FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

If this counts as 2 questions you can count it as such

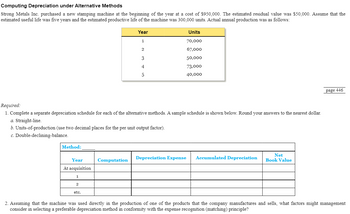

Transcribed Image Text:### Computing Depreciation under Alternative Methods

**Scenario:**

Strong Metals Inc. purchased a new stamping machine at the beginning of the year at a cost of $950,000. The estimated residual value was $50,000. Assume that the estimated useful life was five years and the estimated productive life of the machine was 300,000 units. Actual annual production was as follows:

#### Annual Production Table

| Year | Units |

|------|--------|

| 1 | 70,000 |

| 2 | 67,000 |

| 3 | 50,000 |

| 4 | 73,000 |

| 5 | 40,000 |

#### Tasks:

1. **Complete a separate depreciation schedule for each of the alternative methods:**

- **a. Straight-line.**

- **b. Units-of-production (use two decimal places for the per-unit output factor).**

- **c. Double-declining-balance.**

A sample schedule is shown below. Round your answers to the nearest dollar.

#### Sample Depreciation Schedule:

| Method: ___________ |

|---------------------|

| Year | Computation | Depreciation Expense | Accumulated Depreciation | Net Book Value |

|-------------------|------------------------|----------------------|--------------------------|---------------------|

| At acquisition | | | | |

| 1 | | | | |

| 2 | | | | |

| etc. | | | | |

2. **Discussion Prompt:**

Assuming that the machine was used directly in the production of one of the products that the company manufactures and sells, what factors might management consider in selecting a preferable depreciation method in conformity with the expense recognition (matching) principle?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- arrow_forwardtyping cleararrow_forwardPlease answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forwardsolve it using this method: S2 = (((1+S1)*(1+F2))1/2 )– 1 S3 = ((1+S1)*(1+F3)) 1/3 - 1 P = 50/(1+S1)+50 / (1+S2) 2 + 1050 / (1+S3) 3 and find the value of parrow_forwardG and H are mutually exclusive events. P (G) = 0.5 P (H) = 0.3 P( H | G) = 0.6 Find P (H OR G) Are G and H independent or dependent events? why?arrow_forwardboth a and barrow_forwardarrow_back_iosarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education