Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

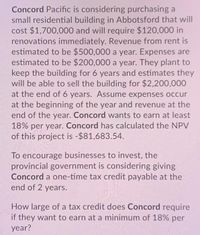

Transcribed Image Text:Concord Pacific is considering purchasing a

small residential building in Abbotsford that will

cost $1,700,000 and will require $120,000 in

renovations immediately. Revenue from rent is

estimated to be $500,000 a year. Expenses are

estimated to be $200,000 a year. They plant to

keep the building for 6 years and estimates they

will be able to sell the building for $2,200,000

at the end of 6 years. Assume expenses occur

at the beginning of the year and revenue at the

end of the year. Concord wants to earn at least

18% per year. Concord has calculated the NPV

of this project is -$81,683.54.

To encourage businesses to invest, the

provincial government is considering giving

Concord a one-time tax credit payable at the

end of 2 years.

How large of a tax credit does Concord require

if they want to earn at a minimum of 18% per

year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Benford Inc. is planning to open a new sporting goods store in a suburban mall. Benford will lease the needed space in the mall. Equipment and fixtures for the store will cost $400,000 and be depreciated over a 5-year period on a straight-line basis to $0. The new store will require Benford to increase its net working capital by $400,000 at time 0. First-year sales are expected to be $1.4 million and to increase at an annual rate of 8 percent over the expected 10-year life of the store. Operating expenses (including lease payments and excluding depreciation) are projected to be $800,000 during the first year and increase at a 6 percent annual rate. The salvage value of the store’s equipment and fixtures is anticipated to be $19,000 at the end of 10 years. Benford’s marginal tax rate is 40 percent. Round your answers to the nearest dollar. Compute the net investment required for Benford. $ Compute the annual net cash flows for the 10-year projected life of the store. Year NCF…arrow_forwardA developer plans to start construction of a building in two years if, at that point, rent levels make construction feasible. At that time, the building will cost $1,000,000 to construct. During the first year after construction (year 3), there is a 50% chance that NOI will be $150,000 and a 50% chance that the NOI will be $75,000. In either case, NOI would be expected to increase at 4% per year thereafter. What is the value of the real option on the vacant land today if the relevant discount rate is 14%? O 109,649 O 137,369 O 192,367 96,183arrow_forwardAthena Investment Company is considering the purchase of an office property. After a careful review of the market and the leases that are in place, Athena believes that next year's cash flow will be $100,000. It also believes that the cash flow will rise in the amount of $6,400 each year for the foreseeable future. It plans to own the property for at least 10 years. Based on a review of sales of properties that are now 10 years older than the subject property, Athena has determined that cap rates are in a range of 0.10. Athena believes that it should earn an IRR (required return) of at least 11 percent. Required: a. What is the estimated value of this office property (assume a 0.10 terminal cap rate)? b. What is the current, or going-in, cap rate for this property?arrow_forward

- Cullumber, Inc. is considering the purchase of a warehouse directly across the street from its manufacturing plant. Cullumber currently warehouses its inventory in a public warehouse across town. Rent on the warehouse and delivering and picking up inventory cost Cullumber $50880 per year. The building will cost Cullumber $477000. Cullumber will depreciate the building for 20 years. At the end of 20 years, the building will have a $132500 salvage value. Cullumber's required rate of return is 12%. Click here to view the factor table. Using the present value tables, the building's net present value is (round to the nearest dollar) O $1017600. O $46077. O $393783. O $-83217.arrow_forwardKotse Automotive is planning to expand its operation by planning to add a machine costing $90,000. The company is facing two possible options which are Option 1 - Lease arrangement which will require the company to pay $15,000 for 5 years and an option to purchase at $20,000 at the end of the lease Option 2 - Purchase the machine thru debt financing which would require the company to pay $20,000 for 5 years. The company is expected to spend $1,000 every year for 5 years for the machines repairs and maintenance. Which of the two options should the company choose if costs of debt is at 9%?arrow_forwardA small strip mining cola company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the shell will cost $150,000 and is expected to have a $65,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for $20,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other strip-mining companies whenever possible, an activity that is expected to yield revenue of $12,000 per year. If the company’s MARR is 15% per year, should the clamshell be purchased or leased on the basis of future worth analysis. (Enter the FW value of the selected alternative with proper positive or negative sign)arrow_forward

- The Ocean City water park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $8,000,000, and it will cost an additional $475,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 7-year class life. Management expects to run about 150 rides per day, with each ride averaging 35 riders. The season will last for 120 days per year. In the first year, the ticket price per rider is expected to be $5.25, and it will be increased by 4% per year. The variable cost per rider will be $1.65, and total fixed costs will be $525,000 per year. After six years, the ride will be dismantled at a cost of $245,000 and the parts will be sold for $600,000. The cost of capital is 8.5%, and its marginal tax rate is 25%. Calculate the NPV, IRR, and MIRR of the new equipment. Is the project acceptable?arrow_forwardBlossom Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.80 million. This investment will consist of $2.00 million for land and $9.80 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.00 million, which is $2.00 million above book value. The farm is expected to produce revenue of $2.00 million each year, and annual cash flow from operations equals $1.90 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 9 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places, e.g. 5,275.25.) NPV $ The project should bearrow_forwardThe Ocean City water park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $8,000,000, and it will cost an additional $475,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 7-year class life. Management expects to run about 150 rides per day, with each ride averaging 35 riders. The season will last for 120 days per year. In the first year, the ticket price per rider is expected to be $5.25, and it will be increased by 4% per year. The variable cost per rider will be $1.65, and total fixed costs will be $525,000 per year. After six years, the ride will be dismantled at a cost of $245,000 and the parts will be sold for $600,000. The cost of capital is 8.5%, and its marginal tax rate is 25%. a. Calculate the initial outlay, annual after-tax cash flow for each year, and the terminal cash flow.arrow_forward

- RealTurf is considering purchasing an automatic sprinkler system for its sod farm by borrowing the entire $30,000 purchase price. The loan would be repaid with four equal annual payments at an interest rate of 12%/year. It is anticipated that the sprinkler system would be used for 9 years and then sold for a salvage value of $2,000. Annual operating and maintenance expenses for the system over the 9-year life are estimated to be $9,000 per year. If the new system is purchased, cost savings of $15,000 per year will be realized over the present manual watering system. RealTurf uses a MARR of 15%/year for economic decision making. Based on a present worth analysis, is the purchase of the new sprinkler system economically attractive?arrow_forwardYour firm is considering an investment in luxury cars for its livery service between Oxford and CVG airport. The purchase price of the cars is $300,000 and the service is expected to contribute gross profit of $150,000 per year (excluding depreciation) for 3 years. The vehicles will be fully depreciated using straight-line depreciation over 3 years. The cars will be sold at the end of the third year for $75,000. There is no expected impact on NWC, the tax rate is 21%, and the WACC is 10%. What is the NPV of the investment?arrow_forwardAthena Investment Company is considering the purchase of an office property. After a careful review of the market and the leases that are in place, Athena believes that next year’s cash flow will be $100,000. It also believes that the cash flow will rise in the amount of $5,000 each year for the foreseeable future. It plans to own the property for at least 10 years. Athena believes that it should earn a return (r) of at least 11 percent. Athena estimates the value of the property today to be $1,224,808. What is the current, or going-in, cap rate for this property? A. 11.05% B. 10.49% C. 8.57% D. 8.16%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education