FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

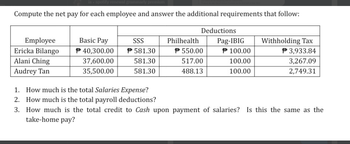

Transcribed Image Text:Compute the net pay for each employee and answer the additional requirements that follow:

Deductions

Employee

Basic Pay

SSS

Philhealth

Withholding Tax

Ericka Bilango

40,300.00

581.30

550.00

100.00

P 3,933.84

Alani Ching

37,600.00

581.30

517.00

100.00

3,267.09

Audrey Tan

35,500.00

581.30

488.13

100.00

2,749.31

1. How much is the total Salaries Expense?

2. How much is the total payroll deductions?

3. How much is the total credit to Cash upon payment of salaries? Is this the same as the

take-home pay?

Pag-IBIG

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ward Feb. 1 6,300 1,355 Required: 1. Calculate the amounts to be reported on each employee's Wage and Tax Statement (Form W-2) for 2018. Note: Round amounts to the nearest whole dollar and enter all amounts as positive values. Employee Gross Earnings Federal Income Social Security Medicare Tax Withheld Tax Withheld Tax Withheld Arnett 3,900 546 234 $ 59 Cruz 5,100 918 306 77 Edwards 2,900 363 174 44 Harvin 2,200 275 132 33 < Nicks 5,650 1,271 339 47 Shiancoe 3,100 481 186 85 Ward 6,300 1,355 378 95 $ 1,318 331 2. Calculate the following employer payroll taxes for the year: (a) social security; (b) Medicare; (c) state unemployment compensation at 5.4% on the first $10,0 employee's earnings; (d) federal unemployment compensation at 0.6% on the first $10,000 of each employee's earnings; (e) total. Note: Round amounts to the nearest whole dollar and enter all amounts as positive values. (a) $ 1,745arrow_forwardAmounts to Be Reported on Wage and Tax Statements (Form W-2) Gross Federal Income Social Security Medicare Employee Earnings Tax Withheld Tax Withheld Tax Withheld Arnett $ 8,250.00 $ 1,416.00 $ 495.00 $ 123.75 Cruz 57,600.00 9,996.00 3,456.00 864.00 Edwards 24,000.00 4,776.00 1,440.00 360.00 Harvin 6,000.00 1,070.00 360.00 90.00 Nicks 110,000.00 25,850.00 6,600.00 1,650.00 Shiancoe 116,000.00 26,000.00 6,960.00 1,740.00 Ward 7,830.00 1,314.00 469.80 117.45 Totals $ 329,680.00 $ 19,780.80 $ 4,945.20 Employer Payroll Taxes a. Social security…arrow_forwardPSa 3-7 Calculate Federal Income Tax Withholding Using the Percentage Method (2020/2021 Form W-4) For each employee listed, use the percentage method to calculate federal income tax withholding for an employee who has submitted a 2020 Form W-4. Refer to Publication 15-T. 1: Stephanie Williams files as single on her tax return and earned weekly gross pay of $700. For each pay period she makes a flexible spending account contribution of 7% of gross pay. Stephanie did not enter any information in steps 2-4 of the form. Federal income tax withholding S 2 Mo Fangia files as single on his tax return and earned weekly gross pay of $1020. He does not make any retirement plan contributions. Mo entered $30 on line 4c of Form W-4 and did not enter any information in steps 2 & 3 of the form Federal income tax withholding S 3: Michaela Sampson files as mamed fing jointly on her tax return and earned weekly gross pay of $1580. For each pay period she makes a 401(k) contribution of 4% of gross pay.…arrow_forward

- Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee.arrow_forwardTaxes to be Withheld From Gross Pay Assuming situation (a), prepare the employer's September 30 journal entry to record salary expense and its related payroll liabilities for this employee. The employee's federal income taxes withheld by the employer are $90 for this pay period. Note: Round your answers to 2 decimal places. General Journal View transaction list Journal entry worksheet 1 Prepare the employer's September 30 journal entry to record accrued salary expense and its related payroll liabilities for this employee. Note: Enter debits before credits. Date September 30 Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardWhich of the following accounts represents the "take-home pay" or "net pay" related to employees? EMPLOYEE BENEFITS PAYABLE OPAYROLL TAX EXPENSE SALARY EXPENSE SALARY PAYABLE TO EMPLOYEESarrow_forward

- UNGER COMPANYarrow_forwardProblem Information Use the following tax rates, ceiling and maximum taxes: Employee and Employer OASDI: Employee* and Employer HI: Self-employed OASDI: Self-employed HI: *Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed. 6.20% 1.45% 12.4% a. OASDI tax b. HI tax 2.9% $147,000 No limit $147,000 No limit $9,114.00 No maximum $18,228.00 No maximum Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows: 1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimal places (round the hourly rate to 2 decimal places before multiplying by one and one-half to determine the overtime rate). 2. If the third decimal place is 5 or more, round to the next higher cent. 3. If the third decimal place is less than 5, drop the third decimal place. Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow. On the last weekly pay of the first quarter, Lorenz…arrow_forwardWhich of the following is not an item deducted from salary expense to arrive at net pay? Multiple Choice O O FICA tax for Social Security FICA tax for Medicare These answer choices are all deducted from salary expense to arrive at net pay Federal unemployment taxarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education