2020, were

$1,910. Stockholders' equity-common on December 31, 2020, was $900. (Round current ratio and inventory turnover to 2 decimal place

e.g. 15.25. Round other answers to 1 decimal place, e.g. 15.2 or 15.2%.)

(a)

(b) Inventory turnover

(c)

(d)

(e)

(f)

Current ratio

(g)

Profit margin

Return on assets

Return on common stockholders' equity

Debt to assets ratio

Times interest earned

2022

1.67

2

7.73

:1

times

%

%

%

%

times

2021

1.79

2

4.42

:1

times

de

%

%

%

%

times

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- Selected financial statement information for 2018, 2019, and 2023 for End Run Corporation is presented below (amounts in millions of dollars): Accounts receivable Current assets Property, plant, and equipment (net) Total assets Current liabilities Long-term debt Sales Cost of goods sold Selling and administrative expenses Income from continuing operations Cash flow from operations Depreciation expense 2020 A. 2020 SAI B. 2020 LVGI C. 2020 TATA D. 2020 Y E. 2020 earnings manipulation probability 10508 30945 11284 68787 29417 8776 101573 92207 3931 946 4837 518 2019 3905 7438 10744 31289 6595 7223 47860 32090 3315 1063 1127 550 2018 2985 5743 10493 26213 6048 7223 33906 27772 2582 739 1863 550 For 2019 and 2020, compute the following amounts relative to Beneish's eight-factor earnings manipulation model:arrow_forwardThe Davidson Corporation's balance sheet and income statement are provided here. Davidson Corporation: Balance Sheet as of December 31, 2021 (millions of dollars) Assets Liabilities and Equity Cash and equivalents $ 20 Accounts payable $ 150 Accounts receivable 610 Accruals 320 Inventories 830 Notes payable 215 Total current assets $ 1,460 Total current liabilities $ 685 Net plant and equipment 2,465 Long-term bonds 1,490 Total liabilities $ 2,175 Common stock (100 million shares) 250 Retained earnings $ 1,500 Common equity $ 1,750 Total assets $ 3,925 Total liabilities and equity $ 3,925 Davidson Corporation: Income Statement for Year Ending December 31, 2021 (millions of dollars) Sales $ 7,250 Operating costs excluding depreciation and amortization 5,430 EBITDA $ 1,820 Depreciation and amortization 410 EBIT $ 1,410 Interest 130 EBT $ 1,280…arrow_forwardThe balance sheets for Mary Company showed the following information. Additional information concerning transactions and events during 2021 are presented below. Mary CompanyBalance Sheet December 31 2021 2020 Cash $ 31,209 $ 10,302 Accounts receivable (net) 43,733 20,503 Inventory 35,350 42,420 Long-term investments 0 15,150 Property, plant & equipment 238,865 151,500 Accumulated depreciation (38,077) (25,250) $311,080 $214,625 Accounts payable $ 17,170 $ 26,765 Accrued liabilities 21,210 17,170 Long-term notes payable 70,700 50,500 Common stock 131,300 90,900 Retained earnings 70,700 29,290 $311,080 $214,625 Additional data: 1. Net income for the year 2021, $61,610. 2. Depreciation on plant assets for the year, $12,827. 3. Sold the long-term…arrow_forward

- The 2021 income statement of Adrian Express reports sales of $19,710,000, cost of goods sold of $12,350,000, and net income of $1,780,000. Balance sheet information is provided in the following table. Assets Current assets: Cash ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Gross profit ratio Return on assets Profit margin Asset turnover Return on equity 45% 25% 15% 2021 Industry averages for the following profitability ratios are as follows: 3.5 times 35% 2020 $ 740,000 $ 880,000 1,650,000 1,130,000 2,070,000 1,550,000 4,940,000 4,360,000 $9,400,000 $7,920,000 $1,964,000 $1,784,000 2,436,000 2,524,000 1,950,000 1,930,000 3,050,000 1,682,000 $9,400,000 $7,920,000arrow_forwardConsider the following financial data for Terry Enterprises: Balance Sheet as of December 31, 2018 Cash $ 86,000 Accounts payable $ 15,500 Accts. receivable 91,500 Notes payable 93,500 Inventories 65,500 Accruals 19,500 Total current assets $ 243,000 Total current liabilities $ 128,500 Long-term debt 162,500 Net plant & equip. 419,500 Common equity 371,500 Total assets $ 662,500 Total liab. & equity $ 662,500 Statement of Earnings for 2018 Industry Average Ratios Net sales $ 642,500 Current ratio 2.2× Cost of goods sold 482,000 Quick ratio 1.7× Gross profit $ 160,500 Days sales outstanding 44 days Operating expenses 119,500 Inventory turnover 6.7× EBIT $ 41,000 Total asset turnover 0.6× Interest expense 14,500 Net profit margin 7.2% Pre-tax earnings $ 26,500…arrow_forwardThe comparative balance sheets of Madrasah Corporation at the beginning and end of the year 2020 appear below. Madrasah CorporationBalance Sheets Assets Dec. 31, 2020 Jan. 1, 2020 Inc./Dec. Cash $ 20,000 $ 13,000 $ 7,000 Inc. Accounts receivable 106,000 88,000 18,000 Inc. Equipment 39,000 22,000 17,000 Inc. Less: Accumulated depreciation—equipment 17,000 11,000 6,000 Inc. Total $148,000 $112,000 Liabilities and Stockholders' Equity Accounts payable $ 20,000 $ 15,000 5,000 Inc. Common stock 100,000 80,000 20,000 Inc. Retained earnings 28,000 17,000 11,000 Inc. Total $148,000 $112,000 Net income of $44,000 was reported, and dividends of $33,000 were paid in 2020. New equipment was purchased and none was sold. Instructions a. Prepare a statement of cash flows for the year 2020. b. Compute the current ratio (current assets ÷ current liabilities) as of January 1, 2020, and December 31, 2020,…arrow_forward

