FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

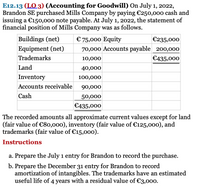

Transcribed Image Text:E12.13 (LO 3) (Accounting for Goodwill) On July 1, 2022,

Brandon SE purchased Mills Company by paying €250,000 cash and

issuing a €150,000 note payable. At July 1, 2022, the statement of

financial position of Mills Company was as follows.

Buildings (net)

€ 75,000 Equity

€235,000

Equipment (net)

70,000 Accounts payable 200,000

Trademarks

10,000

€435,000

Land

40,000

Inventory

100,000

Accounts receivable

90,000

Cash

50,000

€435,000

The recorded amounts all approximate current values except for land

(fair value of €80,000), inventory (fair value of €125,000), and

trademarks (fair value of €15,0o0).

Instructions

a. Prepare the July 1 entry for Brandon to record the purchase.

b. Prepare the December 31 entry for Brandon to record

amortization of intangibles. The trademarks have an estimated

useful life of 4 years with a residual value of €3,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On 1 July 20X7 Brown Ltd bought a machine for GHS 48,000. The machine was depreciated at 25% per annum on a straight-line basis until 30 June 20X9. On 1 July 20X9, the machine was revalued to GHS 30,000. Brown Ltd considers that its remaining useful life is three years. According to IAS 16 Property, Plant and Equipment, what should be the depreciation charge for the year ended 30 June 20Y0 and the balance on the revaluation surplus as at 30 June 20Y0? (Ignore any transfer of excess depreciation.) Depreciation charge Revaluation surplus A GHS 8,000 GHS 4,000 B GHS 8,000 GHS 6,000 C GHS 10,000 GHS 6,000 D GHS 10,000 GHS 4,000arrow_forwardA machine was purchased on 1 January 2021 and the other details of the machine are:- Cost of machine N$324 000 Depreciation rate 5 % Determine the amount of deprecation as at 31 December 2021arrow_forwardAn asset's book value is $36,000 on January 1, Year 6. The asset is being depreciated $500 per month using the straight-line method. Assuming the asset is sold on July 1, Year 7 for $25,000, the company should record: Multiple Choice O O O Neither a gain or loss is recognized on this type of transaction. A gain on sale of $2,000. A loss on sale of $1,000. A gain on sale of $1,000. A loss on sale of $2,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education