Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide help

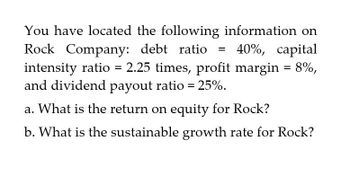

Transcribed Image Text:You have located the following information on

Rock Company: debt ratio

=

40%, capital

intensity ratio = 2.25 times, profit margin = 8%,

and dividend payout ratio = 25%.

a. What is the return on equity for Rock?

b. What is the sustainable growth rate for Rock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- To help them estimate the company's cost of capital, Smithco has hired you as a consultant. You have been provided with the following data: D₁ = $1.45; Po = $22.50; and gL = 6.50% (constant). Based on the dividend growth approach, what is the cost of common from reinvested earnings? O a. 13.59% O b. 12.94% c 11.10% d. 12.30% e. 11.68% Oarrow_forwardProvide solution for this questionarrow_forwardProvide answer for this questionarrow_forward

- Consider the following security: Brous Metalworks Earnings Per Share, Time = 0 $2.00 Dividend Payout Rate 0.250 Return on Equity 0.150 Market Capitalization Rate 0.125 Required: Using the information in the tables above, please calculate the sustainable growth rate, dividends per share, and intrinsic value per share. Then solve for the present value of growth opportunities. (Use cells A5 to B8 from the given information to complete this question.) Brous Metalworks Sustainable Growth Rate Dividends per share (Next Year) Intrinsic Value No-Growth Value Per Share Present Value of Growth Opportunities (PVGO)arrow_forwardAssuming the following ratios are constant, what is the sustainable growth rate? PLEASE INCLUDE EXCEL FUNCTIONS. Thank you! Assuming the following ratios are constant, what is the sustainable growth rate? Total asset turnover Profit margin Equity multiplier Payout ratio Plowback ratio 3.40 5.2% Complete the following analysis. Do not hard code values in your calculations. Return on equity 22.98% Sustainable growth rate 1.30 35%arrow_forwardAs a consultant to Bass Inc, you have been provided with the following data D1= $0.67, P0= $27.50 and gl=8%. What is the cost of common from invested earning based on the dividend growth approach? (11.51%, 10.44%, 9.91%, 9.42%, or 10.96%)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning