ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:E

F4

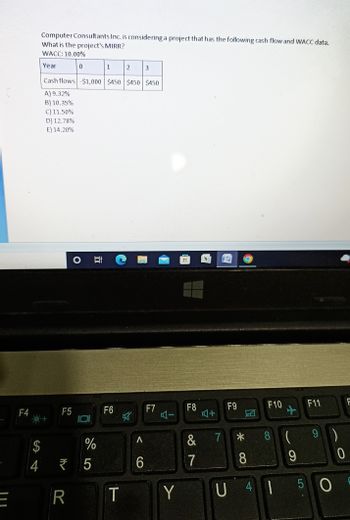

Computer Consultants Inc. is considering a project that has the following cash flow and WACC data.

What is the project's MIRR?

WACC: 10.00%

Year

0

1

2

3

Cash flows -$1,000 $450 $450 $450

A) 9.32%

B) 10.35%

C) 11.50%

D) 12.78%

E) 14.20%

$

4

F5

O E C

F6

R

%

₹5

T

叼

A

6

F7

Y

--

BE

F8

&

7

F9

4+

7

*

F10

8 (

8

U 41

+

F11

9

F

9)

0

506

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Q1 DRAW DETAILED CASH FLOW DIAGRAM SHOWING ALL VALUES & SYMBOLS FOR THE FOLLOWING CASE. A project of 14-year lifecycle, started with an investment of (25,000 JD); under MARR=8% and expecting to have the following cash flows: • A revenue of geometric increment (g-7%) starting by (3,000) from the end of (year 3) up to end of (year 12). • A uniform income equal to (500 JD) starting from end of (year 1) up to end of project. • A sale amount of (5,000 JD) at end of (8). Expenses of decreased Geometric gradient (g-5%) series by (600 JD) from end of (year 1) up to end of year (10). Salaries of annual uniform amounts (500 JD) from end of (year 1) up to end of (year 12). • Maintenance of project of an amount of (3,000 JD) at end of (year 6) • Salvage value (5,000 JD) of the project at end of (year14). when you solve it quickly I give you 3 like frome my account and friends accountarrow_forwardIf the interest rate, i=10%, the capitalized cost (CC) of the given project whose Cash Flow diagram is given below is closest to: 0 PO=$800,000 1 2 $200,000 (Nonrecurring) 3 F--- -% per year 4 5 A= $5,000 6 7 8 Year $1025890 O $1030560 $1038450 $1027273 $2027372 Oarrow_forwardMARR 20% EOY Cash Flow 0 $(70,000.00) 1 $ 20,000.00 2 $ 19,000.00 3 $ 18,000.00 4 $ 17,000.00 5 $ 16,000.00 6 $ 15,000.00 7 $ 14,000.00 8 $ 13,000.00 9 $ 12,000.00 10 $ 11,000.00 11 $ 10,000.00 12 $ 9,000.00 13 $ 8,000.00 14 $ 7,000.00 15 $ 6,000.00 16 $ 5,000.00 17 $ 4,000.00 18 $ 3,000.00 19 $ 2,000.00 20 $ 1,000.00 Plot a graph of FW versus MARR, where MARR varies from 0 percent to 50 percent by 1 percent increments.FW should be on the y-axis and MARR on the x-axis. How do you find FW? Please show all steps and formulas used in excel format. Thank you!arrow_forward

- MARR 20% EOY Cash Flow 0 $(70,000.00) 1 $ 20,000.00 2 $ 19,000.00 3 $ 18,000.00 4 $ 17,000.00 5 $ 16,000.00 6 $ 15,000.00 7 $ 14,000.00 8 $ 13,000.00 9 $ 12,000.00 10 $ 11,000.00 11 $ 10,000.00 12 $ 9,000.00 13 $ 8,000.00 14 $ 7,000.00 15 $ 6,000.00 16 $ 5,000.00 17 $ 4,000.00 18 $ 3,000.00 19 $ 2,000.00 20 $ 1,000.00 Plot a graph of FW versus MARR, where MARR varies from 0 percent to 50 percent by 1 percent increments.FW should be on the y-axis and MARR on the x-axis.arrow_forwardOn August 6, 2021, Nike purchased new cash registers for their stores for $105,000 total. They will realize a $9,700 profit on the first Friday of every month ( Hint: You will need a calendar) starting on 9/3/2021 for an entire year (ending on July 1, 2022). What is the rate of return of this project? (X.X%)arrow_forwardm mmm. m Given the cash flows in table below, determine the rate of return. Year Cash Flow 0 $10K 1 $0 2 $5K 3 $0 4 $10K Group of answer choices Cannot determine 100% 8.91% 7.6% 4.9% 11.2% Flag question: Question 8arrow_forward

- Q1arrow_forwardSolve by incremental cashflow then PW = 0. To get the value of i by interpolation. Problem 3: Two plans for a hydroelectric project in Peru have been proposed. The opportunity cost, in soles, of resources is 10 percent. Data on the two alternatives are: System First cost ($/,000,000,000) 300 160 Economic life (years) 40 20 Salvage value ($/,000,000,000) 15 12 Annual benefits (S/.000,000,000) 25 22 Annual costs ($/,000,000,000) 3 1 Using the internal rate of return method, which of the two systems should be chosen or should either be selected?arrow_forwardSubject:ecoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education