FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

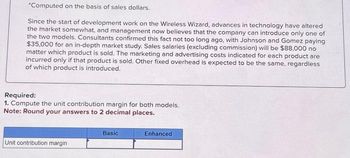

Transcribed Image Text:*Computed on the basis of sales dollars.

Since the start of development work on the Wireless Wizard, advances in technology have altered

the market somewhat, and management now believes that the company can introduce only one of

the two models. Consultants confirmed this fact not too long ago, with Johnson and Gomez paying

$35,000 for an in-depth market study. Sales salaries (excluding commission) will be $88,000 no

matter which product is sold. The marketing and advertising costs indicated for each product are

incurred only if that product is sold. Other fixed overhead is expected to be the same, regardless

of which product is introduced.

Required:

1. Compute the unit contribution margin for both models.

Note: Round your answers to 2 decimal places.

Unit contribution margin

Basic

Enhanced

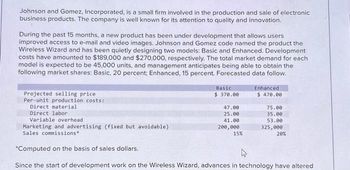

Transcribed Image Text:Johnson and Gomez, Incorporated, is a small firm involved in the production and sale of electronic

business products. The company is well known for its attention to quality and innovation.

During the past 15 months, a new product has been under development that allows users

improved access to e-mail and video images. Johnson and Gomez code named the product the

Wireless Wizard and has been quietly designing two models: Basic and Enhanced. Development

costs have amounted to $189,000 and $270,000, respectively. The total market demand for each

model is expected to be 45,000 units, and management anticipates being able to obtain the

following market shares: Basic, 20 percent; Enhanced, 15 percent. Forecasted data follow.

Projected selling price

Per-unit production costs:

Direct material

Direct labor

Variable overhead

Basic

$ 370.00

47.00

25.00

41.00

200,000

Enhanced

$ 470.00

15%

75.00

35.00

53.00

325,000

Marketing and advertising (fixed but avoidable)

Sales commissions"

*Computed on the basis of sales dollars.

Since the start of development work on the Wireless Wizard, advances in technology have altered

20%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardB&B has a new baby powder ready to market. If the firm goes directly to the market with the product, there is only a 65 percent chance of success. However, the firm can conduct customer segment research, which will take a year and cost $1.13 million. By going through research, B&B will be able to better target potential customers and will increase the probability of success to 80 percent. If successful, the baby powder will bring a present value profit (at time of initial selling) of $18.3 million. If unsuccessful, the present value payoff is $5.3 million. The appropriate discount rate is 13 percent. Calculate the NPV for the firm if it conducts customer segment research and if it goes to market immediately. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Market immediately Research option Should the firm conduct customer segment research or go to the market immediately? O Market…arrow_forwardEarl Massey, director of marketing, wants to reduce the selling price of his company’s products by 15% to increase market share. He says, “I know this will reduce our gross profit rate, but the increased number of units sold will make up for the lost margin.” Before this action is taken, what other factors does the company need to consider?arrow_forward

- (Related to Checkpoint 13.4) (Using break-even analysis) Mayborn Enterprises, LLC runs a number of sporting goods businesses and is currently analyzing a new T-shirt printing business. Specifically, the company is evaluating the feasibility of this business based on its estimates of the unit sales, price per unit, variable cost per unit, and fixed costs. The company's initial estimates of annual sales and other critical variables are shown here: E a. Calculate the accounting and cash break-even annual sales volume in units. b. Bill Mayborn is the grandson of the founder of the company and is currently enrolled in his junior year at the local state university. After reviewing the accounting break-even calculation done in part a, Bill wondered if the depreciation expense should be included in the calculation. Bill had just completed his first finance class and was well aware that depreciation is not an actual out-of-pocket expense but rather an allocation of the cost of the printing…arrow_forwardEasy Removals offers a complete interstate, door-to-door solution for residential and commercial removals. As the market for removal services is very competitive, Easy Removals aims to deliver services at a low cost. Its management accountant prepared the following information - the growth, price-recovery, and productivity components that explain the change in operating income from 2020 to 2021. Growth Component Price-recovery Component Productivity Component Revenue effect $ 310,000 F $ 98,000 U - Cost effect $ 210,000 U $ 32,000 U $ 128,000 F Suppose that during 2021, the market growth rate in the industry was 10%. The number of jobs billed was 400 and 500 in 2020 and 2021, respectively. Any increase in market share more than 10%, and any change in selling price, are the result of Easy Removals’ strategic actions. Required: Compute how much of the change in operating income from 2020 to 2021 is due to the: (a) industry-market-size factor; (b)…arrow_forwardKey Corporation is considering the addition of a new product. The expected cost and revenue data for the new product are as follows: Annual sales 2,500 units Selling price per unit $ 304 Variable costs per unit: Production $ 125 Selling $ 49 Avoidable fixed costs per year: Production $ 50,000 Selling $ 75,000 Allocated common fixed corporate costs per year $ 55,000 If the new product is added, the combined contribution margin of the other, existing products is expected to drop $65,000 per year. Total common fixed corporate costs would be unaffected by the decision of whether to add the new product.At what selling price would the new product be just breaking even? $232 per unit $282 per unit $250 per unit $246 per unitarrow_forward

- I am struggling to figure out what I am doing wrong to correctly answer 7.arrow_forwardplease answer with complete solutionarrow_forwardWarner clothing is considering the introudciton fo a new baseball cap for sales by local vendors. The comapny has collected the following price and cost characteristics. A. What number must Warner sell per month to break even? B. What number must Warner sell per month to make an operating profit of $30,000?arrow_forward

- 5. A supplier has offered us 1200 pounds of filberts for $950. Should these filberts be purchased? If yes, how much would profits increase? Need explanation for the answer pleasearrow_forwardi need the answer quicklyarrow_forwardHeat Inc. sells computer hard drives, and the market is competitive (i.e., sales price will not be affected by Heat's sales volume). Its EBIT for 2022 was $69,000 when the sales quantity was 500 units. In 2023, its EBIT was $119,000 when the sales quantity was 700 units. a) Calculate its contribution margin per unit and total fixed costs. b) Calculate the degree of operating leverage for 2022 and 2023. c) If Heat changes its production technology by doubling its fixed costs and the breakeven (indifferent) quantity is 1, 120 units, find the new contribution margin. Heat has $40,000 debt that pays annual interest of 15% and 2,000 outstanding common shares that are trading at $25. Its tax rate is 30% . d) Calculate EPS for 2022 and 2023. e) Calculate the degree of financial leverage for 2022 and 2023. f) Calculate the degree of total leverage for 2022 and 2023. g) Heat considers borrowing $20,000 new debts (that also pay 15% interest) to buy back common shares (at current price of $25 per…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education