- he current sections of Skysong, Inc.’s balance sheets at December 31, 2021 and 2022, are presented here.Skysong’s net income for 2022 was $152,700. Depreciation expense was $27,600. 2022 2021 Current assets Cash $107,600 $95,900 Accounts receivable 78,400 89,400 Inventory 167,800 172,100 Prepaid expenses 26,800 22,000 Total current assets $380,600 $379,400 Current liabilities Accrued expenses payable $15,800 $8,600 Accounts payable 84,900 95,500 Total current liabilities $100,700 $104,100 Prepare the net cash provided by operating activities section of the company’s statement of cash flows for the year ended December 31, 2022, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)arrow_forwardCondensed financial data of Pat Metheny Company for 2020 and 2019 are presented below. Pat Metheny CompanyComparative Balance SheetAs of December 31, 2020 and 2019 2020 2019 Cash $1,800 $1,150 Receivables 1,750 1,300 Inventory 1,600 1,900 Plant assets 1,900 1,700 Accumulated depreciation (1,200) (1,170) Long-term investments (held-to-maturity) 1,300 1,420 $7,150 $6,300 Accounts payable $1,200 $ 900 Accrued liabilities 200 250 Bonds payable 1,400 1,550 Common stock 1,900 1,700 Retained earnings 2,450 1,900 $7,150 $6,300 Pat Metheny CompanyIncome StatementFor the Year Ended December 31, 2020 Sales revenue $6,900 Cost of goods sold 4,700 Gross margin 2,200 Selling and administrative expense 930 Income from operations 1,270 Other revenues and gains Gain on sale of investments 80 Income before tax 1,350 Income tax expense 540 Net income 810 Cash dividends 260 Income retained in…arrow_forwardThe 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,250,000, and net income of $1,700,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity 2020 $ 700,000 $ 860,000 1,600,000 1,100,000 2,000,000 1,500,000 4,900,000 4,340,000 $9,200,000 $7,800,000 $1,920,000 $1,760,000 2,400,000 2,500,000 1,900,000 1,900,000 2,980,000 1,640,000 $9,200,000 $7,800,000 Industry averages for the following profitability ratios are as follows: Gross profit ratio Return on assets Profit margin Asset turnover Return on equity 45% 25% 15% 2.5 times 35% Required: 1. Calculate the five profitability ratios listed above for Adrian Express. (Round your…arrow_forward

- The 2021 income statement of Adrian Express reports sales of $15,642,000, cost of goods sold of $9,351,500, and net income of $1,590,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Common stock Retained earnings Total liabilities and stockholders' equity Average collection period Average days in inventory Current ratio Debt to equity ratio Industry averages for the following four risk ratios are as follows: Risk Ratios Average collection period Average days in inventory Current ratio Debt to equity ratio 25 days 60 days 2 to 1 50% days days 2021 Required: 1. Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 decimal place.) to 1 % 2020 $ 590,000 1,380,000 $750,000 990,000…arrow_forwardPresented here are summarized data from the balance sheets and income statements of Wiper Inc.: WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2020 2019 2018 Current assets $ 685 $ 917 $ 773 Other assets 2,417 1,924 1,723 Total assets $ 3,102 $ 2,841 $ 2,496 Current liabilities $ 581 $ 816 $ 714 Long-term liabilities 1,510 995 860 Stockholders’ equity 1,011 1,030 922 Total liabilities and stockholders' equity $ 3,102 $ 2,841 $ 2,496 WIPER INC. Selected Income Statement and Other Data For the year Ended December 31, 2020 and 2019 (in millions) Income statement data: 2020 2019 Sales $ 3,054 $ 2,917 Operating income 300 314 Interest expense 88 69 Net income 203 198 Other data: Average number of common shares outstanding 41.7 47.1 Total dividends paid $ 54.0…arrow_forwardThe comparative balance sheet of Gus Company at December 31, 2021 and 2020 appears below: Assets: 12/31/2021 12/31/2020 Cash $ 53,000 $ 120,000 Accounts receivable (net) 37,000 48,000 Inventories 108,500 100,000 Equipment 573,200 450,000 Accumulated depreciation-equipment (142,000) (176,000) $629,700 $542,000 Liabilities & Stockholders Equity: Accounts payable $ 62,500 $ 43,800 Bonds payable, due June 2021 0 100,000 Common stock, $10 par 335,000 285,000 Paid-in capital in excess of par - Common stock 74,000 55,000 Retained earnings 158,200 58,200 $629,700 $542,000 The income statement for the year ended December 31, 2021 appears below: Sales $625,700 Cost of merchandise sold 340,000 Gross profit 285,700 Operating expenses (includes $26,000 depreciation expense) 94,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education