Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

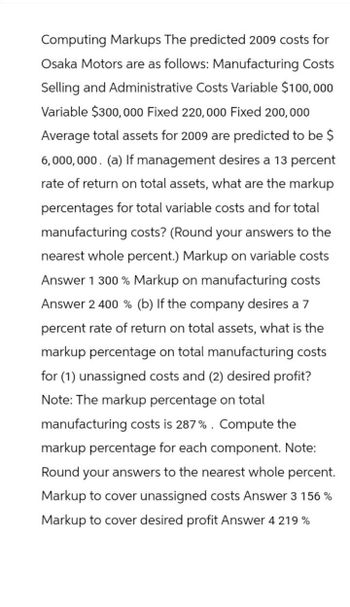

Transcribed Image Text:Computing Markups The predicted 2009 costs for

Osaka Motors are as follows: Manufacturing Costs

Selling and Administrative Costs Variable $100,000

Variable $300,000 Fixed 220,000 Fixed 200,000

Average total assets for 2009 are predicted to be $

6,000,000. (a) If management desires a 13 percent

rate of return on total assets, what are the markup

percentages for total variable costs and for total

manufacturing costs? (Round your answers to the

nearest whole percent.) Markup on variable costs

Answer 1 300% Markup on manufacturing costs

Answer 2 400 % (b) If the company desires a 7

percent rate of return on total assets, what is the

markup percentage on total manufacturing costs

for (1) unassigned costs and (2) desired profit?

Note: The markup percentage on total

manufacturing costs is 287%. Compute the

markup percentage for each component. Note:

Round your answers to the nearest whole percent.

Markup to cover unassigned costs Answer 3 156 %

Markup to cover desired profit Answer 4 219%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me with calculationarrow_forwardPlease help me with show all calculation thankuarrow_forwardCompute the Revenue Effect- Growth Component, indicate if favorable/(unfavorable). *The activity driver for conversion cost is the direct labor hours. PROBLEM: Financial Perspective Gloria Corporation presents the following information for year 2020 & 2021 2020 2021 Sales P 45, 000 P 38, 000 Production Expenses Direct materials 9, 504 8, 976 12,000 Direct labor 10,000 Factory overhead Gross Profit 5, 000 P 14, 520 5, 000 P 18, 000 Operating Expenses 13,000 13, 000 Operating income P5, 000 P1, 520 During the year 2020, the corporation was able to sell 10, 000 units which is 25% above the sales in 2021. The same capacity was used for factory overhead and operating expenses for years 2020 and 2021. Other data are as follows: 2020 2021 Raw materials used ( kg) 1, 200 720 Direct labor hours 1, 000 816arrow_forward

- Using the following data, estimate the new Return on Investment if there is a 10% decrease in variable and fixed costs - with average operating assets as the base. Sales $2,000,000 Variable costs 1.100.000 Contribution margin 900.000 Controllable fıxed costs 300.000 IControllable margin $600,000 Average operating assets $5,000,000 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forwardPlease provide this question solution accountingarrow_forwardJellico Inc.’s projected operating income (based on sales of 450,000 units) for the coming year isas follows:TotalSales $11,700,000Total variable cost 8,190,000Contribution margin $ 3,510,000Total fixed cost 2,254,200Operating income $ 1,255,800Required:1. Compute: (a) variable cost per unit, (b) contribution margin per unit, (c) contribution margin ratio, (d) break-even point in units, and (e) break-even point in sales dollars.2. How many units must be sold to earn operating income of $296,400?3. Compute the additional operating income that Jellico would earn if sales were $50,000 morethan expected.4. For the projected level of sales, compute the margin of safety in units, and then in salesdollars.5. Compute the degree of operating leverage. (Note: Round answer to two decimal places.)6. Compute the new operating income if sales are 10% higher than expected.arrow_forward

- Using the following data, estimate the new Return on Investment if there is a 11% decrease in the average operating assets - with the new average operating assets as the base. Sales $2,565,862 Contribution margin 48% Controllable fixed costs 293,294 Average operating assets $4,671,197 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forwardUsing the following data, estimate the new Return on Investment if there is a 8% increase in sales - with average operating assets as the base. Sales Contribution margin Controllable fixed costs $3,646,059 45% 266,167 Average operating $5,897,345 assetsarrow_forwardUsing the following data, estimate the new Return on Investment if there is a 10% increase in sales - with average operating assets as the base. Sales $2,000,000 Variable 1,100,000 costs Contribution 900,000 margin 45% Controllable 300,000 fixed costs Controllable $600,000 margin Average operating $5,000,000 assetsarrow_forward

- Using the following data, estimate the new Return on Investment if there is a 10% decrease in variable and fixed costs- with average operating assets as the base. Sales Contribution margin $3,662,879 37% Controllable fixed costs 333,341 Average operating assets $5,266,981| Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forwardNombre Company management predicts $390,000 of variable costs, $430,000 of fixed costs, and a pretax income of $155,000 in the next period. Management also predicts that the contribution margin per unit will be $9. Use this information to compute the (1) total expected dollar sales for next period and (2) number of units expected to be sold next period.arrow_forwardUsing the following data, estimate the new Return on Investment if there is a 10% increase in sales - with average operating assets as the base. Sales $2,000,000 Variable costs 1,100,000 Contribution margin 45% 900.000 Controllable fıxed costs 300.000 Controllable margin $600,000 Average operating assets $5,000,000 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub