FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

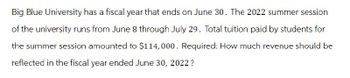

Transcribed Image Text:Big Blue University has a fiscal year that ends on June 30. The 2022 summer session

of the university runs from June 8 through July 29. Total tuition paid by students for

the summer session amounted to $114,000. Required: How much revenue should be

reflected in the fiscal year ended June 30, 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the end of 2022, the following information is available for Great Adventures. Additional interest for five months needs to be accrued on the $32,200, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $12,200 of the $32,200 loan discussed above is due next year. By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $27,200 during the year and recorded those as Deferred Revenue. Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $14,200. For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $6,200. No Date General Journal Debit Credit 1 Dec 31 Interest Expense 805 Interest Payable 805…arrow_forwardSole this journal entry Question: Record the appropriate adjustment to the January and February revenue.arrow_forwardTesla State University is a public university. Assume deferred revenues as of July 1, 2022 are in the amount of $3,500,000. Record appropriate transactions for the year ended June 30, 2023. Properly classify the revenue transactions in your answers (operating revenues, nonoperating revenues, etc.): 1. Deferred revenues were earned prior to December 2022. 2. During the fiscal year ended June 30, 2023, student tuition and fees were assessed in the amount of $68,000,000. OF that amount, $52,000,000 was collected in cash. Also, of that amount, $2,400,000 pertained to that portion of the 2023 summer session that took place after June 30, 2023. 3. Student scholarships amounted to $2,500,000. No services were required of the students. 4. Student assistantships and work-study stipends amounted to $2,000,000. 5. Auxiliary enterprise revenues amounted to $10,500,000. 3. The state appropriation for operations was received in the amount of $43,000,000. Pell Grants in the amount of $ 18,000,000…arrow_forward

- Dawson City has a December 31 fiscal year end. The City levies property taxes of $5,000,000 on February 1, 2022 and expects 2% to be uncollectible. The City has two due dates for collection, 1/2 on October 31, 2022 and 1/2 on April 30, 2023. Record the requested journal entries: 1. Record the levy on February 1, 2022, assuming the City records the entire levy as unavailable revenue. 2. Record the collection of property taxes of $2,410,000 on October 31, 2022. 3. Record any necessary adjusting journal entry at December 31, 2022. 4. Record any necessary journal entry to recognize revenue associated with the 2/1/2022 levy in 2023. Repeat this process and record all four journal entries if the entire levy had been treated as revenue at the time of the levy.arrow_forwardHamilton Township needs to make its closing entries to close out its budgetary and operating accounts. Assume that Hamilton Township has a balance remaining of $275,000 in encumbrances outstanding as of the end of the year. The outstanding invoices are expected to be honored in the next fiscal year. Required: Prepare the journal entries to close the encumbrance accountarrow_forwardEastern University had the following transactions at the beginning of its academic year: 1. Student tuition and fees were billed in the amount of $7,190,000. Of that amount, $4,640,000 was collected in cash. 2. Pell Grants in the amount of $2,014,000 were received by the university. 3. The Pell Grants were applied to student accounts. 4. Student scholarships, for which no services were required, amounted to $610,000. These were applied to student tuition bills at the beginning of each semester. Required: Prepare journal entries to record the above transactions assuming: a. Eastern University is a public university. b. Eastern University is a private university. Complete this question by entering your answers in the tabs below. Public University Private University Prepare journal entries to record the above transactions assuming Eastern University is a public university. Note: If no entry is required for a transaction or event, select "No Journal Entry Required" in the first account…arrow_forward

- Godo Subject: acountingarrow_forwardSubject: acountingarrow_forwardCherry Corporation, a calendar year C corporation, is formed and begins business on 6/1/2019. In connection with its formation, Cherry incurs organizational expenditures of $54,200. Round the per month amount to two decimal places. Round your final answer to the nearest dollar. Determine Cherry Corporation's deduction for organizational expenditures for 2019. $fill in the blank 1 Do not give answer in image and hand writingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education