FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

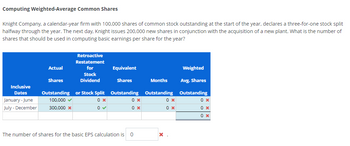

Transcribed Image Text:Computing Weighted-Average Common Shares

Knight Company, a calendar-year firm with 100,000 shares of common stock outstanding at the start of the year, declares a three-for-one stock split

halfway through the year. The next day, Knight issues 200,000 new shares in conjunction with the acquisition of a new plant. What is the number of

shares that should be used in computing basic earnings per share for the year?

Inclusive

Dates

January -June

July-December

Actual

Equivalent

Weighted

Avg. Shares

Shares

Outstanding or Stock Split Outstanding Outstanding Outstanding

100,000 ✓

300,000 *

0 x

0✔

Retroactive

Restatement

for

Shares

Stock

Dividend

0 x

0 x

The number of shares for the basic EPS calculation is

0

Months

0 x

0 x

x .

0x

0 x

0 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Urmilabenarrow_forwardNot Graded Earnings per ShareLucky Corporation began the year with a simple capital structure consisting of 200,000 shares of outstanding common stock. On April 1, 90,000 additional common shares were issued, and another 30,000 common shares were issued on August 1. The company had net income for the year of $690,000. Calculate the earnings per share of common stock. Round to two decimal points.Earnings per Share $Answerarrow_forwardReturn on Equity Evans & Sons, Inc., disclosed the following information in a recent annual report: Net Income Average stockholders' equity Dividend per common share Earnings per share Market price per common share, year-end Previous Year Current Year $94,500 1,000,000 Previous Year $ Current Year $ 5.13 7.70 51.30 Did the return improve? The return on common stockholders' equity Calculate the return on equity for Evans & Sons for each year. Did the return improve? Numerator Denominator $129,600 1,500,000 0 0 5.40 8.64 56.70 ◆ 0 0 from the previous year to the current year. ROE % %arrow_forward

- Financial Statement Presentation of EPS To illustrate EPS reporting for various combinations of gains and losses, assume that 1,000 weighted- average shares of common stock were outstanding for each of the four cases below. Also assume preferred stock dividends of $2,500 were declared and paid during the year in each case. Case A Case B Case C Case D Income (loss) continuing operations $ Income (loss) from discontinued operations 0 $ 0 0 $ 0 $ 0 0 0 0 Required Show the EPS financial statement presentation for basic EPS for each Case A through D. Basic EPS Case A Case B Case C Case D Income (loss) from continuing operations $ 0 $ 0 $ 0 $ 0 Income (loss) from discontinued operations, net of tax 0 0 0 0 Net income (loss) $ 0 $ 0 $ 0 $ 0 Checkarrow_forwardEarnings Per Share Financial statement data for the years ended December 31 for Brown Cow Inc. follow: 20Y6 20Y5 Net income $4,243,200 $2,855,360 Preferred dividends $64,000 $64,000 Average number of common shares outstanding 128,000 shares 104,000 shares a. Determine the earnings per share for 20Y6 and 20Y5. Round your answers to two decimal places. 20Y6 per share 20Y5 per share b. Does the change in the earnings per share from 20Y5 to 20Y6 indicate a favorable or unfavorable trend? %24 %24arrow_forwardUsing the information for The Great Cookie Company presented in the table below, determine the following: Highest price paid for a share of stock in the last 12 months. The last price paid for a share of stock on this trading day. Lowest price paid for a share of the stock in the last 12 months. Additional Resources Year-to-Date % Change 14.62% EPS $1.13 52-Week Hi $40.20 PE Ratio 31.07 52-Week Lo $28.44 Volume 2,810,000 Dividend $0.88 Close Price $35.11 Yield Percentage 2.51% Net Change 1.07 1. Highest price paid: $ 2. Last price paid: $ 3. Lowest price paid: $arrow_forward

- Statement of stockholders’ equity Noric Cruises Inc. began the month of October with the following balances: Common Stock, $120,000; Additional Paid-In Capital, $3,300,000; and Retained Earnings, $12,300,000. During June, Noric issued for cash 30,000 shares of common stock (with a stated value of $1) at $18 per share. Noric reported the following results for the month ended October 31: Net income $2,250,000 Cash dividends declared 475,000 Prepare a statement of stockholders’ equity for the month ended October 31. If there is a net loss or there has been a decrease in stockholders' equity, enter that amount as a negative number using a minus sign. If an amount box does not require an entry, leave it blank. Noric Cruises Inc.Statement of Stockholders' EquityFor the Month Ended October 31 CommonStock AdditionalPaid-InCapital RetainedEarnings Total $Balances, October 1 $Balances, October 1 $Balances, October 1 Balances, October 1 Issued Common Stock Issued…arrow_forwardIdentifying and Analyzing Financial Statement Effects of Stock TransactionsMelo Company reports the following transactions relating to its stock accounts in the current year. Use the financial statement effects template to indicate the effects from each of these transactions.(a) Mar. 2 Issued 7,000 shares of $1 par value common stock at $30 cash per share.(b) Apr. 14 Issued 10,500 shares of $100 par value, 8% preferred stock at $250 cash per share.(c) June. 30 Purchased 2,100 shares of its own common stock at $22 cash per share.(d) Sep. 25 Sold 1,050 shares of its treasury stock at $26 cash per share.Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction.Note: Indicate a decrease in an account category by including a negative sign with the amount.arrow_forwardsarrow_forward

- 15arrow_forwardYou are considering an investment in Roxie's Bed & Breakfast Corporation During the last year, the firm's income statement listed an addition to retained earnings of $16.20 million and common stock dividends of $1.30 million. Roxie's year-end balance sheet shows common stockholders' equity of $55.9 million with 19 million shares of common stock outstanding. The common stock's market price per share was $8.10.arrow_forward) Calculate the weighted average number of shares for the following Shares outstanding 100,000 Date Shares changes Beginning balance 20,000 shares issued 50% stock dividend 50,000 shares issued 1Jan-07 120,000 180,000 230,000 230,000 1-Apr-07 1.Jun-07 1-0ct-07 31-Dec-07 Year end balancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education